#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth. Get in touch to see how we can support your growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Moove, the Uber-backed gig-economy vehicle financing company, which is powering Uber’s autonomous fleet, is raising $1.2 billion in debt financing to support US and AV fleet expansion. Moove, which started in 2020 and today is active in 13 global markets with 38,000 vehicles under management, had $275M revenue in 2024 and expected to reach more than $400M this year.

My analysis: who would operate autonomous fleets is a frequently industry asked question. Prime candidates are car rental companies (e.g. Enterprise, Sixt) or major car distributors/dealers, who both have the operational expertise (vehicle turnaround, maintenance, parts, workshops etc.) and the financing capabilities to support such operations. For now, those players are keeping quiet. Are those players silently building up capabilities? Time will tell. For now, Moove seems to be in the winning position in the AV fleet management race.

CaoCao, China ride-hail app, a division of Geely, raises $236M, going public on the Hong Kong exchange. My analysis: The Chinese ride hailing market is dominated by DiDi, which holds 70-80% of the market followed by AMAP (by Alibaba) which holds circa 20%. CaoCao is perhaps the 3rd largest, hoping to claim the #2 position. For more, read an interview I did with Lock Tang, VP of the Chinese ride-hailing association, on the Chinese ride-hailing market.

GrabCab, Grab’s own taxi service, launches in Singapore. Grab Malaysia bans all Neta (Chinese OEM) EVs from its e-hailing service, due to low (zero stars) safety rating.

BuuPass, Kenyan-founded online bus bookings, secures investment from Yango Ventures. umob partners with Clickdrive, a driving school, offering €10 credit to new drivers on vehicles rented from umob’s platform. Yango adds public transport in Abu Dhabi and Sharjah.

Car Sharing/renting 🚗

Zoomcar reports a loss of $25.6M and negative EBITDA of $9.9M for the year ending March 31st, 2025; net revenue was $9.1M. Zoomcar’s (OTC) stock is priced at $0.66 per share, after starting 2025 at roughly $40 per share. My analysis: while these numbers are better than last year’s, it is extremely hard to see how Zoomcar can reach profitability with those numbers. Zoomcar has already issued a ‘going-concern’ a few months ago, and the company’s market cap is (July 3rd) only $4.12 million. An M&A activity soon or diversifying from its core business to something such as vehicle financing? Time will tell.

Free2Move now powers the CERN car-sharing fleet.

What will be the demand three days from now? Which vehicles should we perform battery swap on first? Which is our most underperforming location? Gathering insights takes time - but it doesn’t have to anymore.

SWITCH’s Agentic AI solution allows you to communicate with insights using simple chat, clicks on dashboard and/or using repeating API connection. So you can have the answers to all of the above, and more.

SWITCH is opening early access for micromobility and car-sharing modes, in riding, delivery and logistics. If you are a fleet manager, product or tech - this is for you.

Places are limited: https://getswitch.io/agentic-ai-for-mobility-and-logistics/

Micromobility 🚲🛴

Neuron Mobility merges Beam Mobility. The combined entity will operate a fleet of 100,000 vehicles across 100 cities globally. The brands will continue separately, with each company focusing on its strong markets.

Lime’s IPO: valuation is expected to be ‘significantly higher’ than the $510M valuation the company received in 2020. To date Lime has raised $1.5 billion in equity and debt.

Lime to exit Brussels, rules court. A legal battle between Lime and Brussels started in July 2024, after a tender process selected Bolt and Dott. Lime appealed on claims of fairness of process and lack of transparency, keeping its vehicles in the city. Now the license has expired.

Yandex Uzbekistan launches E-Scooter service in Samarkand and Bukhara. Freenow adds Voi to its London platform. HelloRide expands Singapore fleet to 20k vehicles.

Delivery 🍽🧺

Ninja, a Saudi-based gorcey and food delivery company, raises $250M in a reported valuation of $1.5 billion. Ninja operates in Saudi Arabia, Bahrain, Qatar, and Kuwait and funds will be used to expand in the region. An IPO is planned in 2027.

Chowdeck, Nigerian food, groceries and medicine delivery, acquires Mira, a restaurant point-of-sale and management system. The acquisition is designed to allow Chowdeck a better vendor offer.

Meituan plans to open 1,200 centralised kitchens for food safety, over the next three years. My take: this sounds a lot like forcing suppliers to work off Meituan’s own managed kitchens, controlling (and profiting) more of the value chain, under the pretense of food safety. Readers prove me wrong.

ZILO, Indian quick-fashion delivery, raises $4.5M. Swiggy launches '99 Store' - single-serve low priced meals for budget-conscious consumers - in 175 cities. Manna works with Vodafone to test BVLOS communications over 4G network. .

I love meeting new people and learning about innovation. Let’s get-to-know.

Autonomous & remote-driving 🤖℡

Beep raises $52.7M to grow autonomous operations. Beep is a AV management company (or in their words, Autonomous Mobility as a Service provider), partnering with the likes of Mobileye, Oxa, Holon, Navya and others to operate services across the US. Funds will be used to expand in the US and into new markets. Also Beep to launch another AV program in Florida, with Ford vehicles and Oxa technology.

Tesla robotaxi efforts just got potentially sidelined because… Musk is launching a new political party. And if there is one dude you don’t want to get cross with, especially when your tech is weaker than competitors, it's Trump. Even more so when you just spend the last months cutting budgets for one of your regulators, the NHTSA.

And in the news - the NHTSA is investigating Tesla for vehicle behaviour that came up in the many videos posted since launch - such as crossing the speed limit or going into the wrong lane. Also - Tesla launches FSD in Spain, its 5th European country.

Bliq (ride-hailing, Germany) and Elmo (teledriving, Estonia) partner to launch the world’s first public remote-driven taxi service; the service operates in Tallinn, Estonia.

Tier IV minibus to drive on public roads in Japan (video). Also Tier IV partners with Newmo, a taxi & ride-hailing operator with more than 1,000 taxis, to commercialise robotaxis in Japan.

WeRide secures 2nd autonomous logistics Robovan W5 vehicle testing permit in Guangzhou. The Robovan W5 can carry up to 1,000kg, and drive up to 220 km.

Pony.ai begins road testing in Luxemburg. The Connect AV shuttle pilot, run by Ford and Perrone Robotics, is returning to Detroit. Waymo is still making noise and people in Santa Monica are trying to stop night charging with duct tape.

Flying cars 🚁

EHang signs an order for 50 of EH216-S models with the Guizhou Scenic Tourism Development Co. Also EHang partners with Reignwood Aviation Group. At first, focusing on low-altitude tourism; later expanding to operational ground management and training.

Joby delivers first aircraft to Dubai; commercial flights are expected to start in early 2026.

Gig economy 💰

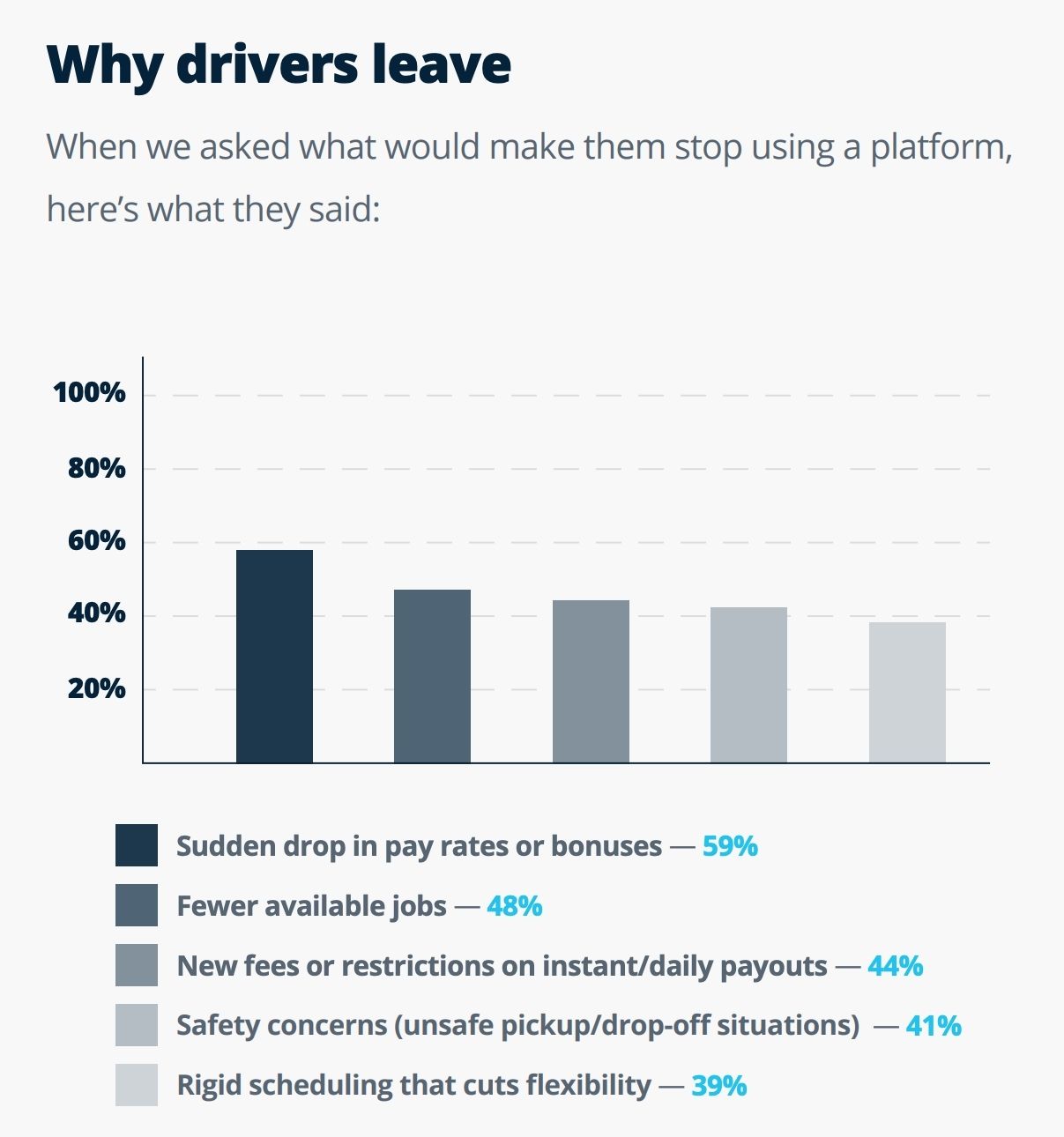

2025 Gig driver report, by Everee, based on a survey of 419 drivers. Main takeaways:

70% prefer daily or instant pay; 65% have borrowed money while waiting to be paid; and 61% have delayed bills because of payout lags.

Only 27% say gig driving is a full time gig but for 59% it’s at least half their income.

Much more in the full report.

Last week it was an Oxford study, this week Columbia Business School. A new study found that since introducing upfront pricing in 2022, Uber take-home share has increased, from 32% to 42% today; obviously at the expense of the drivers.

Uber drivers in Canada unionise, seek to reach the first collective deal for ride-share drivers in the country. Glovo Italy suspends heatwave courier bonus, after taking criticism. Grab Indonesia keeps driver commission under 20% (s mandated by the Minister of Transportation) - excluding platform fees and additional costs like carbon emission fees. So more than 20%.

In other news 📰

Zuppin is a Turkish mobility company who chose to work with the industry rather than disrupt it, creating multiple partnerships. Read the founder's Medium post on his journey.

Rivian struggles with sales, yet archives gross profit and unlocks another $1 billion investment from Volkswagen, in the form of share sale.

Pebble reveals its EV travel trailer.

Clutch, Canada’s largest auto e-commerce platform, just crossed $1 billion in cars purchased. Intel is closing its automotive processors division.

UVeye expands to the UK & EU.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Helen Dolphin is the new Senior Programme Manager Access and Inclusion @ Network Rail.

Jeanne Tallon is the new Global Communications Manager @ BABLE Smart Cities.

Jorge Orue Garcia is the new Head of Inside Sales @ Uber.

Sally Bailey is the new Head of EVC Sales - UK @ VESTEL Mobility.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.