#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth. Get in touch to see how we can support your growth.

Lyft 💰 FREENOW

Lyft acquires FREENOW for €175 million (±$197M). The news itself is pretty straightforward, so let’s quickly move on to insights:

It had to be you. With no room to grow in North America, holding at circa 25% US market share for years, Lyft needed to grow outside of the US.

FREENOW is the perfect candidate: an acquisition would allow Lyft a much quicker entry to a similar (developed) market; the company has been on the table for years; and honestly, there aren’t a lot of other options. KISS.Show me the money: €175M (±$200M). That is the same valuation Kakao Corp gave back in November 2023, and was turned down. Compared to Cabify (circa $1.4 billion) and Gett ($175M) this looks like a great deal.

Customer and driver obsession. Risher, Lyft’s CEO, entered office in April 2023, two years ago, and has taken Lyft to profitability by focusing on customer & driver experience and operational efficiency. Expect FREENOW to become customer obsessed.

Fend off Bolt. Bolt is gearing up for a $14 billion IPO, which is likely to take place in the coming year. Post-IPO, it would have made sense for Bolt to acquire Lyft (market cap circa $4.5 billion). Now Lyft has made things more complicated.

Read Lyft’s Investor update (8-K) for more on Lyft’s strategic rationale.

Oh, and one ask from Lyft: could you get FREENOW to write its name without all capital letters? It would be a much better writer experience. Thanks.

Announcement 📣

I am speaking at the Italian Automotive Dealer Day on how ‘new’ mobility and automotive dealers can work together. I am looking for solutions in the fields of:

1) EV fleet management / financing ⚡

2) Connected Cars & Data 💾

3) Corporate Mobility Solutions 🏢

And am open to new ideas which aren’t car sharing/rental or logistic management.

Solutions must help dealers grow or offer their clients better products and services.

Please reach out to me via LinkedIn (here) or at [email protected].

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

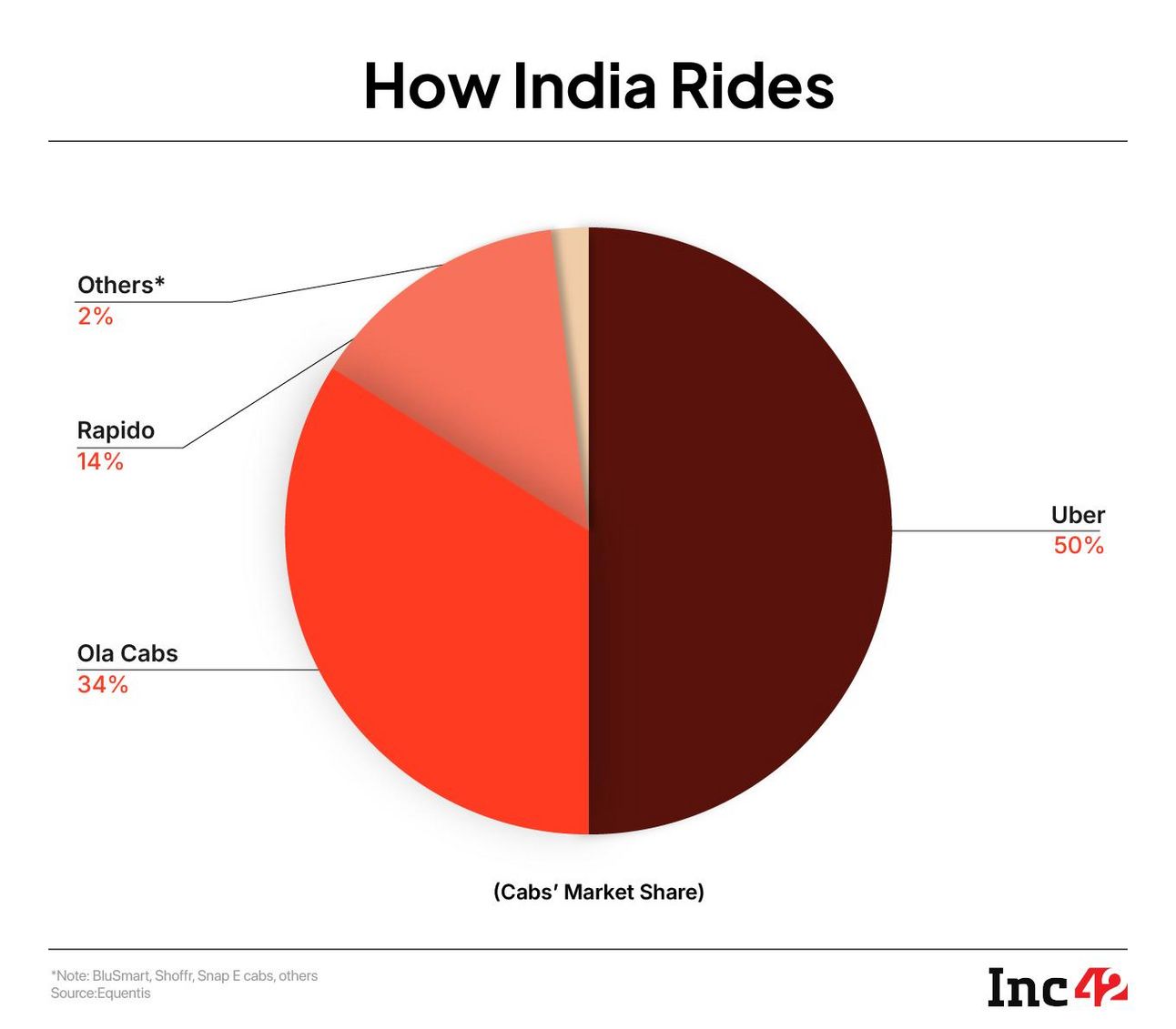

BluSmart abruptly quits ride-hailing, aims to become an Uber fleet partner. Blusmart faced substantial cash burn as an asset-heavy company, and facing increasing competition from Uber, Rapido, and other premium & ‘green’ providers.

It gets complicated. This latest development links back to Gensol Engineering, which, same as BluSmart, is facing liquidity challenges. The relationship in short: same company owners; Gensiol leased EV it acquired to BluSmart, at least 3,000 vehicles of the 8,500 BluSmart leased. For a detailed analysis and also here.

The future of the company is unclear; Gensol owners have been distanced from BluSmart by the Indian regulator, which is investigating ‘misuse’ of funds (both are public companies); the company has shut down services and exited Dubai.

Enter Eversource Capital (PE), who is looking to acquire BluSmart for $90-$120 million, 60% drop from the previous $300M valuation. This is a developing story.

Yango enters Oman via acquisition of local-taxi app Otaxi. The acquisition was done together with government company ITHCA Group. Yandex acquires Boxberry, a Russian delivery service.

Over in Southeast Asia, Grab is interested in GoTo (Gojek), and is reportedly looking to secure a $2 billion loan, valuing GoTo at $7 billion.

Grab operates ride-hailing, delivery and financial services across 8 markets, main ones being Singapore, Malaysia and Indonesia.

Indonesian-founded GoTo offers mobility, delivery (Gojek) and financial services, and also offers E-commerce services via Tokopedia, operating across 5 markets.

The deal is expected to concern regulators, particularly in Indonesia, as it creates a regional SE Asia monopolistic power.

For a more detailed analysis.

Also Grab (via GrabCab subsidiary) receives street-hail operator licence in Singapore, becoming the 6th taxi operator in the country. Grab has three years to reach a 800 vehicle fleet size. Gojek enhances partnership with Google Maps.

🇮🇳 The Indian government is planning to launch a driver-cooperative ride-hailing solution. The new service will have a range of transport modes, such as two-wheelers, auto-rickshaws and four-wheelers. There isn’t a launch date. And in Karnataka, India: The High court bans bike-taxi services by Uber, Rapido and Ola (etc.) until the government creates the regulatory guidelines. It has three months to do so.

🇰🇷 There are rumours that Kakao is looking to sell its Mobility division; the union is against it. Currently Kakao has a 57.3% stake in its mobility division, the rest are various financial investors. Kakao denies.

Uber and OpenTable partner on both ride-hailing and delivery to restaurants on the OpenTable platform. Integrations between both companies' apps are underway; 1st phase will roll-out the ability to book a restaurant and a ride to it.

InDrive receives permit to operate in Saudi Arabia, making it InDrive’s 49th country. The company already operates in Jeddah. InDrive launches InDrive Money in Peru, the 4th country to be introduced to the InDrive Money solution after Mexico, Colombia and Indonesia. In Spain, the Court forces Madrid to grant Cabify with 2,500 vehicle (VTC) licenses. eCabs is a Malta-based taxi service offering a ride-hailing white-label solution. It has clients in Greece and Romania and it wants to expand to additional European markets. Didi launches pet transportation service.

Via closes new contracts in Colorado ($2.9M contract) and Connecticut (over $3M). Argo rolls-out in Ontario.

Virtua launches a hotel ride-hailing booking solution in Dubai, partnering with Uber. So far the company has signed 45 hotels, and has already performed its first ride.

🚌 The commute segment is full of news:

SWVL released its FY24 results. In a LinkedIn post, CEO shares SWVL’s focus in the past two years, being: improving margins; increasing recurring revenues; dollar contracts to fend off currency fluctuations; moving costs to Egypt and Pakistan; and investing in high-margin business such as luxury vehicles and captain lending. From the P&L:

Revenue down 25% YoY to $17.2M

Gross profit up 3 percentage points to 21%

SWVL is trading at a operational loss of $8.48M on a $3.64M gross profit

Cash flow from operating activities: negative $3.56M

Cash and cash equivalents at the end of the year: $4.96M.

More in the investor update and Financial Statement.

Uber Shuttle expands to JFK. The shuttle business presents a budgeted way of travel, circa $25 a ride vs. a $80 ride fare with UberX. For now, vehicles are limited to 14 passengers, with services running every half hour. The Uber Shuttle business in the US is concentrated on airports and concerts.

Enakl, Moroccan commute player, chosen as one of Africa’s most promising startups - and is the only transport player on the list.

Busforfun, Italian-founded employee commute and events player active also in Switzerland and Spain, to sponsor the Milan Cortina 2026 Olympic and Paralympic Winter Games.

Zeelo delivers 5 million rides in 10 months.

Waymo ride-hailing numbers in Austin are probably closer to 6% than to 20%, as data used takes into account only the percentage within the operating area, which is limited for Waymo. For a detailed analysis.

Car Sharing/renting 🚗

Turo lays off 15% of staff, circa 150 employees, citing “economic uncertainty”. The company has recently decided not to go public, and this may be some efficiency measures before an IPO is resumed.

Insights on the INVERS mobility meetup, by Arthur Burnin: South Korean Socar has 20% of the Korean population signed up to the app (!), €300M in annual turnover, and operates 20,000 cars using a station-based, pay-per-minute model. Turkish TikTak combats non-user vandalism by… Having no branding. For more insights.

Micromobility 🚲🛴

Prague is banning shared scooters. Similar to Paris, Melbourne and Madrid, the focus will shift to bikes. The new regulation is expected to go into effect next month.

Tallinn tightens rules for light vehicles and micromobility. This includes placing visible branding and contact information on all vehicles, lower speed limits and tighter parking restrictions.

Also is a new micromobility player, spun off from Rivian with a $105M raise from Eclipse Ventures. Where does Rivian/Also believe it could succeed where other e-bike manufacturers (VanMoof, CAKE, FUELL to name a few) failed? Bringing prices down, by lowering costs via efficient supply chain management and high volume sales.

Today acquires Dockr, B2B e-cargo bike subscription, to expand subscription business, after securing €4 million in funding.

Veo is EBIT profitable, The company had $52M revenue in 2024, Estonian Tuul Mobility reported a 7% YoY revenue drop to €2.69M in 2024. EBITDA €175k, net loss €904k.

Beryl launches in Northern Ireland; will operate the Belfast Bikes scheme. Initial deployment of 300 pedal bikes and 100 e-bikes across 60 stations. Beryl will replace nextbike.

nextbike to manage the VéloCité bike share system in the French city of Mulhouse, initially deploying 300 e-bikes across 26 stations.

Lime to recycle its batteries by working with Redwood Materials. The agreement between the companies is for the United States, Germany, and the Netherlands. Lime shares that an e-bike.scooter battery usually lasts 500 charge cycles, or 5-7 years (comes out roughly a charge cycle every 4.5 days), before they end their life.

Solent Transport (region in the UK) to use the Vianova data platform

Delivery 🍽🧺

Uber is reportedly in talks to acquire Turkish delivery platform Trendyol Go.

DoorDash expands sidewalk robot delivery partnership with Coco, introducing bot deliveries in LA and Chicago. In Japan, Rakuten partnered with Avride for delivery bots. Avride’s bots have a volume of 54 litters; can deliver with rain of up to 20 millimeters of rain per hour; run for 12 hours on a single charge and take 3.5 hours to fully recharge. Manna, drone delivery, expands to Cork. A few weeks ago the company completed a $30M raise, bringing the total raised to $60M.

Careem launches 20-min grocery delivery in Riyadh. The Saudi market is crowded, with Jahez, Ninja, Nana, Hungerstation, and Keeta all operating in the country. DoorDash partners with Klarna to offer BNPL to its customers. Deliveroo’s white-label solution, Express, signs Tesco as its first delivery partner. Express enables grocers and retailers to offer rapid, on-demand delivery through their own online channels.

Swiggy launches Pyng, an app for professional services, in fields from health and finance through education and travel to DJs. A total of over 100 specialisations. The app will first be introduced in Bengaluru.

Zedify postmortem: company was never profitable since setting up 10 years ago due to low volumes and high operational costs. In 2021 Zedify had over 600k deliveries for over 500 customers, but investments made by the company were not aligned with customer growth

I love meeting new people and learning about innovation. Let’s get-to-know.

Autonomous & remote-driving 🤖℡

Wayve partners with Nissan. Wayve’s software and sensor set will be integrated into ProPilot, Nissan’s ADAS (L2) system. Mass production set for 2027. This is Wayve’s first such OEM partnership.

Nuro raises $106M at a $6 billion valuation. So far the company raised $2.2 billion. The current round is a down-round, from a $8.6 billion valuation in 2021 - but it reflects a wider industry “down” valuation trend than reflects specifically on Nuro.

WeRide obtains a L4 permit in France. The company has been running a commercial service in the Drôme region since February; this permit will allow for a driverless operation, which WeRide together with project partners beti, Renault and Macif, plan to start in July.

Waymo begins testing in Japan, with 25 manually-controlled vehicles. This is Waymo’s first foray outside of the US; in Japan Waymo is working with local taxi app GO.

Zoox begins testing / mapping in Los Angeles. Later this year Zoox will start offering public rides in San Francisco and Las Vegas. Other markets Zoox is active in mapping activities are Austin, Miami, and Seattle.

Pony.ai obtains a permit for L4 autonomous testing in Luxembourg. The company will work with Emile Weber, a mobility solutions provider.

The Jacksonville Transportation Authority (JTA) to order 100 Holon Shuttles, manufactured in Holon’s facility in… Jacksonville. JTA wants to be the first US transit authority to use AV shuttles as part of the fare paying transport system. Price of a shuttle: $409,000. The JTA currently runs AV pilots, retrofitting Ford E-Transit with Perrone Robotics software stack.

Uber and Waymo prepare to launch in Atlanta in the summer, users can now join Waymo’s interest list.

DiDi and GAC partner on robotaxi deployment.

Oxa and Applied EV partner to deploy industrial autonomous vehicles. The new partnership is expected to lease 100 new vehicles. Client(s?) unknown.

Aurrigo unveils an autonomous cargo vehicle, developed with UPS, to be first deployed at East Midlands Airport, the UK’s second largest cargo terminal. The cargo vehicle can transport a standard pallet or 2 ULDs, and up to 4,.5 tonnes, with an option for a up to 12 tonne trailer. It travels at 25 km/h and has 8 hours run time between charges.

WeRide, ComfortDelGro and Yutong sign MOU to jointly advance commercialisation of AV, starting in Singapore.

Vay opens a new hub in Las Vegas as the company increases its fleet from 50 to 100 vehicles. The article mentions 15 teledrivers, from which I understand the driver-car ratio to be 1:1, i.e. each car requires a dedicated driver.

Kodiak is getting ready to SPAC at a pre-money value of circa $2.5 billion. Completion planned for H2/25.

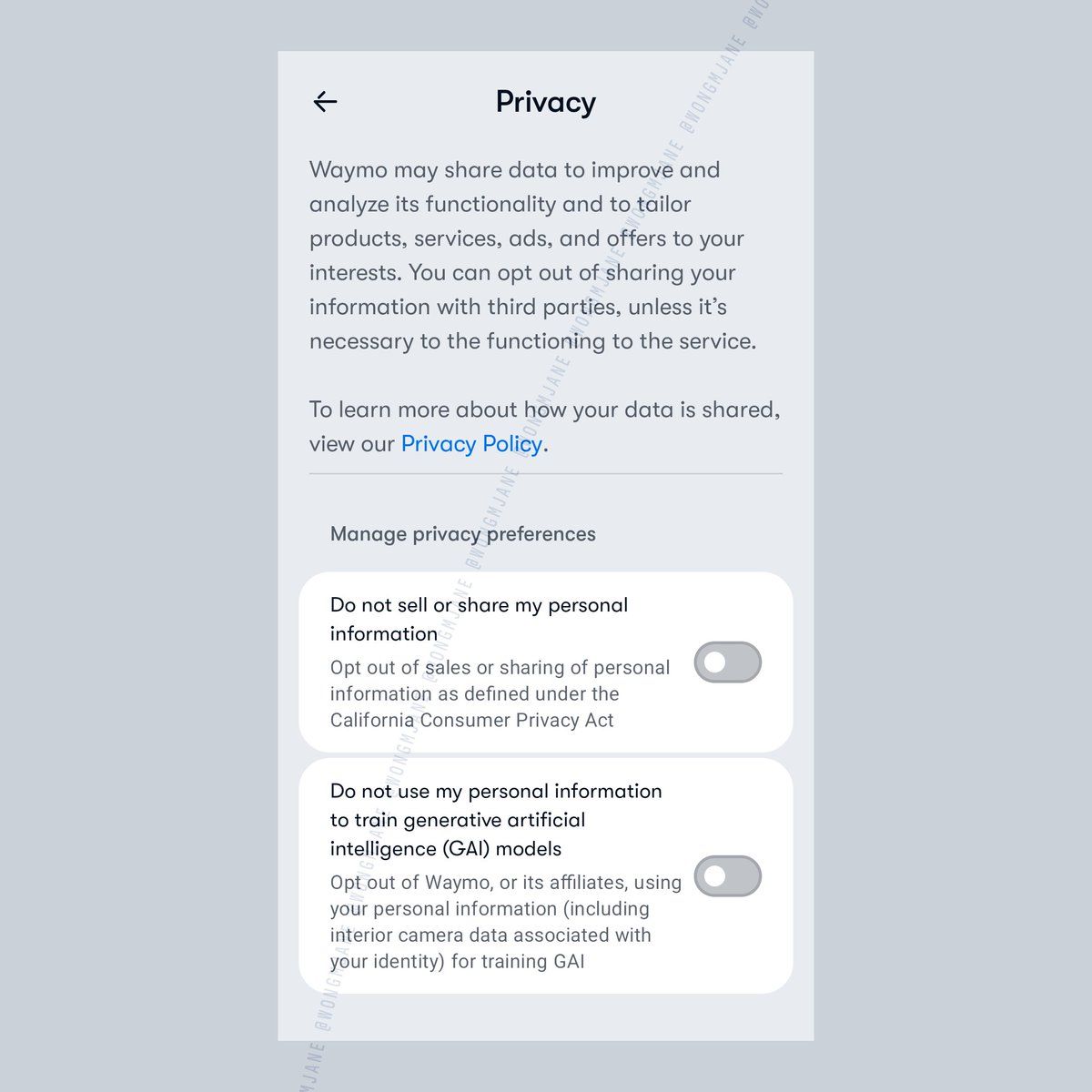

Waymo to use its in-car cameras to train AI models and may or not use it to collect data intended for advertising. Riders will be able to ‘opt-out’, Waymo denies data collection will be used for ad purposes.

Flying cars 🚁

EHang received regulatory approval for its EH216-S eVTOL to begin commercial flights in China. The company wil initiate flights in Guangzhou and Hefei, mainly for sightseeing.

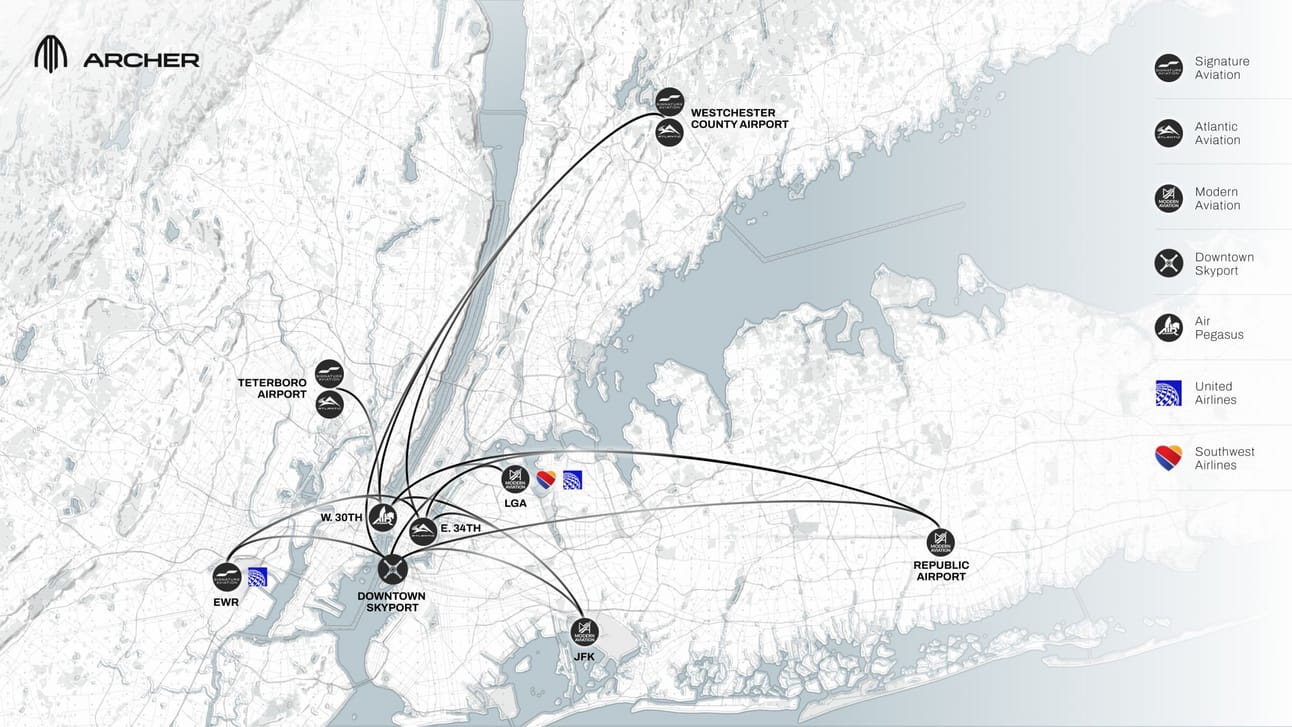

Archer and United Airlines plan future taxi service:

Skyports completes vertiport in Bicester Motion, Oxfordshire, UK.

OEMs 🛺⚡️

Canoo’s CEO to buy the company assets for $4M, following Chapter 7 bankruptcy back in January. The process has been messy, with one of the “assets” being a trade secrets lawsuit against Harbinger, which contested the sale based on the lawsuit potential only known to Mr. Aquila, Canoo’s CEO, and not to other bidders, therefore being ‘unfair’ to Aquila’s advantage; and also accused Canoo of hiding assets.

Lucid Motors wins bankruptcy auction for Nikola’s Arizona factory and other assets, committing circa $30M in cash and non-cash considerations. According to Lucid’s CEO: “as we continue our production ramp of Lucid Gravity and prepare for our upcoming midsize platform vehicles, acquiring these assets is an opportunity to strategically expand our manufacturing, warehousing, testing, and development facilities”. Lucid only acquired EV-related assets, and none of Nikola’s hydrogen assets.

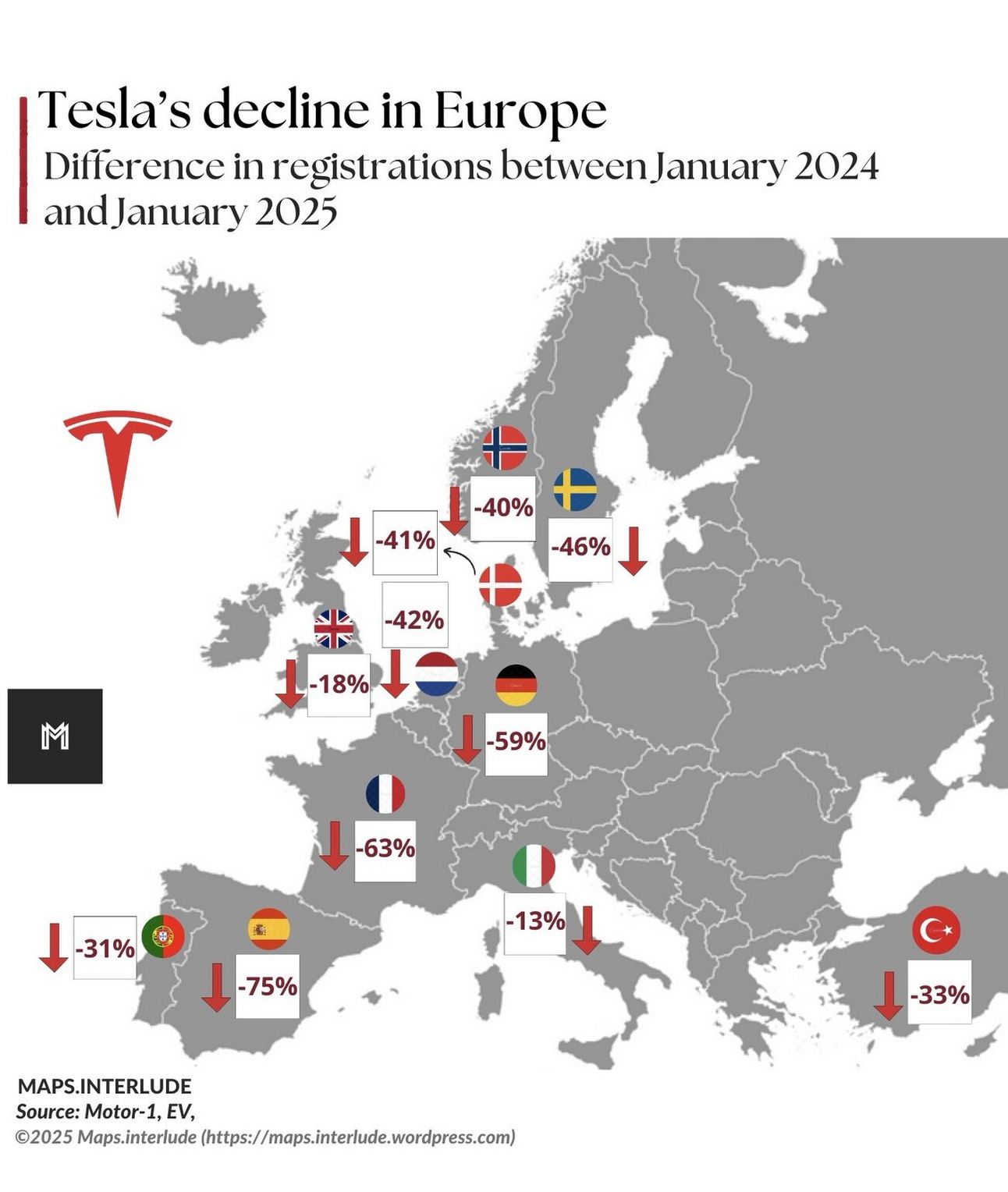

Tesla sales are down in the US and in Europe. Tesla delays new affordable Model Y in the US. Tesla launches in Saudi.

Slate Auto is an EV OEM startup backed by Bezos, expected to come out of stealth and begin production in 2026. TechCrunch has learned that Slate Auto’s goal is to build an affordable two-seat electric pickup truck for around $25,000. More here.

Zapp EV, British two-wheeler manufacturer, receives type approval (regulatory OK) for its i300 (moped) and appoints Green Mopeds as its first authorised UK reseller.

Rivian’s first B2B deliveries to a non-Amazon client: 70 vans to HelloFresh. Scania buys bankrupt Northvolt's heavy industry battery packs unit. XPENG enters the Polish market. What's wrong with Harley? US-based Revel Bikes close down - days after debuting a new model.

The rise and wobble of Ola Electric (BBC).

Ola lost close to 70% of value since IPO in August 2024

A series of malfunctions and fires have hurt the brand

Competition got better

The company has been going through efficiency measures with over 1,000 employees laid off, but cash flow is tight

But Ola has 25-50% market share. So maybe the problem is an unrealistic cost structure? For more.

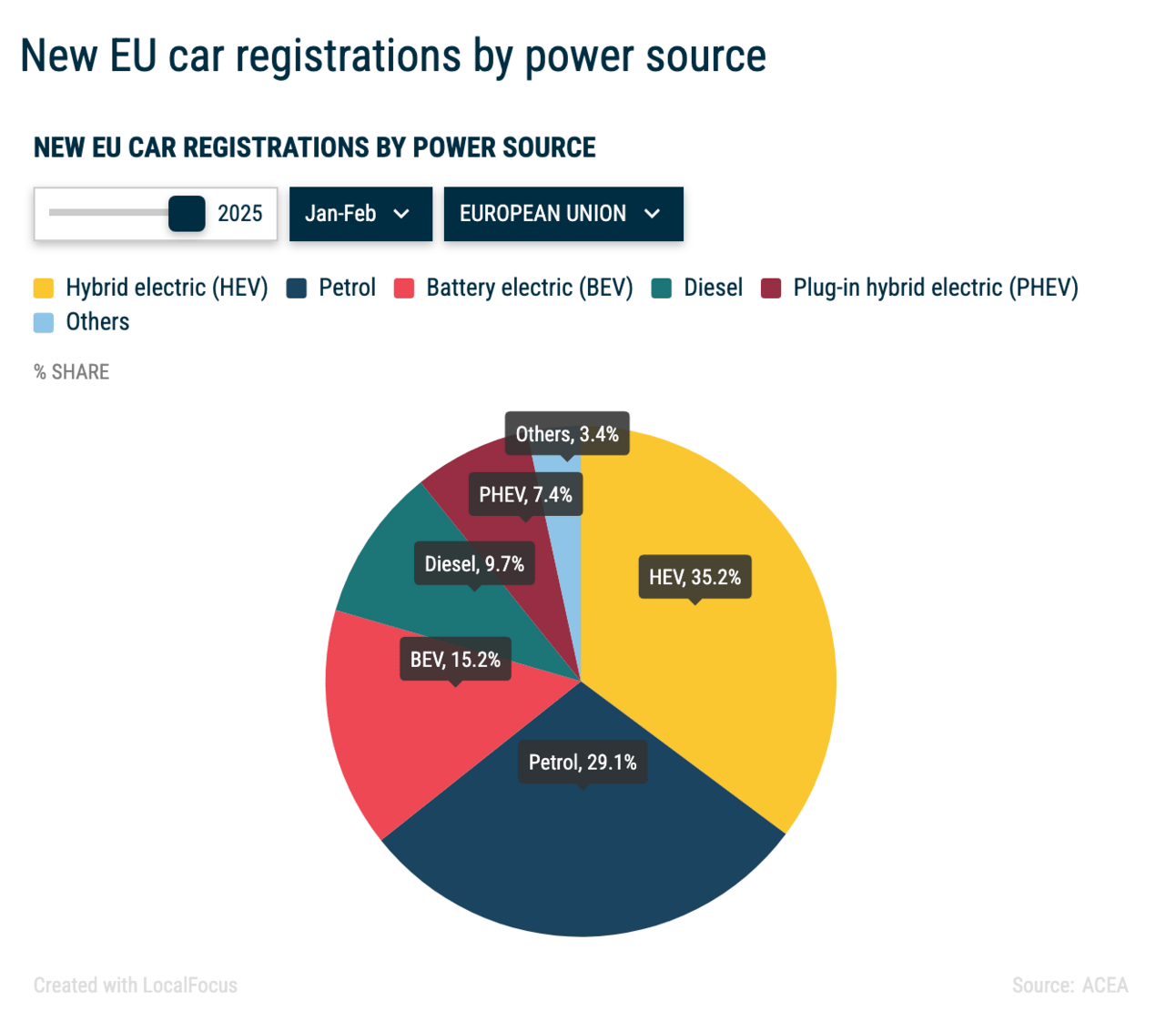

New EU car registrations, Hybrid vehicles lead with 35.2% market share, followed by petrol with 29.1%.

BYD leads EV sales.

Gig economy 💰

In 2024, several US states and the EU were trying to tackle gig-economy head-on. It had very limited access. From how 2025 started, it looks as if the worker battle is lost.

Ride-hailing strike in Prague. Drivers are complaining about ±25% drop in fares while expenses, such as insurance and fuel, are going up. Uber and Bolt drivers strike across Poland. Dozens of Uber and Lyft drivers banned from Nashville airport after protest caravan. Indian auto rickshaw drivers protest against ride-hailing.

In other news 📰

Trafi, a leading European MaaS player, is acquired by Enghouse Systems, a Canadian enterprise software solutions provider, with activity in various industries, including transport.

Electra.aero, hybrid-electric aircraft, close a $115M Series B. Blue Water Autonomy, autonomous ships, comes out of stealth and announces $14M seed raise. Nowos secures €6M to scale battery repair across Europe.

WHILL, autonomous power-chair for airports, launches in Rome Fiumicino Airport.

Careem’s CEO interviews to “Rest of World” about his plans to launch one of the largest consumer internet platforms (or “a digital butler for everyday life”) and on his journey so far.

A bit of old news on Trump’s pardon to Nikola’s founder Trevor Milton but has to be said - it is a dangerous precedent to have political connections come before conducting fair - uncorrupted - business.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Alexander Weedon is the new Enterprise Innovation Director @ Connected Places Catapult.

Ash Seed is the new Chief Commercial Officer @ CMAC Group.

Benjamin Ledoux is the new Principal Product Manager @ Zeelo.

Brennan Froud is the new Sr. International Business Development Manager @ Vulog.

Daniel Kite is the new Client Partner @ Addison Lee.

Dillon Twombly is the new Chief Revenue Officer @ Fleetworthy.

Dylan Jouliot is the new Associate Transit Planner - Community Development @ Spokane Transit.

Jaime Mateu Rico is the new Principal Enterprise Architect @ OK Mobility.

Jane Reagan is the new Head of Global Mobility Strategy @ Uber.

Luke Batten is the new Sales Director @ Relay Technologies.

Marvin Ruf is the new Sr. Sales Manager - Business Leader for AI Ecosystem Development | Automotive @ HERE Technologies,

Matias Longo is the new Director of Business Operations @ Bird.

Michael Wiesinger is the new Chief Operating Officer @ Kodiak.

Nina Källström is the new VP, International Strategy & Operations @ Wolt.

Nitsan Avivi is the new Vice President of Business Development @ Lidwave.

Oliver Parker is the new Senior Talent Partner @ Octopus Electric Vehicles.

Paulo Manique is the new General Manager Europe @ BUSUP.

Peter Ahlgren is the new Senior Managing Director Nordics @ Flix.

Philip Nothard is a new Remarketing Advisory Board Member @ Fleet Europe.

Robert Sykes is the new Director of Business Development @ MTS.

Sophia Jackson is the new Key Account Executive @ The Coach Travel Group.

Steve Pyer is the new Director of Highways and Integrated Transport @ Connected Places Catapult.

Steven Rutter is the new Global Manager Country Analytics @ Just Eat Takeaway.

Vered Mane is the new VP Israel Operations & Customer Success @ Questar Auto Technologies.

Vittorio Gattari is the new Public Policy Director, South Europe & Middle East @ Dott

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.