#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Uber is changing the way it works - with Rickshaws.

The Rickshaw segment is ±25% of all motorised rides in India.

Uber is moving to a driver daily usage fee (subscription based), ditching the familiar commission model.

Uber is no longer an intermediate ride provider - fares will be decided by the driver, with Uber only suggesting a price; no more dealing with payment, which will now be either cash or payment via the government payment platform; and Uber will not deal with rider cancellations.

The company keeps in place rider app safety features.

In the Indian Rickshaw segment, Uber has been losing market share to Rapido and Namma Yatri, hence the business model change. In addition, this way Uber relieves itself from fare regulation (implemented by some Indian states) and tax liability, as it now is not a ride aggregator anymore, but a “pure” SaaS player. Note that this change is not limited to India - and applies to some other SouthEast countries, such as Bangladesh.

Grab releases its 2024 financial report and shares drop circa 10%, over lower than analysts’ 2025 revenue forecast. Key takeaways for 2024:

GMV up 16% YoY to $18.3 billion

Revenue up 19% to $2.8 billion. Grab expects revenue to grow by 19-22% in 2025.

Group Adjusted EBITDA is a positive $313M (was a $158M loss in 2023). This is Grab’s first full year of positive adjusted EBITDA.

Financial services are growing - 64% growth in loan portfolio.

Net loss of $158M, improvement from a loss of $485 in 2023.

Grab is facing competition and experiencing the difficult macroeconomic environment we all share; it has potential to grow in SE Asia and there is the possibility of a rumoured deal with Gojek. TBC. For the Earning Call presentation and transcript.

Fetii, group rideshare, raises $7.35M. Fetii specialises in on-demand young demographic group travel - think going to a party or a sports game with over 6 friends and wanting to go together - classic ride-hail doesn’t solve that need. Fetti is present in 68 US cities across six states, moving 200,000 passengers a month. Funds will be used to expand in the US.

Transferz is a B2B pre-booked ground transportation player, working with a global network of local vehicle fleet suppliers. The company has just secured an undisclosed sum geared to improve partners’ payment terms - Transferz wants to pay partners within days - and to fuel tech and data investments to be able to offer better service to both riders and drivers. Transferz puts an emphasis on fair partner pay, what it calls the “Fare=Fair” principle.

Buser, Brazilian intercity transport (similar to FlixBus) and ticket reseller, reaches annual revenue of over $100M and is cash flow positive - and is now looking for M&As to support growth. Also in Brazil, Uber has recently launched its Shuttle intercity service.

FlixBus plans to launch in Peru and Mexico later this year. In LATAM, the company currently operates in Brazil and Chile. InDrive introduces “Light Cashless” in Nigeria, making it convenient to pay via bank transfer. Tada files a lawsuit against Kakao Mobility for blocking taxi calls and limiting choice. FREENOW backs proposed London taxi fare rise. BluSmart launches pet service.

Bolt launched Bolt Business - a corporate ground mobility solution, from cars to scooters. Bolt Business allows you to book for employees, customers and partners, offering app and web booking, scheduled rides, control over spending limits, emission offsetting and automated reports on usage, costs and sustainability.

Check it out via this link - I have a coupon good for 25% off 20 rides - just type in “BB25OFF20” when registering.

Car Sharing/renting 🚗

Turo CEO says IPO is postponed because of “choppy” market conditions and the IPO itself becoming a distraction for the company. Turo had revenue of $950M in 2024 (up from $880 in 2023); balance sheet has over $250M of cash.

UK’s Hiyacar has been acquired by Don Iro, an investor / entrepreneur. Good luck!

SOCAR reaches profitability in Q4, registering $2M operating profit on $85.2M revenue - i.e. 2.3% operating profit. The company attributes the move to profitability to operational improvement and increase in used car sales. When looking at 2024 as a whole, operating loss is similar to that of 2023 and stands at $6.8M on $300M revenue.

Carly, Australian car subscription, merges with Carbar. Free2move expands its car sharing fleet in Germany, adding 400 new vehicles to the fleet. In Boadilla del Monte, Spain, car sharing usage registered almost 3,200 trips since launch in September. That is roughly 650 trips per month, or just over 20 a day. WiBLE, Voltio and ZITY operate in the city. 60% of rides were to Madrid, many to the airport.

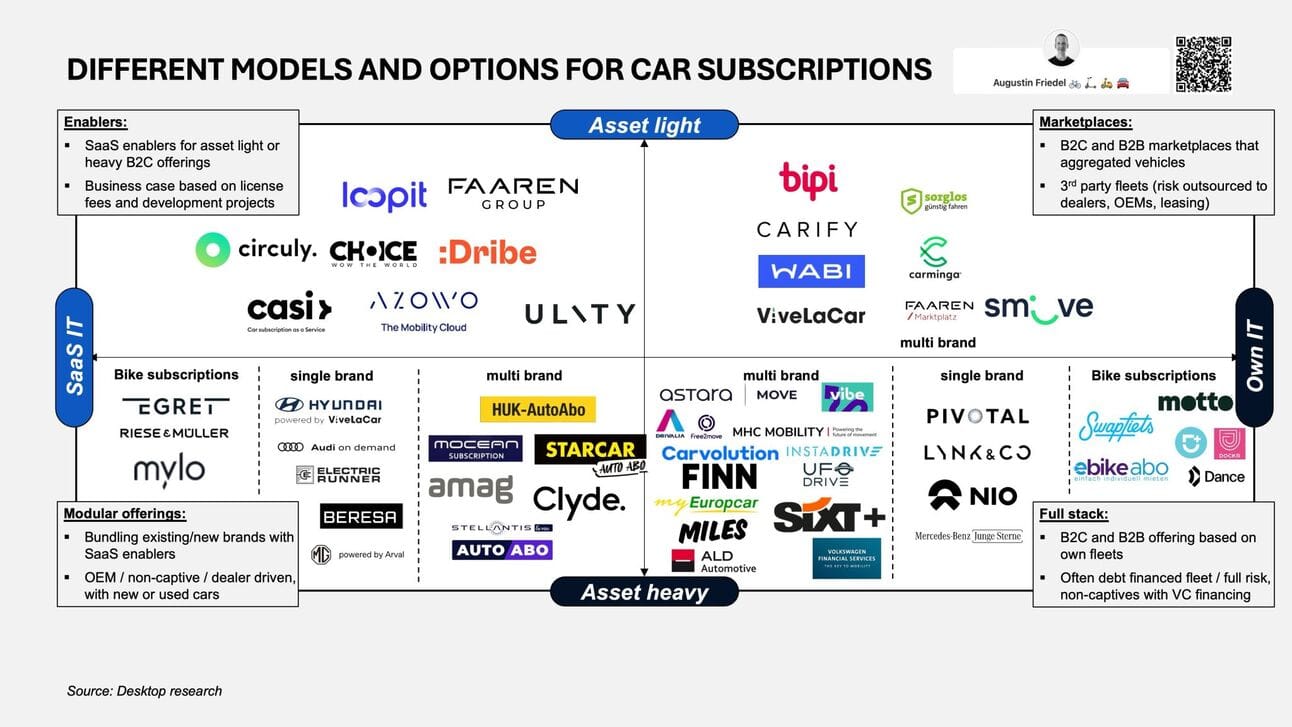

Augustin Friedel on the car subscription market:

Market to double to $13 billion

In Germany, monthly rates dropped by 11% to €563. This is attributed to lower share of BEVs and price pressures

Hyundai, via its service Mocean, is expanding. Other OEMs such as Toyota, VW and Ford are using the subscription business as a sales channel

Micromobility 🚲🛴

Third Lane Mobility, also known as Bird and Spin, achieves Adjusted EBITDA profitability. Key 2024 takeaways:

Gross booking up 17% YoY to $204M

Adjusted EBITDA $19.2M - 9.4% of gross bookings

Circa 35 million rides - so roughly $5.8 per ride

In H1/25 the company is set to launch in 15 new markets, 8 of those have been secured through a competitive RFP process. Bird is also asking Vancouver to award it with a tender given to Lime, citing economic protectionism as its reason. .

Gross booking up 31% YoY to 810M

Net revenue $686M, up 32% YoY

Adjusted EBITDA of over $140M - roughly 17.2% of gross bookings

Over 200 million rides - so roughly $4 per ride

Free cash flow positive for second consecutive year

Voi rolls out 220 new lighter e-bikes in Cambridge in a global first.

Delivery 🍽🧺

Just Eat Takeaway has just been acquired by the Prosus Group for €4.1 billion. Who? What?

Prosus is an Amsterdam based global investment group, majority-owned by South African multinational Naspers (Wiki). In 2024 Prosus managed $152 billion in assets. In Prosus’ delivery and transport portfolio are Delivery Hero, iFood, Swiggy, Oda, Flink, Wolt, Bykea, Dott - and others. Just last week it invested ±$30M in Rapido, giving Prosus a 2.9% stake in the company.

This isn’t the first time Prosus has tried to acquire Just Eat - in 2019 it lost the bidding war to Takeaway.com. This time around Prosus offered JET €20.3 per share in cash, a 49% premium to the 3-month volume weighted average price and a 22% premium to the 3-month high - that sums up to €4.1 billion.

Serve Robotics now in Miami, partnering with Shake Shack (burger) and Mister O1 (pizza) and with UberEats. According to Serve, the population of the neighborhoods where it will operate in Miami is around 120,000 people.

Zepto Café, 10-min fresh food q-delivery, hits 100,000 orders per day and closes in on a $100M Annualized GMV. Swiggy to invest $115M in its supply chain unit, Scootsy, as deliveries at Instamart scale. Yogiyo has been found not guilty in a fair trade trial. Beijing extends antitrust scrutiny of food delivery leader Meituan.

I love meeting new people and learning about innovation. Let’s get-to-know.

Autonomous & remote-driving 🤖℡

Tesla is expecting delays in its FSD entry into China. The company was expecting regulatory approval to start testing in Q2/25, but now heard from regulators that “there is no timetable” for the approval. Musk’s high position in the US government probably has something to do with it, as China braces for trade talks.

A read about the difference deployment strategies between Tesla and Waymo - and how Tesla is embracing Waymo’s deployment strategy, without admitting it.

Recommendation: I read the “The Driverless Digest” and you should too.

I like meeting new people and learning about mobility & delivery innovation. Let’s get-to-know.

Flying cars 🚁

Christmas doesn't come around twice in the same year - and Lilium goes into its 2nd (and final) insolvency. The company escaped insolvency late December after securing investment - only to see the main investor pull out from the deal.

The ePlane company, Indian eVTOL, signs a deal to supply 788 air ambulances for a deal valued over $1 billion. Operations to begin during the 2nd half of 2026. Remember, those deals are only worth anything if you can actually build aircrafts - a task not accomplished yet by many.

Vertical Aerospace released a presentation - and we learn that:

Pure-play OEM - with a plan for 50% revenue split between sales and on-going maintenance

Opportunity - airport to city routes

Quieter than an Uber Black car!

Certification target - 2028

Beta’s go-to-market is also an OEM play. Beta develops two aircrafts, for urban environment and regional transport, which are different to each other only the propulsion and propellers, and invests heavily in electric charging infrastructure, counting Archer as one of its customers. The company plans to launch with its first customer, Air New Zealand, later this year.

Doroni Aerospace has secured a $30M strategic investment from Innovation Wings Industries, a Saudi company. Money will be used to speed up R&D and production and open a manufacturing site in Saudi, with the goal of flying late 2026 / early 2027.

Archer receives FAA Certification to launch its pilot training academy. Heven Drones developed a new hydrogen-powered UAS - Teaser video.

OEMs 🛺⚡️

Nikola, maker of electric trucks, files for Chapter 11 bankruptcy. Nikola is looking to sell the business by Apri, either as a business, or “just” the assets. The company, which at the peak was valued at $30 billion, has over $1 billion in liabilities and between $500M and $1 billion in assets.

Rivian: release FY24 results, highlighting the VW partnership and US DoE loan to build its manufacturing plant in Georgia; the company produced 49,476 vehicles and delivered 51,579; recorded 1st ever gross profit; and gave a modest (less than analysts’ expectation) 2025 delivery forecast. Also Rivian CEO says “Hands-Free” driving is coming “in weeks”.

Jeep’s parent company, Stellantis, announces ‘hands free, eyes off’ driving feature, aka “Level 3+”. The tech is ready, but is yet to be deployed due to regulatory hurdles and market acceptance. TBC.

Cowboy shifts bike assembly to France, to improve delivery times, quality and scale responsibly, partnering with Re-Cycles.

Tesla’s Cybertruck receives a 5-star crash rating.

Car affordability - yes, they cost more, but everything has gone up.

In other news 📰

VNV 2024 annual report - I’ve covered their Q4 report a couple of weeks ago and this is more of the same - but you're welcome to refresh your memory on BlaBlaCar, Voi, Gett, Hungry Panda - which are all there.

Cubic launches an AI & ML innovation centre with Imperial College London. Mastercard’s approach to Urban Mobility in 2025. City of Astana to deploy a $190M AI-powered smart city project.

Careem Pay expands remittance service to 18 European countries - allowing expats based in Dubai to send money home to more countries. Careem Pay launched two years ago, a spinoff from Careem.

I like meeting new people and learning about mobility & delivery innovation. Let’s get-to-know.

People 🧑🤝🧑

Aaron Fodge is the new Treasurer Board of Directors @ the Association for Commuter Transportation.

Andy Taylor is the new Vice President Urban Mobility @ Mastercard.

Cynthia (Yu) Zhang is the new Regional Director @ Zeekr.

Derek Fretheim is the new VP Business Strategy @ RATP Dev USA.

Emmanuel Ayoyi is the new Sales Specialist @ Onn Travel KE.

Hannah Fortune is the new Senior Project Manager @ Connected Places Catapult.

Innocent Kpetsigo is the new Head of Growth and Expansion @ Wahu Mobility.

Richard Balshaw is the new Executive Director for Strategy, Corporate Operations, Technology and People @ Toyota GB.

Roger Atkins is the new Advisory Board Member @ The Battery Show Asia.

Rory Brimmer is the new Managing Director UK @ Turo.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.