#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Top Story: Lyft partners with Tensor

Lyft partners with Tensor, a personal robotaxi brand, to provide robotaxis for Lyft’s own & partner fleets and also benefiting private AV owners. The deal, to be driving in streets as soon as 2027, will see Tensor’s robotaxis coming off the production line “Lyft-ready” - i.e. vehicles will be ready to integrate seamlessly into the Lyft network. That means that private AV owners could integrate their vehicles to the Lyft network when not in use. Those private owners would also be eligible to receive maintenance from Flexdrive, Lyft’s fleet management subsidiary. So, Lyft would not only gain from the flexible supply of private AV cars, but also earn revenue from the continuous care & maintenance of these vehicles.

With this partnership (if Tensor is indeed at the L4 quality the company says it is, or at least by 2027), Lyft is catching up to Uber’s 20,000 vehicle partnership with Lucid and Nuro; while positioning itself as a future leading player in the integration of private vehicles into a ride-hailing fleet. The integration of private vehicles to the network is a critical element in the future of ride-hailing. Professional fleets maximise utilisation, therefore it is expected that there will be a shortage of supply at peak times. That shortage would be fulfilled with either human drivers, or in this case, private AV ownership.

Tensor is a US based company with roots in China (once branded AutoX); manufacturing is by VinFast, the Vietnamese-based OEM; uses Tensor’s self-driving technology; for a detailed review of the company and car specs.

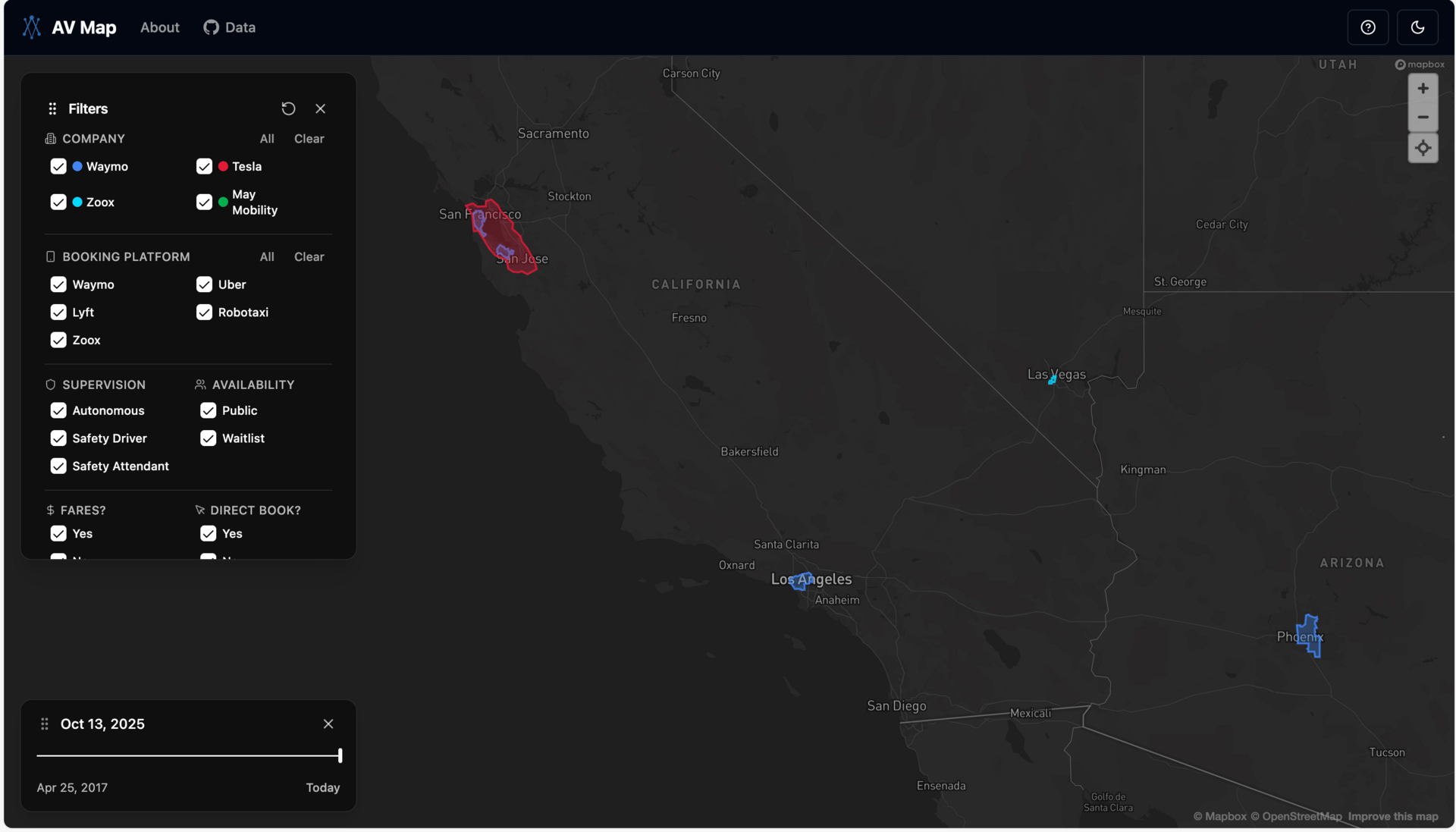

Mapping the autonomous industry

The past few weeks have seen more and more data and maps on autonomous operations. This week a new US focused map - a good one from Jackson Lester - emerged (see a video of how to use the map):

Also this week a new list of Czech autonomous deployments came out; adding to previous data I’ve recently highlighted:

Excel list of 93 AV deployments worldwide.

Map of European test sites.

List of cities (global) you can ride a robotaxi.

Drill down post on AVs in the Middle East.

Autonomy global map - focused on cars and delivery.

Trucking startup list.

No one list is complete (with buses & trucks usually underrepresented) - but put together we have a full picture of autonomy.

Let me know if you think there are any other good sources I missed, especially ones dealing with China and with off-road applications.

“Self-driving cars are already a reality in the United States and China. The same should be true here in Europe” - quoted from European Commission President Ursula von der Leyen. Will Europe start catching up to the US & China (and Gulf states)?

Ride-Hailing & Robotaxi 🚙🚕

DiDi Autonomous Driving raises $280M (2 billion RMB) Series D to accelerate L4 development. Today the company runs unmanned test operations in Beijing and Guangzhou.

Data on Taxi and Ridehailing Usage in New York City, some key points:

Ride-hailing is 85% of the market (the 15% is yellow taxis) of the roughly 730,000 trips a day taking place in the city

Within ride-hailing, Uber with 70% and Lyft with 30%

Average fare for ride-hailing is ±$32; for yellow taxis is ±$23.5

And ride-hailing drivers take more home - roughly between $7.5k to $8.5k; cab drivers bring in $6.2k to $7.5k

So by how much would you say the number of licensed yellow cabs in New York City has reduced in the past decade? Only 15%. More here.

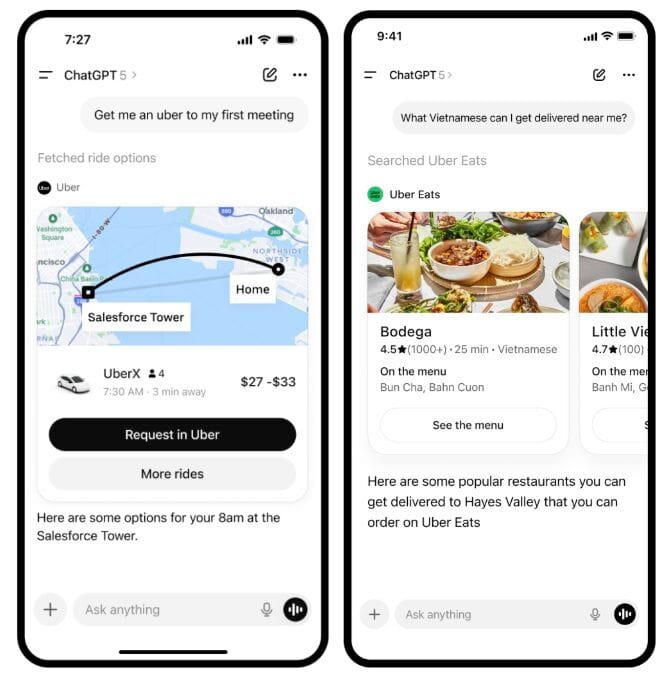

Uber is now integrated into ChatGPT.

Uber South Korea partners with Naver, an internet conglomerate - offering the Uber One subscription service via Naver’s subscription base. Uber hopes this move (& others) will shift the needle in its direction; its rival Kakao has +90% of the market. Uber Hong-Kong partners with Cathay to earn mileage points.

Vert and Jyrney partner for premium chauffeur ride-hailing services across the UK. RooRides, a new ride-hailing player, launches in Western Australia; tech partner is eCabs Technologies, based in Malta.

Nissan to launch autonomous mobility pilot in Yokohama, Japan. The pilot, planned to start next month, will see five vehicles used by a group of 300 selected members of the public.

Tesla’s FSD is under NHTSA investigation for crossing red lights and driving on the wrong lanes.

Waymo hires lobbyists to enter Minnesota. The law today mandates a human driver, so any future operations would have to see the law modified. Waymo is thinking long term. In Tennessee, Chattanooga’s Mayor wants to see autonomous cars arrive in his city, after the Waymo-Lyft announcement of entering state-capital Nashville.

Autonomous platforms meet homeland security. A new autonomous car (by Peronne Robotics), combined with a drone, featuring infra-red, license-plate reading and real-time data gathering, is now being tested by the Miami-Dade police force.

DRT, Bus-Based Mobility & AV shuttles 🚍🚌

Mirai Share integrates LINE, a Japanese super-App with 97 million users, to its service. RideCo won a 450 vehicle paratransit tender in Southern Nevada. The Routing Company (TRC) partners with RATP in Lompoc, California, launching a paratransit and fixed route solution. BusUp opens a Mexican office and eyes the US for expansion.

Car Sharing/renting 🚗

TikTak acquires domestic peer GetirAraç, for an estimated $22M. GetirArac was established in 2021, the result of Getir’s founders acquiring a local Turkish car-share company (from the Anadolu Group) and rebranding it. GetirArac was majority held (75%) by Mubadala, the Dhabi sovereign wealth fund which took over Getir’s assets from the founders (still in legal disputes), with remaining shares (25%) by Anadolu. Anadolu Group says it received $5.51M for its 25%; which gives the company a valuation of $22M.

TikTak was founded in 2020 by a fleet leasing company, and spun off in 2021. This acquisition will grow the fleet from 4,700 vehicles to 8,500 vehicles, making it Turkey’s largest carsharing operator and amongst the top in Europe. TikTak will now have over 500,000 active users with an annual turnover exceeding $110M.

GreenMobility updated guidance reveal that, in the first nine months of 2025 compared to 2024: Revenue grew 23%, to ±€15.5M (DKK 115.2M); and that EBITDA up 60% to ±€5.5M (DKK 41.1M)

Iberdrola invests €1M in TRIBBU, formally known as Hoop Carpool, the leading Spanish car-pool platform. The company will use the funds for its B2C expansion, taking on the likes of blabalcar.

Deer Mobility, German all-electric car sharing, migrates to Wunder Mobility. As part of the new tech, Deer introduces one-way bookings for station-based car sharing. It’s done using vehicle categories (and not specific car ID) and using a smart planner that automatically matches cars to trips and flags conflicts early. Hiyacar launches ‘Hiyacar Lite’ - car sharing for business and public sector. MyWheels rolling out additional 50 bidirectional charging units in the Netherlands.

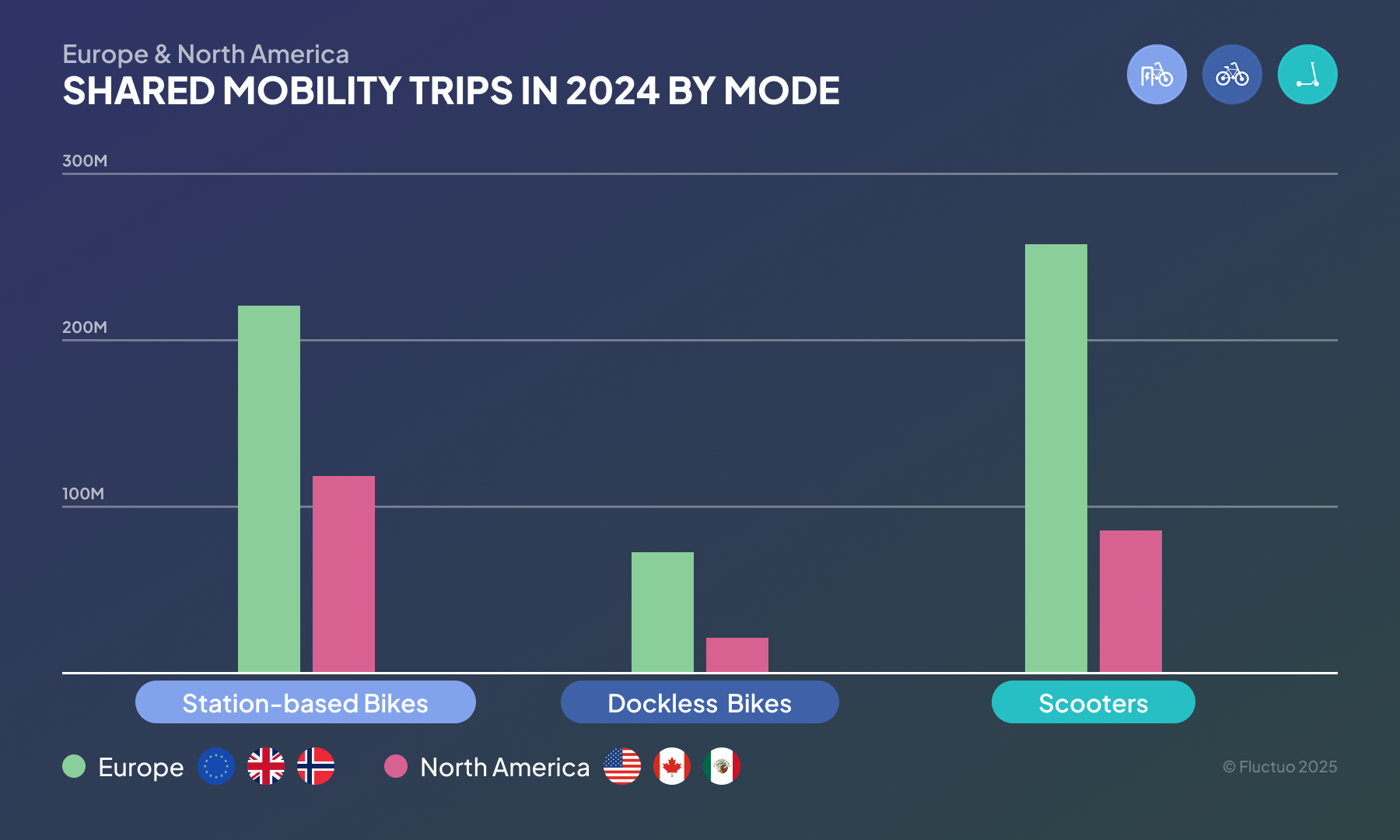

Micromobility 🚲🛴

Shared Mobility - US versus North America.

Delivery - from bikes & cars to bots & drones 🍽🧺

Zapp launches Zapp+, a new subscription service which gives 10% credit back on orders above £30, free delivery on orders over £15 and is free to cancel at any time without fees.

DoorDash partners with Serve Robotics for LA deliveries.

Meituan launches night-time drone delivery

Avride completes 100,000 bot deliveries in Ohio State University. There are over 100 Avride delivery bots making deliveries on a daily basis.

AV Freight & Logistics 🚛🚜

The city of Ordos (China) is becoming an autonomous trucking sandbox. More than a dozen companies are moving around a city, which hasn’t rebounded from the coal price crash of 2012 and the housing bubble.

In other news 📰

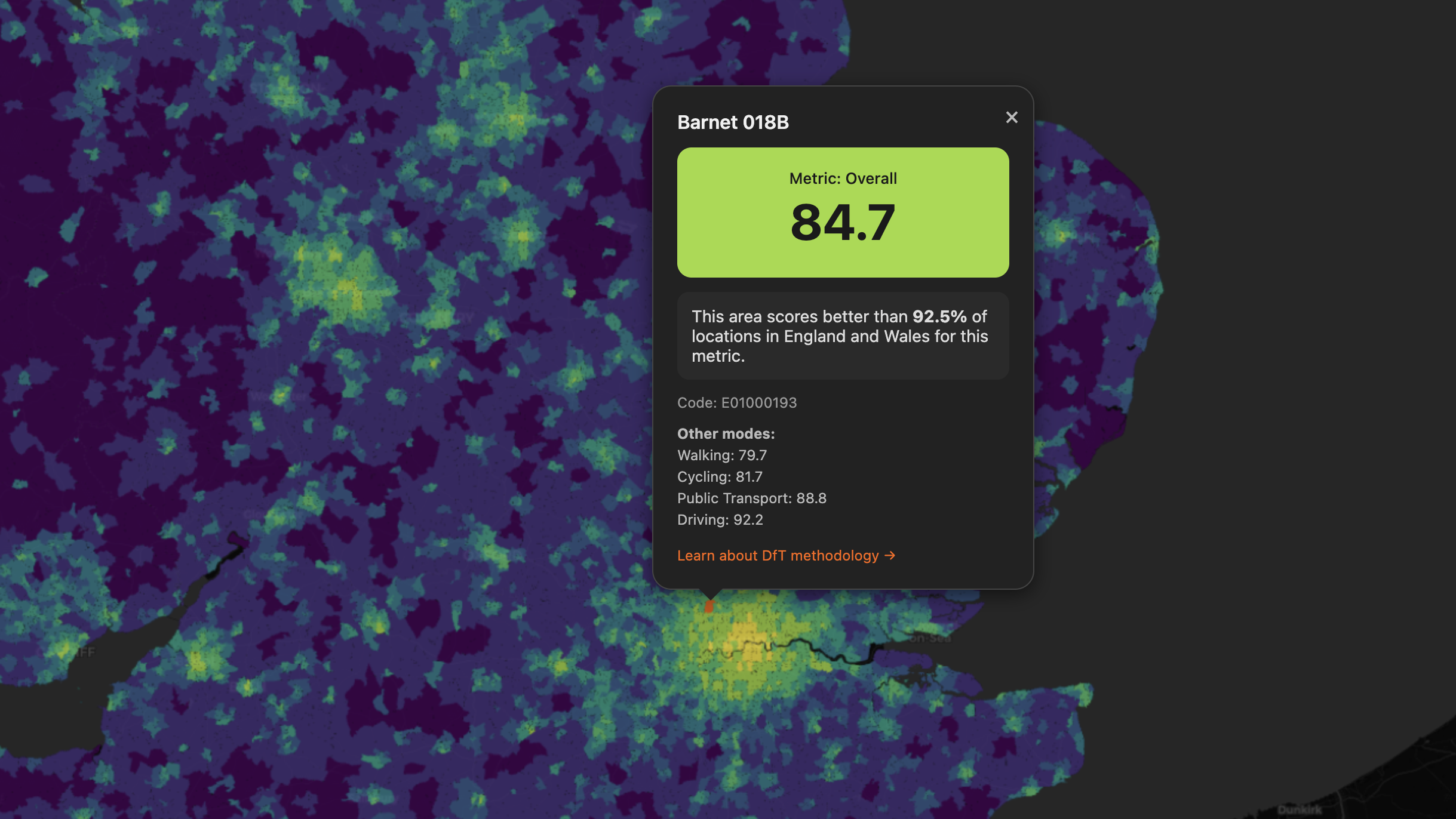

The UK’s DfT published the “Transport Connectivity Metric” - quantifying how well connected are points in the UK. It covers various travel modes, from car to walking, for different purposes. Podaris put it on a map:

The Chinese OEM industry, with close to 300 brands, is its own ecosystem.

The problem with CARIAD wasn’t CARIAD, but VW. And switching to Rivian won’t help that - VW must change to enable software development to thrive.

GrabMaps starts mapping Mongolia, the first mapping of a country outside Southeast Asia.

Candela, electric boats, signs deal in Thailand to supply ten premium ferries to the island of Koh Kood.

eVTOL costs structure is getting more expensive - X2 to X4 what was thought of only a couple years ago. Joby share price fell by ±11% after a discounted share sale. Beta Technologies filing for IPO in the US.

What is the mode of transportation most competitive with the car? The answer is here.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Marc Klein is the new Regional Manager, Commercial Drone Solutions, Americas @ Skyports Drone Services.

Peter Flynn is the new Chief Operations Officer and Director @ EVM UK & IRL.

Scott Bridgman is the new Partner Director @ CitySwift.

Sela Musa is the new Editor @ Zag Daily.

Sharad Kher is the new Director Business Development @ Vay.

Steven Rutter is the new Senior Manager - Country Analytics @ Just Eat Takeaway.

Vincent Hays is the new Managing Director France @ Flix.

Congrats and good luck!

#movingpeople is a weekly mobility & delivery newsletter - from Ride-Hailing & Robotaxi through Remote-Driving & Delivery Drones to e-bikes and Autonomous Freight & Logistics.

Thank you for reading. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.