#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Top story: Lyft and Zoox Enter the AV Ride-Hailing Space

Why does it matter? US autonomous ride-hailing is dominated by Waymo and Uber. Tesla isn’t a real match (yet). Finally, new players are entering the market. Still, Waymo holds near-monopoly status and Uber the dominant lead in demand management.

Zoox, the Amazon-owned AV company, launched ride-hailing operations in Las Vegas, where the company has been testing with employees and limited members since 2023. The service stops at five fixed points along the strip, on a route of 3 miles (4.8 km), picking up a maximum of 4 people at a time at speeds of up to 45 mph (70 km/h). Not yet commercial, for now open to the general public for free. Commercial service is pending additional regulatory approvals. Next stop: San Francisco.

Zoox is a unique company in terms of ownership of the AV value chain - it has its own custom built vehicle; own AV stack; and set to manage its rider and demand operations - i.e. controls almost all of the value chain. Amazon classic thinking. Yet not 100%, for example it partnered with The Routing Company for its software.

Lyft and May Mobility launch commercial ride-hailing in Atlanta (state: Georgia). The service is modest: small fleet, limited hours, 7 sq. mile (18 sq. km) and safety driver included. May Mobility operates other services across the US, including a commercial microtransit (/DRT) in Georgia. Lyft had some unsuccessful AV bets in the past, partnering with Motional (scaled back) and Argo (shut down). Worth noting: despite this existing partnership and one in the works with Mobileye, Lyft chose Baidu for its European AV operations.

Meet Electreon - a global leader in dynamic (public roads) and static (depots, parking bays) wireless charging. Electreon runs projects in the US (Detroit) and across Europe - Italy, Germany, Norway - and soon to launch a 1 mile public road charging project on the A10 in France. Relevant for cars, commercial vehicles, buses and heavy duty vehicles, Electreon offers anything from 25kW static car charging to 200kW dynamic heavy-duty vehicle charging.

DM me for more.

Ride-Hailing & Robotaxi 🚙🚕

Flight-hailing: Joby partners with Uber to display Blade’s “air taxi” on Uber’s platform.

Blade is a company specialising in helicopter travel. It runs regular routes, such as between Manhattan and JFK and to the Hamptons in the US, and in the Monaco-Nice region in Europe. It is an asset-light company. In 2024 the company flew over 50,000 customers.

Joby now partnered with Uber to show Blade’s air-taxi app, from early 2026.

This isn’t a first - Blade was on Uber’s app in the past, but on promotional occasions; now air travel will be a ‘regular’ product

Uber partners with Chinese company Momenta to launch in Munich, Germany, in 2026. The partnership was announced back in May 2025, but only mentioned international markets outside the US and China. This is Uber’s 9th car-relevant autonomous technology partnership, and its 18th in total (inc. trucking and delivery AV tech, OEMs and operations).

Uber is sued by the US Department of Justice (DoJ) for alleged discrimination against disabled riders. The lawsuit brings 17 examples of refusal to provide service and illegal fees. According to the US DoJ, Uber “routinely refuse to serve individuals with disabilities, including individuals who travel with service animals or who use stowable wheelchairs”. A similar lawsuit, which was eventually settled, was in 2021; and the DoJ says it alerted Uber of the mistreatment back in 2024. TBC.

InDrive enters grocery delivery vertical - on route to become a ‘SuperApp’. According to the founder/CEO: “inDrive.Groceries is a natural gateway to retention and multi-vertical adoption: in early pilots, it achieved an NPS of 83%, with an average of around five grocery orders per user per month, meaning that it can drive daily engagement and strengthen loyalty across our entire platform”. The launch in Kazakhstan is using a dark store model; over the next months InDrive will launch deliveries into their top markets: Mexico, Colombia, Peru, Pakistan, Egypt, Brazil and Morocco.

Sherbet, the London Electric Black Cab company, raised £40M investment. Asher Moses, the founder, started as a taxi driver back in 1989 and founded Sherbet in 2013, to today becoming one of the largest taxi operators in London, with a fleet of 550 taxis. Funds will be used to grow the fleet to 3,000 taxis, invest in technology and plan international expansion.

Tesla officially received approval from the Nevada DMV to start testing autonomous vehicles (robotaxis) on public roads. There is another regulatory step required to start operations, but it is an easy one to complete. There will be additional steps for the future service to become commercial. Keep in mind: Nevada’s regulatory regime is extremely friendly to autonomous vehicles. Meanwhile in Austin and San Francisco, people registered are having their access revoked; others report long waiting times, indicating demand > supply.

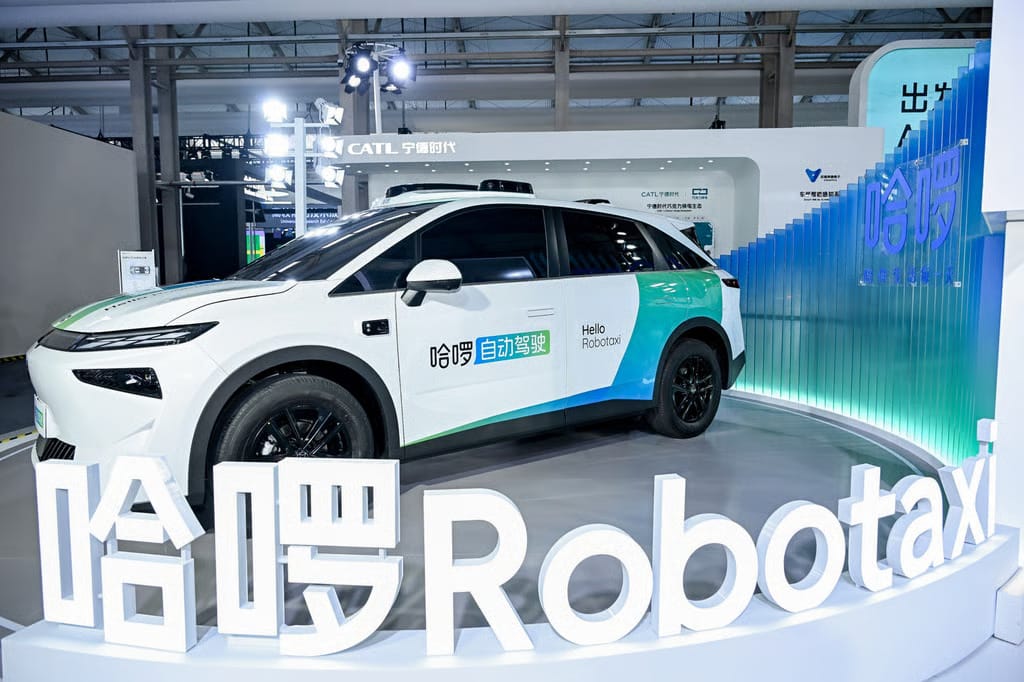

Hello, a Chinese bike-sharing and ride-hailing firm backed by fintech giant Ant Group, unveiled its first driverless taxi. The company plans to have 10,000 self-driving taxis in more than 10 cities next year, with a goal of expanding to over 50,000 vehicles globally by 2027.

Volvo autonomous test vehicle spotted in Mountain View, California. This isn’t new - those vehicles have been spotted since at least 2019. Pictures in the links. Wayve completes autonomous drive from Inverness to Paris. Lyft expected to save $200M annually in insurance costs thanks to the new California deal which allows drivers to unionise in return for easing insurance. Wayla raises €1.12M in a crowdfunding round in under 30 hours. Funds will be used to expand B2B offer, R&D and grow the fleet. BluSmart’s domain is for sale.

DRT, Bus-Based Mobility & AV shuttles 🚍🚌

Via completed its IPO - better than expected:

$493M raised

$46 per share - above its initial range of $40–44.

Valuation of $3.65 billion - higher than the $3.5 billion value from its most recent private fundraising round.

After going public on Friday, the stock closed trade on Friday at $49.51 per share.

SWVL H1/25 results:

Revenue $10.19M, up 26% YoY

Gross margin $2.19M (also up 26% YoY, i.e. no change in margins)

Net profit of $0.43M, versus a loss of $5.7M in H1/24

85% is recurring revenue

Active in Egypt, Saudi Arabia and recently launched in the UAE

Ryde, ride-hailing, partners with AV company MooVita to launch driverless shuttle service in Singapore as early as Q4/25. Safety driver included. The companies are awaiting regulatory approval.

WeRide Robobus enters Belgium. Passenger-less public road testing begins now; from November to January 2026 the service will be piloted as a commercial service, in mixed traffic; to be integrated fully as a regular PT solution in Q1/26.

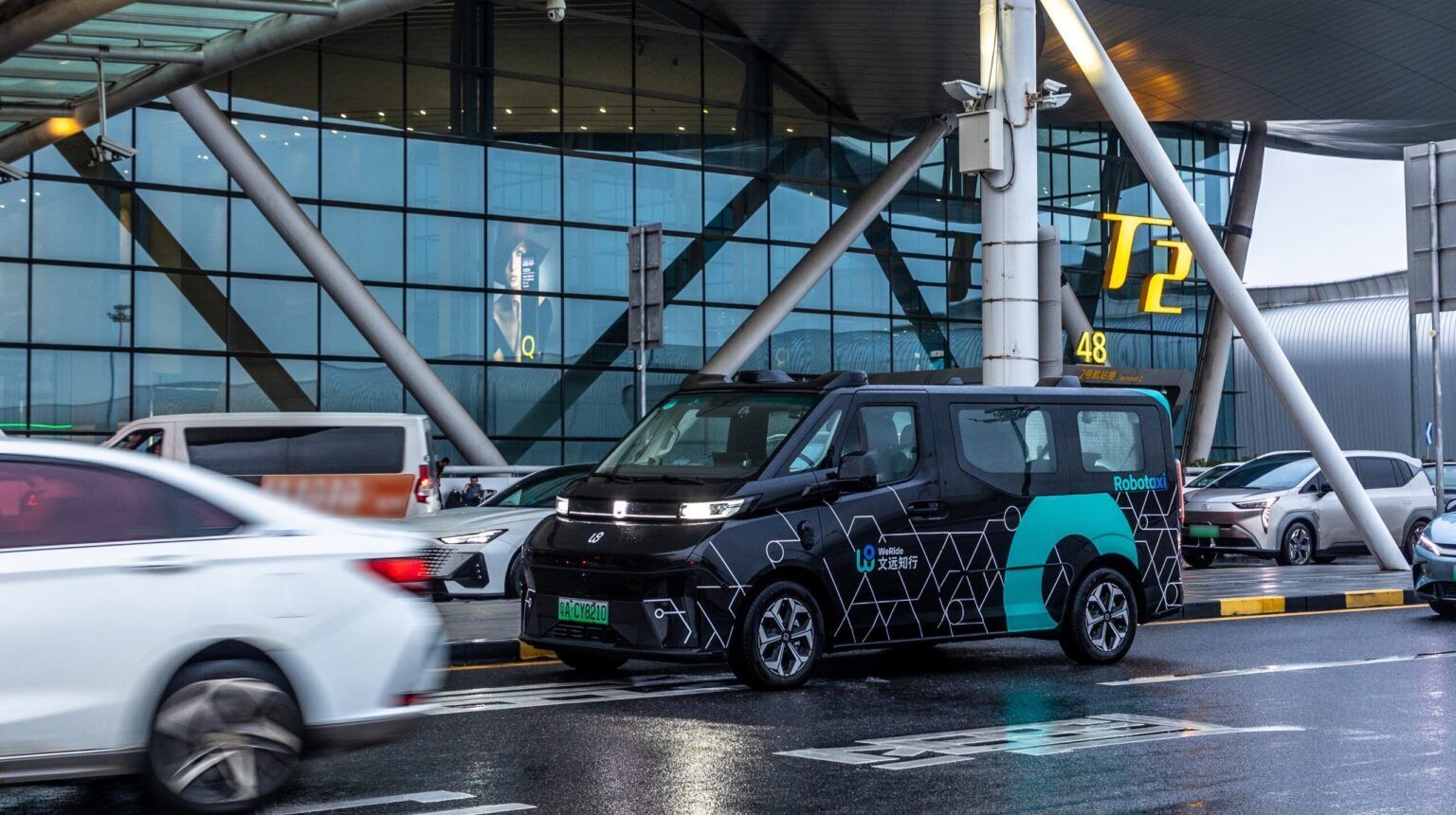

WeRide launches 24/7 fully driverless commercial robotaxi service in Guangzhou. The service started in October 2024, and now completed its pilot period and all necessary regulatory approvals to fully operate.

Car Sharing/renting 🚗

GreenMobility upgrades guidance:

Revenue growth: 13–15 % vs. FY2024 (from 10-13%)

EBITDA growth: 32–42 % vs. FY2024 (from 25-40%)

The experience of a Turo host. A very long read so I asked ChatGPT to summarise this:

Micromobility 🚲🛴

Lime partners with HELLO CYCLING to allow users in Japan to access each other's fleet.

Upway and Lease a Bike offer second-hand corporate bike leasing in Belgium. The alliance enables employees to lease Upway’s second-hand bikes directly through the Lease a Bike platform.

Delivery - from bikes & cars to bots & drones 🍽🧺

Amazon invests $25M in Rappi. Rappi is a South American ‘Superapp’ - offering food, grocery & goods delivery, financial services and online travel. The company is active in 9 Latin American countries in more than 250 cities, with major markets being Colombia (founded), Mexico and Brazil. In 2024 revenue was circa $1 billion and its valuation exceeded $5 billion when it last raised equity, in 2021.

So, $25M is not that much actually. Then why?

For Amazon, access to last mile delivery speed and to Rappi’s financial arm, as a payment ‘gateway’ for couriers.

For Rappi, it is facing competition from the larger Mercado Libre and from iFood, as well as from new entrants Keeta (Meituan) and 99 (DiDi). Being backed by Amazon sure helps.

Qatar suspends Talabat services for a week for misleading consumers. Uber Eats partners with Pipe, fintech, to support small businesses (i.e. restaurants) with cash flow. Fizz, a college social app, partners with GoPuff to expand into grocery delivery. Wolt: 23% of all deliveries are now made in ‘clean’ vehicles - between July 2024 and July 2025, all worldwide deliveries were made using either electric vehicles or bicycles. Austria (>80%) and Germany (⅔) lead. RIVR in Leeds with Evri.

AV Freight & Logistics 🚛🚜

Roush delivered the first Kodiak driver-equipped autonomous truck from its production line, to Atlas Energy Solutions Inc. in August 2025. This is the 8th autonomous truck delivered to Atlas - what is special is that this is the first to have come directly from a production line, and not be fitted afterwards.

PlusAI and International (part of the Traton Group) launch customer autonomous truck fleet trials in Texas, with two people onboard: a trained safety driver and a test engineer to collect data. Commercialisation planned for 2027.

KargoBot.ai, autonomous trucking, partner with SuperPanther, new energy heavy-duty truck maker, to develop L4 autonomous trucks. .

Daimler Truck seeks investment partner for Torc Robotics subsidiary. Developing autonomous vehicles is expensive (€600M a year), and OEMs aren’t doing that great lately. Daimler holds 91% of Torc.

Aurora trucks drove 50,000 driverless miles on public roads.

In other news 📰

Tesla is changing FSD branding - adding the word “supervised” to the description. This is what happens when you lose a court case and have to pay $243M in damages AND create a dangerous precedent.

As for the CEO package, it describes FSD as: “an advanced driving system, regardless of the marketing name used, that is capable of performing transportation tasks that provide autonomous or similar functionality under specified driving conditions”. Vague.

Hyundai’s eVTOL startup Supernal pauses work following CEO and CTO departures. Supernal was still working toward its first untethered test flight before the pause. Meanwhile in Germany, AAMG is locked in stalemate with administrator Pluta over the Lilium acquisition, which insists on an escrow deposit to complete the deal.

And more on the subject of eVTOLs: Grizzly Research published a report on Archer Aviation titled: Archer Aviation, the Nikola of the skies. The report (see here) claims that Archer’s design is suboptimal and would not be competitive; that their level of product maturity is behind competitors; and that the company is creating a false appearance of progress. This isn’t the first time Archer get tough criticism - back in May Culper Research had a report (see here) titled: When You Can’t Earn Airtime in the Sky, Buy it on Late Night Television. It made similar conclusions. TBC.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Adam Pearson is the new Resource & Capability Development Manager @ Transport for London (TfL).

Catherine Whitfield is the new Chair at ITS UK and the new Project Director ITS @ Mott MacDonald.

David Spain is the new Human Resources Director @ Bolt.

Eike Bethmann is the new VP Global Operator Enablement @ MOIA.

Gonzalo Ramos is the new Sr. Director of Business Development (Interim) @ Supernal.

Hattie James is the new Project Manager @ Peninsula Transport.

Jean-François Dhinaux is named co-founder at Vapaus, after completing AZFALTE acquisition.

Laura Reupke is the new CEO @ BABLE.

Laurianne Krid is the new CEO @ European Cyclists' Federation.

Lewis Evans is the new Senior Account Expansion Manager @ Zeelo.

Matt Kassler is the new Senior Customer Success Manager & Go-To-Market Team Lead @ Zeelo.

Razwan Ahmed is the new Senior Key Account Manager @ Tesla.

Tom Benson is the new Research Affiliate @ MIT Senseable City Lab.

Congrats and good luck!

#movingpeople is a weekly mobility & delivery newsletter - from Ride-Hailing & Robotaxi through Remote-Driving & Delivery Drones to e-bikes and Autonomous Freight & Logistics.

Thank you for reading. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.