Ride-Hailing & Taxi, Buses & DRT 🚙🚐

MaaS Global declares bankruptcy, after last week the company withdrew its app, Whim, from Helsinki. Let’s stop to explain how meaningful this bankruptcy is: Sampo Hietanen, founder & CEO, is the man who originated the concept of Mobility-as-a-Service and gave birth to the MaaS industry; he is also a proponent of the B2C MaaS model - which has proven to be uncommercial even before MaaS Global went bankrupt. In the end, this is a symbolic, inner-industry event, more than anything else. MaaS Global was founded in 2015; raised €65M over the years; had 120 employees at its peak; in 2022 the company lost €9.3M on €3.8M in revenue. Today, Hietanen’s vision is carried on by multiple MaaS players offering commercially-viable B2G/B2B services.

The Great Minneapolis experiment: Minneapolis City Council voted (again) to approve an ordinance that will guarantee drivers $1.40 per mile and 51 cents per minute - overriding a veto by the city's Mayor on the council’s previous similar vote on the matter. A $1.21 per mile and 49 cents per minute “compromise”, offered by the state and accepted by ride-hailing companies, was not accepted. See Mayor’s frustrated reaction. As a result, Uber and Lyft are threatening to leave if the ordinance goes into effect on May 1st. Will this really go into effect? Would other TNC companies, maybe InDrive, come in? What would the effect on the people of Minneapolis be? Hopefully TBD.

InDrive secures another $150M in debt financing to accelerate expansion, after a previous $150M debt raise back in February 2023. I bet that soon we’ll hear about acquisition deals coming from InDrive.

icaabi acquires Moovex. icaabi is a taxi & NEMT (paratransit) dispatch SaaS solution, owned by Renault’s Mobilize; Moovex mainly brings advanced route-optimisation capabilities to the table. These will be used by icabbi’s dispatch engine to improve ride efficiency.

Bolt strengthening position with UK Black Cabs - waiving its £2 booking fee (Bolt already has 0% commission in place) and partnering with Drovo, on-vehicle advertising agency, to offer Bolt’s drivers access to on-vehicle ads. The big picture: Uber is trying to enter the Black Cab space, and while the company is experiencing hardship from the taxi rank, the first to sign up to Uber would be ones who did so for Bolt. This could explain why Bolt is on the defensive.

Rapido introduces a driver subscription model. This is similar to the structure used by Namma Yatri, but differs from the commission structure used by Ola & Uber (25-30% commission) and InDrive (10-12%).

Kupos is the leading Chilean bus tickets seller, founded in 2014 and selling $190M in GMV in 2023, with revenue of roughly $10M (5% margin). Read an interview with the founder.

Uber to pay $178M to end legal fight with Australian taxi drivers. Uber launches Comfort Electric, its all-electric luxury service, in NYC. The expansion to NYC is the result of the city removing its regulatory cap on ride-hailing EVs. Uber launches “emissions savings” feature, so you know how much EV saves versus ICE. Uber launches yet another shuttle bus (HCV) in India. Khosrowshahi’s vision for Uber: electric, affordable and delivering everything.

Bolt launches in the Democratic Republic of the Congo (one of the most troubled countries in the world); the company is offering drivers six month no-commission. Malaga, Spain: VTC demand via Cabify has gone up 40% in 2023. Chalo celebrates 10 years. BluSmart reaches 7,000 vehicles. Angkas has a new app. Advertising on ride-hailing: work well while people wait and in-car, but people hate push-notifications. Didi to face US investor lawsuit over IPO. Pune will allow ride-hailing companies Ola and Uber to continue operations until mid-April giving companies time to appeal their suspension of service.

CiME is a new France-based think tank for Innovation in Mobility & Environment set up by François Hoehlinger and Erwann Le Page. Focused on the future of mobility, they build an expert network to propose new objectives for the 2019 "Loi d'Orientation des Mobilités” French law to find best practices and lessons going forward for future European implementation.

Car Sharing/renting 🚗

GreenMobility to exit the Belgium market - will focus entirely on the Danish home market with the goal of bringing the company to profitability in 2024. This follows decisions to exit the Netherlands and Finland.

Careem partners with ekar, P2P plus fleet-based car-sharing and subscription, to provide car sharing service in Saudi Arabia. Carlili returns from liquidation, acquired by Rent A Car. Insurance burdens UK’s car clubs. Hertz’s CEO leaves post after the company’s failed EV push.

I love meeting new people, learning about innovation and exchanging opinions. Want to get-to-know and talk mobility? Let’s set up a half-hour coffee chat.

Micromobility 🚲🛴

Surf Beyond acquired Superpedestrian’s European business for around €5M. Wait, Who? Surf Beyond is a Norwegian scooter operator founded in 2021, with ±5,000 scooters in ±10 Norwegian cities. For €5M Surf Beyond buys circa 25,000 that are deployed in 8 European countries, and gets hold of the tech. This acquisition is surprising, and while it upgrades Surf Beyond from a small local player to a European-wide competitor, the company has ahead the gruelling task of post-merger integration.

Voi raises $25M in equity for expansion + more in debt for vehicles. In addition, $85M of convertible notes have been converted to equality. At the end of 2023, VNV, holding 23.1% of Voi, valued the company at $334.8M.

Ryde, Nordic e-scooter sharing company with ±50K vehicles, 2023 figures (by Prabin, which is worth you following): revenue €28.35M in revenue, up 78% YoY; EBITDA €11.62M (40% margin); EBIT €6.19M (22%). Profitability is achieved thanks to a lean HQ structure running a tight margin business. Read an interview with the CEO on how the company achieved profitable growth.

NextBike by Tier to be sold to PE STAR Capital. Tier pulls out of York in what could mean a planned exit from the UK all together.

Beam expands in Tasmania.

Delivery 🍽🧺

Deliveroo reports FY23 - highlights: GTV down 3.1% YoY to £7.06 billion; revenue up 2.8% to £2.03 billion, revenue margin is 28.7%; Adjusted-EBITDA £85.4M, 4.2% of revenue; loss £31.8M and negative free-cash-flow (FCF). For 2024 the company expects higher Adjusted-EBITDA (but not yet full year profitability) and a positive FCF for the full year. For more.

In Taiwan, merger negotiations fail between Foodpanda and Uber Eats. Taiwan wasn’t a part of the countries discussed on the foodpanda-Grab talks. This could mean that foodpanda is gearing up for Asian expansion or that anti-competition scrutiny was too challenging for the deal, as UberEats would have had 80% of the market if the deal went ahead.

Zomato's Blinkit leads Indian q-delivery with 46% of the market, in GMV terms. Followed by Swiggy’s Instamart with 27%, Zepto with 21% and Bigbasket with 7%. To succeed, companies are investing in dark store operations and supply chain efficiency; partnering with FMCG brands and farmers; increasing avg. basket size; and adding advertising revenue. These efforts are bringing companies to achieve profitability. In related news, Flipkart is rumoured to relaunch q-delivery operations. This is why.

And in other Indian delivery news, Swiggy merges InsanelyGood, its premium grocery vertical, with Instamart. This is the result of operational efficiency and profitability pursuit within Swiggy.

GoPuff expands to 24/7 in Liverpool and Newcastle. Wolt officially in Albania. Packfleet raises $10M.

Hope you enjoy reading #movingpeople. If you do, please share it with others so that they benefit from it too. Weekly suggestion: share this with someone named Jack, John or Jill.

Autonomous & remote-driving 🤖℡

Applied Intuition, Autonomous AI-powered vehicle software, raised $250M at a $6 billion valuation. The company works across automotive, defence, construction and agriculture, and in automotive works both with OEMs such as GM, Toyota & Volkswagen and with startups such as Gatik, Motional & Kodiak.

Phantom Auto is shutting down. Founded in 2017, the company raised $95M in total to develop teledriving technology, focusing in logistics, specifically forklifts and yard trucks. The CEO quotes “market conditions and insufficient funding” as factors leading to the decision to close the company, which was not yet profitable.

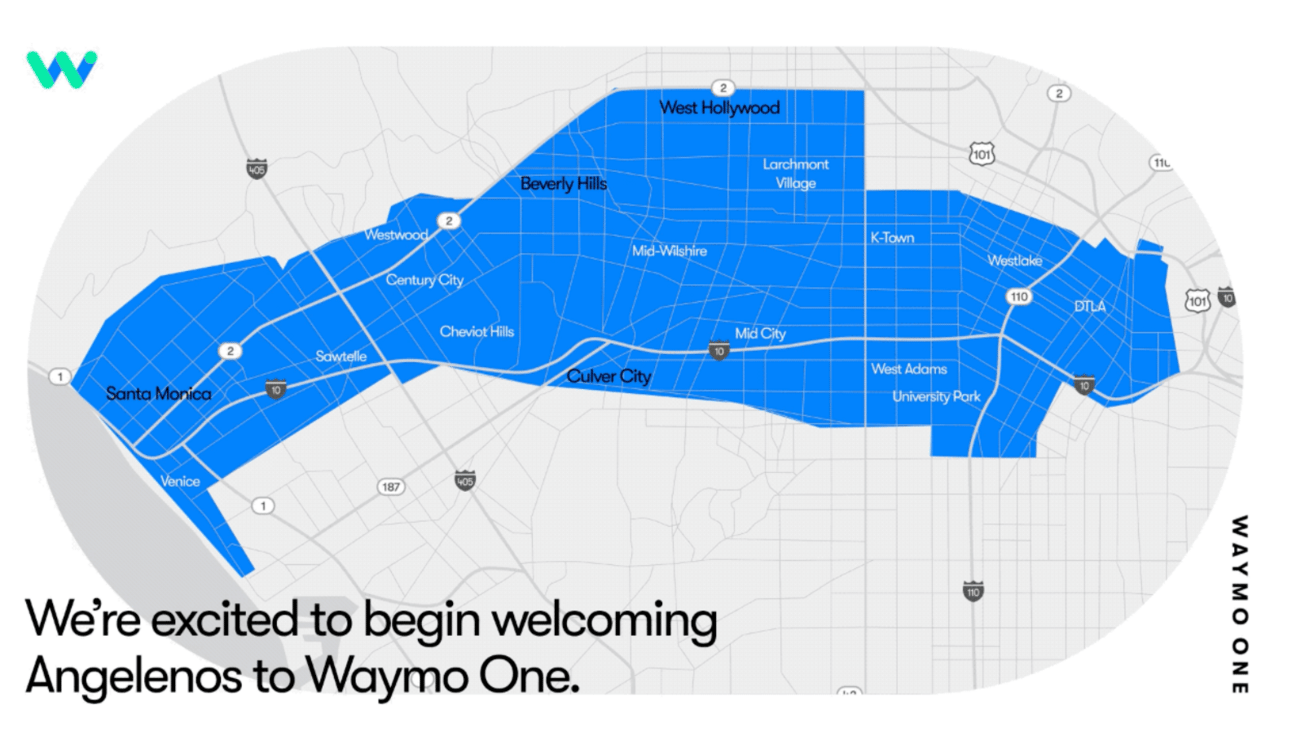

Waymo launches in Los Angeles and will transition to an all-public paid service in a few weeks. In Austin, the company plans to launch robotaxi operations by the end of the year, making Austin the 4th commercial city Waymo operates in.

Zoox expands robotaxi operations in California and Nevada - larger operating zones, longer hours including at night, driving in tougher conditions (rain!) and at higher speeds.

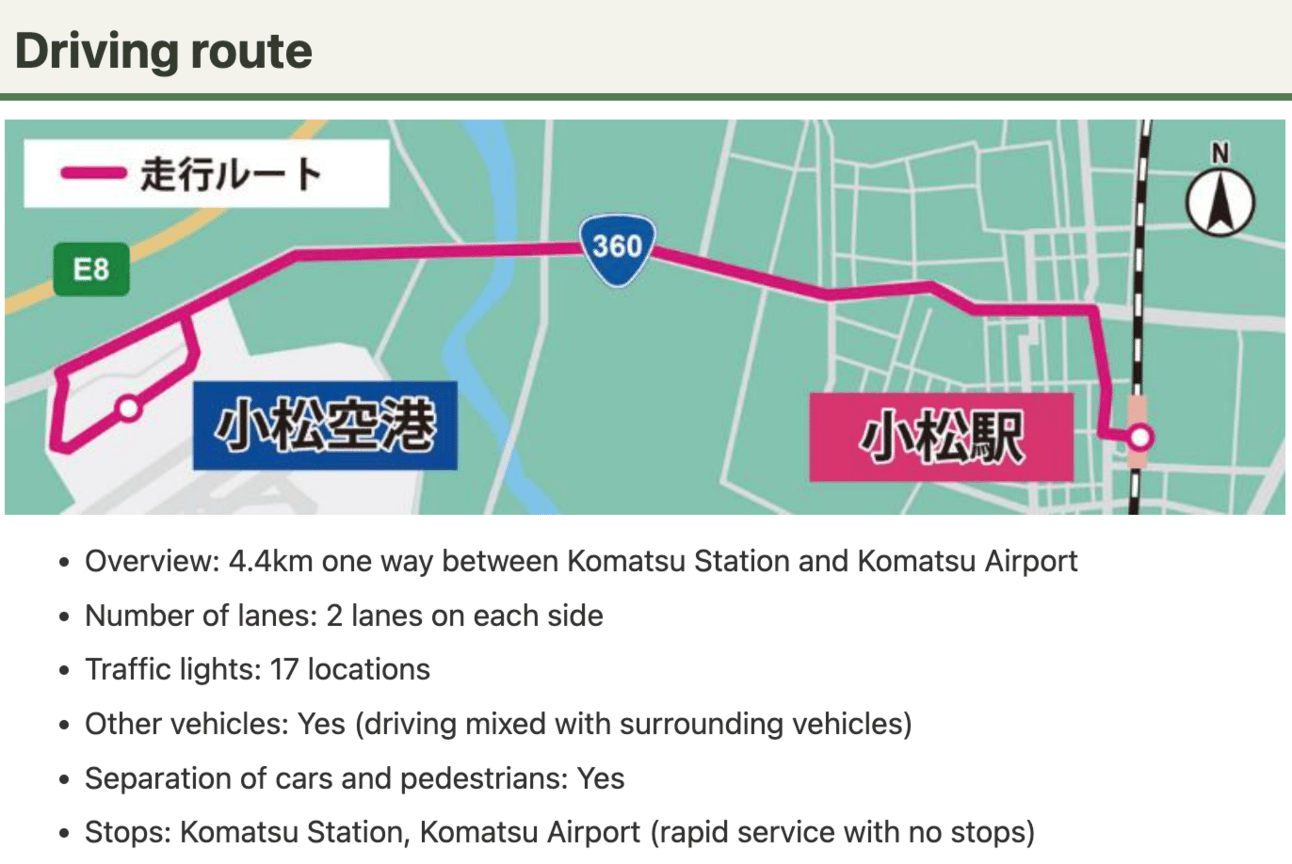

Komatsu City, Japan, launched the first commercial autonomous service operating year-round in Japan, powered by TIER IV tech.

Wayve welcomes an ex-Mobileye executive as its President, with the goal of advancing sales to OEMs. Mobileye shuts down its after-market unit, as ADAS is now a part of the OEM’s manufacturing process. Motional secured a bridge loan while it searched for long term funding.

Flying cars 🚁

Stellantis increases stake in Archer, buys $15.6M worth of stock. Stellantis is already a strategic investor and manufacturing partner with Archer. To put things in perspective, Archer’s market cap is roughly $1.5 billion.

SkyDrive starts eVTOL aircraft production with car maker Suzuki.

OEMs 🛺⚡️

Fisker prepares for possible bankruptcy filing. Nissan is in talks with the company, although nothing is concluded.

Lordstown Motors - now known as Nu Ride Inc. - emerged from bankruptcy with $78M in cash. The company aims to continue its lawsuit against Foxconn and “pursue one or more potential business combinations or acquisitions”.

Gig economy 💰

The EU, not able to move forward European wide consensus regarding gig-employee rights, sends the decision powers back to member states. Unions seem to be happy, ride-share companies less so because of the continued hassle in each and every state. My guess is that this will come back to the EU’s table in the next few years.

In Vietnam, ShopeeFood miscalculates delivery distance - and couriers pay the price.

In other news 📰

Joyride raises $5.2M. goUrban raises €3M. Both provide SaaS solutions to share economy companies. Necture (formerly Ubiq) raises €7M to optimise EV Fleet Management. Van Hool is in crisis and the government is looking for a private investor to rescue the company. Japanese smart mobility knowledge by Azarel Chamorro.

Thank you for reading #movingpeople. I’m always happy to get-to-know over a coffee chat (Calendly set-up) and please subscribe to the publication on Beehiiv via this link.