#movingpeople is a part of Mobility Business - a consultancy dedicated to growth in mobility.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

This week’s news points to two major ride-hailing supply trends: (1) partnering with taxis and (2) vehicle financing as a way to assure supply.

Ride-hailing 🤝 Taxi

Uber launches in Denmark via a partnership with local taxi company DRIVR, making it now possible to book DRIVR’s fleet via the Uber app in Denmark. While no immediate surprise - this partnership was announced 5 months ago - this is a major move - Uber has been trying to enter Denmark since 2014.

Bolt launches in Greece with local taxi drivers, starting in Athens. Same as in Denmark, gig-drivers are not an option, and so we see ride-hailing companies arriving late.

Ride-hailing finances (and controls) drivers

Moove, which is linked to Uber via investment, acquired Kovi, its Brazilian counterpart. Moove now has 36,000 vehicles and an ARR of $275M. The company will also make use of Kovi’s proprietary IoT software and driver behaviour algorithm.

Yango launches short-term lending service for gig drivers in Ivory Coast, partnering with two local financial firms.

(More) Ride-Hailing & Taxi, Buses & DRT 🚙🚐

VNV Q4 report - highlights for BlaBlaCar, Voi (in the micromobility section) and Gett:

BlaBlaCar

Tough year for BlaBlaCar due to political uncertainty in France which took away revenue from long distance energy saving certificates. VNV expects the scheme to be reinstated, but at lower levels. On the plus side, Spain now has a similar scheme, and Europe seems to be headed in the same positive direction.

Completed the acquisition of Turkish Obilet, the leading online bus marketplace in Turkey, and 2nd largest in the world.

More than 100 million members in 22 countries.

In April 2024 the company secured a €100M revolving credit facility

VNV reduced BlaBlaCar’s fair value by 25%, giving the company a valuation of $1.49 billion.

Gett

Still waiting for the Israeli antitrust authority to approve the sale; expected to close in Q1/25.

Gett is cash generating. Cash and cash equivalents exceeding $60M, with no debt.

Gross booking up 5% YoY to over $500M.

VNV also holds shares in SWVL, Iraqi ride-hailing company Baly, No Traffic and in delivery companies Glovo, Borzo and HungryPanda - but those holding aren’t significant enough for VNV to deep-dive on. For more.

South Korea 🇰🇷: IM Mobility launches Everyone's Taxi to compete with Kakao in underserved markets. The solution allows booking by phone and also offers a phone connection feature within the app, to help those with limited digital literacy. The company is differentiating, to find market share against Kakao and Uber. And Kakao to expand MyCab, its low commission taxi franchise service nationwide. The service has a commission of 2.8%, instead of the 5% Kakao takes normally.

Via wins patent infringement case against RideCo. Jury found that RideCo infringed three Virtual Bus Stop patents, while finding that Via did not infringe on two patents RideCo claimed it did. RideCo will pay Via $1.4M in damages.

Chinese short-video platform Douyin (the Chinese Tik-Tok) integrates in-app ride-hailing services. FREENOW expands fixed-price fares to Hamburg & Cologne. Namma Yatri expands to Trichy. SCALAR by ZF is launching a DRT service in Krakow, Poland. Morocco to soon regulate ride-hailing apps. Read an interview with Arsen Tomsky, InDrive’s founder, on how the company started and up to today, with 200 million downloads and presence in 888 cities across 48 countries.

US Teleport, a crypto-based ride-hailing player, shuts down after eight months, “due to a lack of market readiness for decentralized ridesharing”. My take: people don’t care if it's crypto or not - they just want a cheap ride.

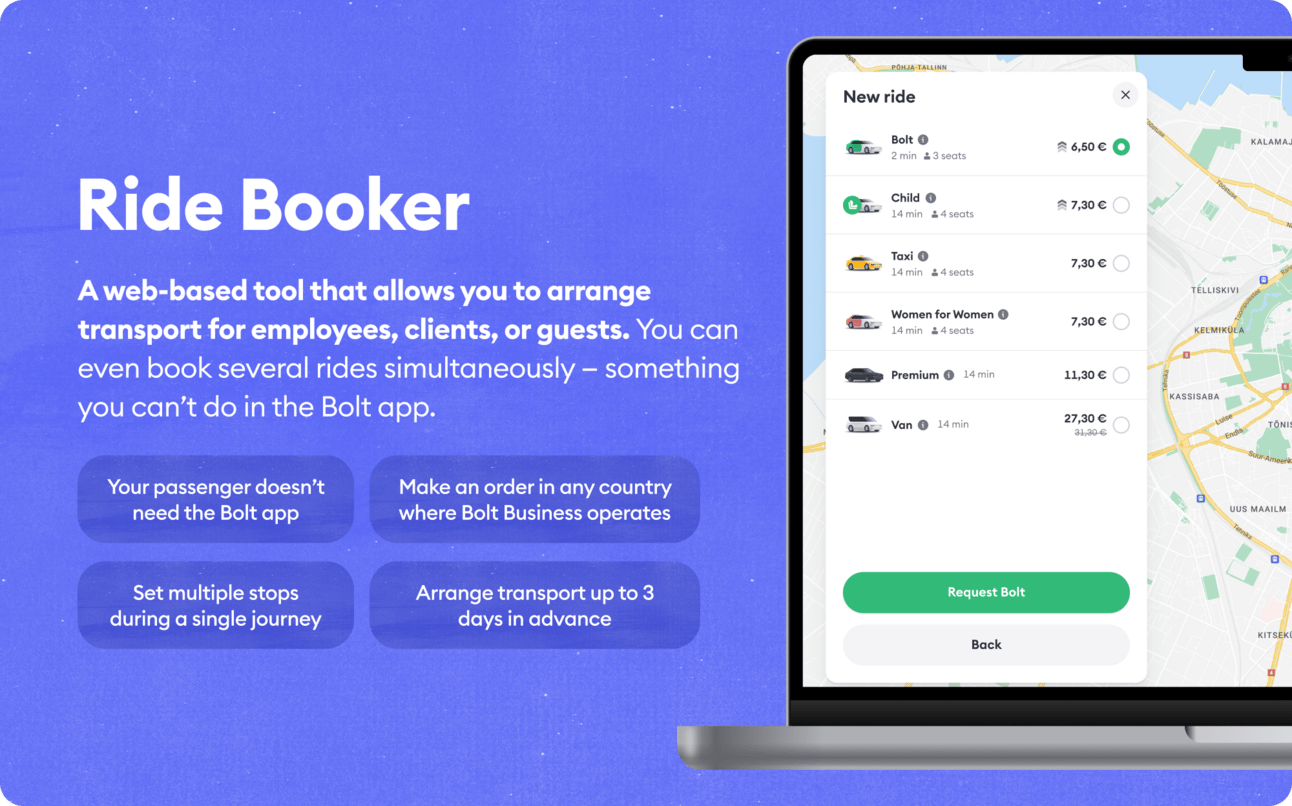

Bolt launched Bolt Business - a corporate ground mobility solution, from cars to scooters. Bolt Business allows you to book for employees, customers and partners, offering app and web booking, scheduled rides, control over spending limits, emission offsetting and automated reports on usage, costs and sustanabiity.

Check it out via this link - I have a coupon good for 25% off 20 rides - just type in “BB25OFF20” when registering.

Car Sharing/renting 🚗

Selfdrive partners with FAW Group's Bestune (Chinese OEM) and Al Khalid Auto (UAE dealership) to introduce 1,500 new cars, including premium models. Selfdrive, founded in 2017, now operates subscription/rental in the UAE, Oman, Qatar, Bahrain, Kuwait, KSA, UK, Ireland, and Turkey, with over 1.5 million customers.

Zity disappears as a brand and integrates into Mobilize; the app has been replaced with a new one named Mobilize Share & Zity.

Micromobility 🚲🛴

Bolt launches the Hopp brand (history lesson) in the US, in D.C. with 700 scooters, joining Lime, Veo, and Spin. This is Bolt’s 1st US market!

Voi reaches EBIT profitability - let’s deep dive into the company:

Active in more than 100 cities in 12 countries.

Closed 2024 with revenue of €132.8M, up 13% YoY.

Adjusted EBIT of €0.1M (±€104,000) - or 0.08% of revenue - extremely small margin. But up from minus 31.1M Adjusted EBIT in 2023 - so there is much improvement.

Vehicle profit grew to €75.7, a 30% increase from €58.2 in 2023.

Raised €50M via public bond in Q4/24, to be used primarily to expand scooter and bike fleets.

Per VNV, Voi’s fair value hasn't changed, and total valuation stands at $484M.

There are rumours about Voi buying Bolt’s micromobility business - remember that Bolt has a bigger business (245k scooters vs. Voi's 110k), that a sale would undermine Bolt's entire "super-app" strategy, and that Bolt is closer to an IPO. Acquisition sounds much more reasonable the other way around.

Lime to invest £20M in London, to create 2,500 new parking spots and increase patrol team by 100 to 400 people. Lime has been taking heat lately for having its bikes thrown around the city. Dott (Tier) renewed in Bristol and scrapped in Basildon, UK. Still in the UK, Dott partners with CycleSaver to begin offering cycle-to-work scheme. Voi expanding into its 35th city in Germany. In the US, Oonee and Swobbee receive a $3.7M federal grant to expand micromobility parking and charging networks in Jersey City and Minneapolis.

Delivery 🍽🧺

Delivery news this week full of drones and delivery bots.

Amazon to begin first planned Prime Air drone delivery in the UK - in Darlington.

Manna and Wolt launch winter drones delivery tests in Finland. And Manna Ireland 2025 rollout plan - if you see your business in one of those circles - contact Manna.

In South Korea, Baemin expands subscription plans nationwide.

UK’s Zedify goes into administration. Just recently, in November, the company expanded into Birmingham.

Autonomous & remote-driving 🤖℡

This week is full of Waymo news.

Waymo to test robotaxis in 10 new cities in 2025. These are only tests (“road-trips”), with no commercial timeline set. Remember, Waymo operates commercial services in Phoenix, SF and LA, and plans to launch commercial services in Miami, Atlanta (which just opened for Waymo’s employees) and Austin in 2025.

Waymo was involved in a fatal accident - not the Waymo fault. A Waymo vandalised in LA (video) by a crowd.

Tesla's commercial robotaxi service is said to begin in Austin in June. To be continued.

Taiwanese autonomous driving startup Turing Drive enters the Japanese market. May Mobility partners with Deloitte to optimise autonomous transportation services globally. WeRide and Beti, a part of the French Bertolami group, sign commercial agreement to operate AVs. Ioki selected in Zurich for an on-demand driverless shuttle pilot, targeting rural environments. The trial, with SBB, WeRide, Nissan and local government, is planned to start in the spring. Mobileye forecasts downbeat annual revenue as China weakness persists. Wuhan has 400 AVs driving in the city. Italy tests a (one) self-driving vehicle, with Stellantis.

Flying cars 🚁

Airbus suspends - indefinitely- the CityAirBus UAM program. Per the company, battery technology is not yet mature enough to sustain effective flying operations.

A deeper look at the dwindling list of eVTOLs. Volocopter and Airbus are out, and so is Rolls-Royce, with Boeing (Wing) and Embraer (Eve expands in India) still in the game. Lilium limping. Vertical alive, for now. Joby still has to complete two certification hurdles (out of five) and final certifications aren’t expected before 2027. E-Hang leads. A combination of a demanding and costly certification process, safety concerns, winds generated and battery limitations are the reason why eVTOLs aren’t getting off the ground (pan intended).

Lilium has trouble paying wages. Remember the company was just recently acquired after going into administration.blablabla

Gig economy 💰

In Malaga and Barcelona, taxi drivers bring the city to a halt over high insurance costs and ride-hailing competition.

In other news 📰

UVeye, AI vehicle inspection, raises $191M in debt and equity to scale in the US and in Europe.

JLR bets £65M on bespoke paint services. Only time will tell if JLR’s plans to replace its audience with young wealthy individuals, Gen Zs, will work out. Uber shut down its ads on Meta, saved $35M, and… no measurable business impact. AutoAcquireAI, automated vehicle acquisition platform, raises an undisclosed 7-figures round. GuardKnox, an automotive cyber-security startup, shuts down. Google Maps follows Trump name changes. Whoosh to launch a gondola-like ride-hailing network in Queenstown, New Zealand, by 2027. Why is everything ride-hailing?

London transport in 9 graphs - this is my favourite:

I love meeting new people, learning about innovation in mobility innovation and exchanging opinions. Let’s get-to-know / catch-up.

People 🧑🤝🧑

Adam Toone is the new Chief Commercial and Operations Officer @ Ticketer.

Adi Kain Carni is the new Metro Line Manager (M2) @ NTA. Special congrats Adi!

Ben Kennedy is the new Senior Service Manager - Transport @ Hammersmith & Fulham Council.

Dan Corey is the new Senior Director of Emerging Business @ AtkinsRéalis.

Felicity Kelly is the new Head of Connected Mobility @ Motability.

James Nettleton is the new Strategy Director @ Octopus Electric Vehicles.

Jean-Philippe Féjoz is the new Vice President Sales & Dealer Development Southern Europe and UK @ Monarch Tractor.

Josh Nicklin is the new Chief Strategy Officer @ Masabi.

Yotam Victor is the new Regional Content, Training and Quality Manager (CTQ) @ Wolt.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too. Thank you.