#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth. Get in touch to see how we can support your growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

BluSmart - The End.

The other co-founder (of both Gensol and BluSmart), Puneet Jaggi, is detained by government authorities for his part in the falsification of corporate documents to secure the above loans.

Vehicles are now painted Uber and moving to its platform.

500 employees are waiting for their salaries.

PE offer on hold due to ongoing investigations.

Lyft’s CEO annual letter to shareholders, my key takeaways are:

Lyft increased rider usage frequency by minimising surge (Prime Time) pain with a mechanism called “Price Lock”, which allows riders to lock in their everyday commute rides, surge free. The service sees a 70% monthly renewal rate.

Minimising driver cancellation by allowing drivers better information and transparency. As a result, driver cancellation rates have dropped from 14.4% in Q2 2023 to 5.6% in Q4 2024.

Also Lyft integrates licensed taxis into its network. I wouldn't expect less from a company who just bought Freenow (and Uber has already been doing that).

Flock Mobility, a new UK managed-mobility (SaaS + TaaS) player, focusing on regulated industries, raised £1M.

Rapido tests non-AC rides for a lowered fare. To put in perspective, right now the average daytime temperature in Bengaluru is circa 33 degrees celsius (91F), with over 60% humidity. ☀️

DiDi prepares to venture out of mainland China - starts recruiting drivers in Hong Kong. The FTC is suing Uber for false saving promises and making it too hard to cancel the Uber One membership (23 different screens to go through!) and other deceptive practices. Uber Taiwan introduces a $4-10 administrative fee to any trip. The Routing Company launches in Minnesota College. Virtua expands to the UK via partnership (with minority owner) Ouno.

Mobico's announcement that it plans to sell its US yellow school bus unit to Arriva-owner, I-Squared (PE) has worsened its problems.

Car Sharing/renting 🚗

Volug is launching a new car-share scheme in Montreal and this week unveiled its name: Leo (yes, Volug has a similar name operation in France, but the companies aren’t connected). The Montreal service is a free floating service, with 600 vehicles, and 3 employees.

Communauto expands in Montreal and Longueuil. HiyaCar wins a 3-year contract with Adur & Worthing Council (UK) to operate its pool car scheme. Free2move adds 50 Electric vehicles to its fleet in Amsterdam

Micromobility 🚲🛴

VisionEdgeOne, a PE company, acquires micromobility company Inurba Mobility. Inruba is a Spanish-based bike-sharing operator, with presence in 10 European cities and 18,000 vehicles. It has been a part of the Moventia Group since formation in 2014.

Micromobility.com 2024 financial results, in a nutshell:

Revenue $1.42 million (or $1,422,000)

Loss from operations: $2.3M

Income from discontinued operations: $10.5M. This mostly has to do with liabilities now unrecognised, after the sale of Wheels back in August 2024

Bringing net income to $8.15M

Cash flow improved, from $143,000 end-of-2023 to $397,000 on 31/12/2024.

Also micromobility.com announcement a private placement of common shares for the gross proceeds of $25M and a convertible note of $2.75M.

Delivery 🍽🧺

DoorDash offers £2.7 billion ($3.6bn) for Deliveroo. Markets were very happy. This isn’t the first time DoorDash has expressed interest in Deliveroo, now the ball is with Deliveroo’s board. To be continued.

Foodpanda exits Thailand. Big players in Thailand are Grab and Line Man Wongnai, each holding circa 40% of the market. The rest (15-20%) is divided between ShopeeFood, Robinhood and foodpanda.

Yandex Uzbekistan expands express delivery service for businesses. Meituan secures China’s first nationwide drone delivery license. Yulu, Indian shared micromobility, is looking to raise $80M to “capitalize on the booming quick commerce sector”, i.e. offer solutions to gig-economy drivers.

I love meeting new people and learning about innovation. Let’s get-to-know.

Autonomous & remote-driving 🤖℡

MOIA partners with Uber to roll out autonomous ID.BUZZ (vans, or microbuses) in the US, to launch as a robotaxi service by the end of 2026 and become fully autonomous in 2027. MOIA is busy testing its vehicle in Germany, the US, Oslo and Switzerland, as Volkswagen (MOIA’s parent) is getting ready for the autonomous age. My take:

Rolling out autonomous vehicles across the world makes perfect sense for VW / MOIA. At this point, if you have AV tech, you want to use/train as much as you can. So congrats VW on the deal.

Ride-hailing with larger vehicles (microbuses) in the US does not make sense at all. Uber-pool and other sharing services (e.g. Via in London and New York) have proved to be irrelevant and unprofitable; people just don’t like sharing rides.

Furthermore, looking at Waymo reviews, people stress the advantage of being alone in the car. Based on that “I want to be alone” sentiment, there is almost no advantage in sharing rides in an autonomous future, especially in the US.

But Uber also knows that - so what really is the deal?

Comfort. People like to own their stuff, and with cars, there is also an added layer of personal customisation (child seat, emergency Yamaka, favourite food). Private car ownership is not going away.

The same as with Tesla, these vehicles are the likely candidate to add-on to the baseline of Waymo robotaxi fleets in peak times.

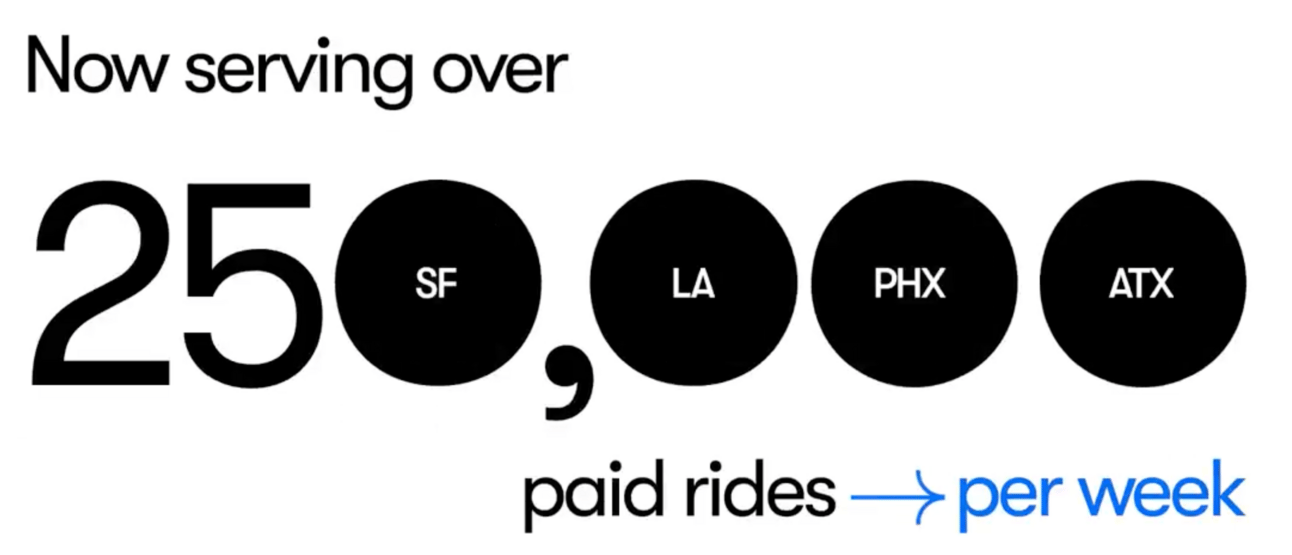

Waymo hits 250,000 paid rides per week.

Wayve expands to Japan; opens a testing and development centre. This follows expansion to the US and Germany and brings the company closer to Nissan, its latest OEM partner.

Torc Robotics, subsidiary of Daimler Truck, to begin autonomous truck testing in Texas. Honda and Momenta to jointly develop ADAS solution. Pony.ai partners with Tencent to integrate robotaxi service into WeChat. SuburVAN focuses on speed.

Austin residents follow San Francisco's - complaints on Waymo vehicles stalling, speeding, and crashing are starting to pile up. Especially this woman.

Flying cars 🚁

Archer to build first eVTOL hybrid heliport at Abu Dhabi Cruise Terminal, fit for both eVTOLs and for “traditional” helicopters. Volocopter restarts.

OEMs 🛺⚡️

Slate in the new OEM in town, coming out of stealth. Key (anti-Tesla) features:

Affordable: starting for under $20k (EV federal credits included)

Customizable: with over 100 different accessories

Analog: manual windows, no infotainment etc.

Production is likely to start in Indiana. First vehicles to reach customers in late 2026.

Gig economy 💰

Uber warns it may leave Colorado if rideshare safety bill passes, The new bill requires stricter safety measures . such as mandatory dash cameras, audio recordings of rides, and a ban on driving after using marijuana.

Nigerian drivers planning to strike on May 1st. Baemin’s riders launched a collective action against the company, accusing it of passing costs on to them.

Rapido to facilitate skill development for gig workers.

In other news 📰

Google introduces Mobility AI, leveraging tech advancements in measurement, simulation, and optimisation to offer local government better transport management solutions.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Daniel Morton | LinkedIn is the new Country Manager UK @ Ferdia.

Hafsa Ameen is the new Director of Customer Experience & Operations @ the Open Road Access (ORA).

Paul Boote is the new Fleet and Conversions Account Manager @ FleetEV.

Racheli Dachbash Peled is the new Technical Project Manager @ Cello.

Stefan Krogh-Hansen is the new Holo CEO.

Vicente Torres is the new Head of Mexico & Central America @ UITP.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.