#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Waymo’s San Francisco ridehailing market share now equals that of Lyft's (in areas Waymo operates). Interestingly, Uber and Lyft had similar market share losses.

Yandex Go launches in Antalya, Turkey. Nemi launches a new DRT service in Palencia, Spain, serving 13,600 residents across 45 villages. Uber Teens launches in Belgium. Uber launches women-only bike-moto service in Bengaluru, India. Uber offers a 15% discount on rides in Singapore. Uber returning to Denmark. For Christmas, Grab offers a free airport bus shuttle in the Philippines. NYC Mobility Dashboard.

Bolt study on drivers in the ride-hailing economy: 78% under age of 44; women are less than 5% of drivers; 25% have full or part time jobs. For more.

Had the unique opportunity of speaking in a Frost & Sullivan's “Think Tank” webinar on the car-sharing and rental industries. My key trends: blurring lines between sharing & rental; increased flexibility in solution offered; slower EV transition and consolidation waiting to happen.

Car Sharing/renting 🚗

Karos continues expanding - this time to Switzerland, via partnership with the Post Office. Switzerland is Karos’ 6th country. Zoomcar managed to reduce net loss - by 73% to a loss of $3.35M - thanks to aggressive cost cutting, and not to increased revenue. Kinto Share expanding in Malmo. Sweden. DriveNow - A decade on by Joseph Seal-Driver.

Micromobility 🚲🛴

Forest and Bird partner to offer international rides.

JET is a profitable Kazakhstan-founded e-scooter brand: over 35K scooters in an own fleet + franchise model; in 2023 $9.8M in revenue and EBIT $2.41. For more.

Dott exits Ireland. Essex councillors want Dott’s e-scooter trials to be scrapped. Columbus launches with Veo, replacing Lyft, Lime and Bird. Veo staying in Charlottesville. Logan City Council, Australia, cancels contract with Beam Mobility. Bremen, Germany, wants to award a new scooter license based on… lottery.

Delivery 🍽🧺

Taiwan regulator postpones decision on the Uber-foodpanda merger until the end of March at the latest.

Bolt launches grocery delivery in Kenya, for now in a 10km radius from its store in Kilimani. Zedify in Birmingham, making it its 10th city.

Swiggy launches invite-only premium membership ‘One BLCK’. The membership offers quicker deliveries, access to top customer care and other perks. Swiggy introduces Scenes, a live entertainment booking tool within its app, focusing on events hosted by partner restaurants. This follows a similar launch by Zomato a few weeks ago. The offer is currently piloted in three cities.

Zomato to pay $95M in taxes and fines. The sum exceeds half of the company’s profits for the fiscal year ending March 2024.

GM pivots Cruise: from robotaxis to personal autonomous vehicles.

In a surprise move, GM will shut down Cruise as an autonomous vehicles unit and will integrate the Cruise team into existing GM ADAS development of the hands-off eyes-off ‘Super Cruise’. In a statement, GM said: “the considerable time and resources that would be needed to scale the business, along with an increasingly competitive robotaxi market”.

I would look at that 1st part of the sentence more closely - in the past automakers believed that robotaxis would replace private cars - today it is more likely that private cars with L2+/L3 ADAS will dominate the roads for the coming years. GM is a publicly traded automaker with high sensitivity to bottom line results (tech companies are often less sensitive), and this move not only saves $1 billion annually (Cruise cost GM $3.48 billion in 2023), but also aligns the tech development more closely with the new usw-case reality. Remember, that Ford and VW shut down Argo AI back in October 2022, in a move similar to that of GMs.

Competition wise, this leaves Waymo, Zoox and Tesla as the main US-based competitors, with today only Waymo leading scaled robotaxi operations.

Autonomous & remote-driving 🤖℡

Drone footage of a Cybercab in motion

Waymo’s robotaxis pass the first responder test - i.e. vehicles can identify and act accordingly when encountering emergency vehicles and traffic cops. The valuation was held by Tüv Süd, a (highly respectful) German standard institute. Waymo’s inability to clear the way to emergency vehicles and “funny” movies about cops needing to stand in front of the vehicle to stop it from continuing onto a crime scene were cause for much criticism against Waymo (and a now defunct company, Cruise).

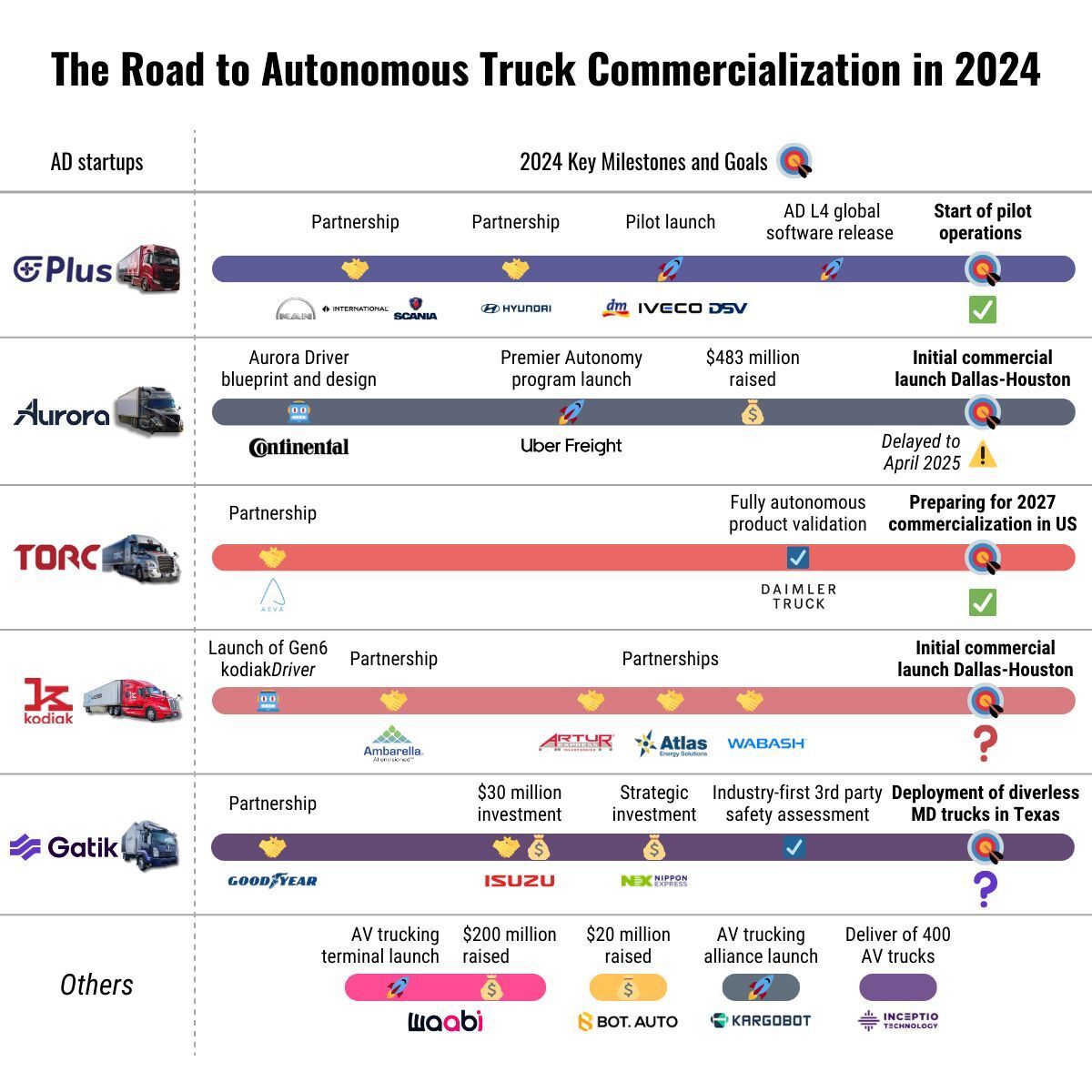

Road to autonomous truck commercialisation - by Wojciech Siwik - featuring key industry players:

DHL and Oxa partner with Heathrow on deploying autonomous technology, with the aim of moving passenger bags autonomously. In Korea, sonnet.ai partner with Navya ro put DRT-robotaxis on the road. Yandex to launch autonomous trucks in Moscow. Mobileye to use Innoviz Lidars for AV platform. Swiss autonomous logistic-solutions firm Embotech raises $27KM. Meanwhile in Switzerland, regulators approve use of self-driving cars on motorways from March 2025 (as long as it's controlled by a teleoperator) .

Flying cars 🚁

TNMT releases the final chapter in its excellent “Navigating the 2024 Advanced Air Mobility (AAM) landscape” series. This chapter touches on public desirability of air taxis - finding that a strong interest exists, fueled by time saving and sustainability motivators - but also that price is a key issue, and that WTP is below current market realities. For more (8/8 is all the way down).

Archer partnered with defense tech company Anduril Industries to develop a hybrid gas-and-electric-powered aircraft and raised $430M via equity offering. Archer has set up an internal unit - Archer Defense - as the company expects government defense contracts to create future revenues.

Joby launches $300M public offering ahead of 2025 commercial eVTOL release. The company recently raised $222M in October. Also Joby completes flight tests In Korea and partners with Jetex, an executive aviation company, to together focus on Middle East operations.

Vertical Aerospace had unpriced convertible notes in the sum of $260M - which made it impossible to attract further funding from external sources. With the latest investment those convertibles were priced, and now Vertical can go to the markets to raise more funds. Ownership: Mudrick controls roughly 70% of voting shares, while founder Fitzpatrick’s stake has been reduced from 70% to 20%.abla

OEMs 🛺⚡️

Carmageddon: a short 5:44 very good video on why Chinese are winning the EV war.

Ji Yue Auto, a EV automaker joint-venture by Baidu and Geely, is facing financial challenges, which are leading to delays in salaries. The two companies have pledged to inject funds into the company.

Gig economy 💰

Mexico’s lower house approves - unanimously by 462 lawmakers - the proposed labour reform for gig workers. In a nutshell: workers who earn above the national minimum wage will be entitled to social benefits and a right to unionise.

In Utah, Lyft to start offering top drivers (80%) a deposit 7% on their quarterly earnings, to be used to cover health & dental, retirement or time off.

In the UK, drivers are complaining against “Trip Radar” for being unsafe (and for making them bid for jobs).

In other news 📰

Amazon is in the US online car auto market, launching Amazon Autos.

The crusade against bright headlights.

I love meeting new people, learning about innovation in mobility innovation and exchanging opinions. Let’s get-to-know / catch-up.

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too. The “Share” button is to your left, under the heart. Thank you.