#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility".

Tesla’s We, Robot event: Not much to drive home about

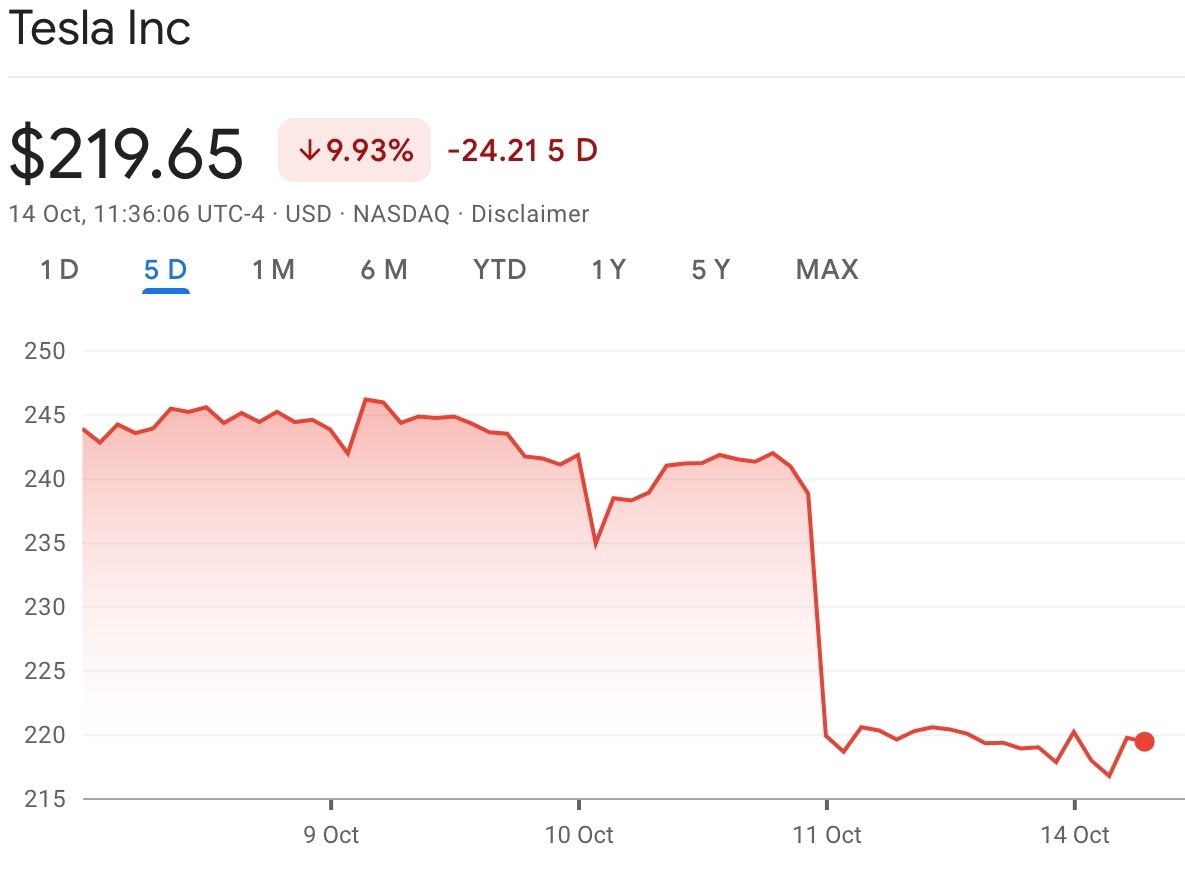

This graph best sums up the event - it shows Tesla’s stock falling by ±10% right after the event. Why is that?

Source: Google Finance

My thoughts: There was nothing truly innovative at the event. Musk talked about fully autonomous capabilities of existing Tesla models only next year, and focusing on “lax” regulatory environments such as California and Texas. The Cybercab is nicely designed (also see ride video), but production planned for sometime 2026-2027 leaves too much room for imagination on where Waymo, Cruise, Uber etc. will be by then. And the Robovan is only a concept car at this stage. Oh, and the Optimus robots weren’t “real”.

Also read Lukas Neckermann’s commentary of the event - because (1) it is very thorough & good (2) we share the same sentiment 🙂

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Uber had its annual GO-GET Zero 2024 in London. Today Uber Green is available in 200+ cities worldwide with EV-only options available across 40 cities, and Uber has 182,000 electric vehicles on the road. In London, nearly 30% of all miles driven are now electric. The company is rolling out features for rides (preference setting, emission reporting, farmers market via Eats), for drivers (AI Assistant powered by OpenAI’s GPT-4o– to help drivers get answers to every EV question under the sun) and for merchants (green packaging). For the full feature list.

Marti begins monetising its ride-hailing service; the company launches driver subscription packages, i.e. drivers pay in order to receive rides.

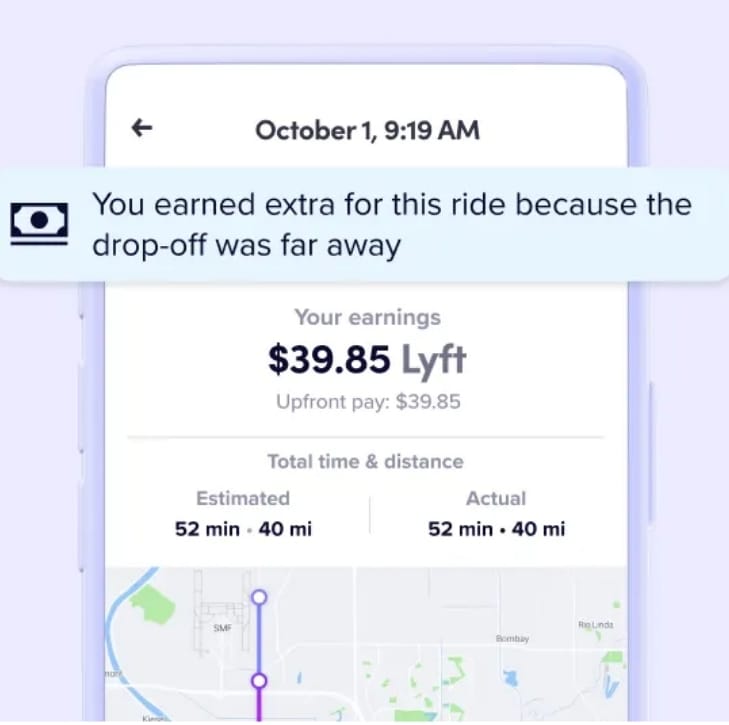

Lyft introduces new earning improvements, such as earning more when traffic is unexpected/calculated, transparent per-hour rate and schemes to save on EV charging and health insurance. For the complete list.

InDrive enters Lesotho. Namma Yatri launches in Kalaburagi, India. Uride expands in Quispamsis, Canada. Uber launches in Murcia, Spain. Bolt plans to launch in Costa Rica. Lyft gets ready to launch in Winnipeg. Uber Pet launches in Bengaluru, India. Bolt & Uber are working together with Kenya’s National Transport and Safety Authority (NTSA) to remove unprofessional drivers. FREENOW PLUS subscription is now available in Germany, Ireland and the UK. For €6.99/month, the new subscription service offers passengers a 10% discount on taxi, ebike and pedal bike trips.

Uber launches a $18 shuttle service between Manhattan and NYC's LaGuardia airport. This service is a part of a larger plan to develop high-capacity-vehicle solutions at Uber, which is also active in places such as India and Egypt.

BluSmart is in talks to raise up to $100M in additional funding, to further grow its ride-hailing and charging network businesses. So far BluSmart raised $486M, of those roughly $300M in the past year, in a mix of equity and debt. Ola Consumer (ride-hailing business renamed) is gearing up for an IPO.

HertsLynx (DRT, UK) reaches 100,000 rides in 3 years. Roger French personally enjoys two DRT rides while not forgetting that “from a professional standpoint, DRT is a complete waste of public money”.

Regulating App-based Mobility: Case Studies from Bangkok, Manila and Phnom Penh by the International Transport Forum. Insights include creating a permissive regulatory environment; treating existing and new mobility providers equally; establishing data reporting to ensure compliance; setting employment protections; and working toward regulatory alignment across ASEAN. For the full 85-pages report.

Virtua Mobility is a one-stop integrator of travel and mobility solutions.

Founded by Mohammed Radi & John Daily Jr, Virtua seamlessly connects ride-hailing companies to physical demand arising from OTAs, Corporate Travel Managers; Hotel chains, Airlines etc. - offering tailor made integration solutions.

Virtua is currently raising a seed round. If you're interested in exploring Virtua’s investment opportunity, feel free to DM the founders or myself for details.

Car Sharing/renting 🚗

GreenMobility Q3/24 report - key takeaways: 2nd consecutive profitable Q; revenue up 92% YoY; on way to “continuing operations” probability in 2024; a bottom-line loss will be registered due to closing of activities across Europe, to focus on Denmark, in which GreenMobility operates 1,400 vehicles.

Stellantis completes the integration of Free2move and Share Now services into a single platform, under the Free2move brand. The app now offers free-floating car-sharing, short, medium or long-term rentals and subscription services, with over 500,000 cars (mostly rental) worldwide.

An analysis on why SEAT failed with shared mobility.

Micromobility 🚲🛴

“...will be managing European Sales Operations and Strategy for Lyft. ❤️ 🚲 I can't wait to bring the best of Lyft's bikeshare systems to the UK and Europe”. Not only in the US - Lyft is definitely doubling down on its bike services.

Voi issues a €50M bond at roughly 9.9% annual interest. Money will go towards growth and debt restructuring.

Voi to launch in Le Havre and Octeville-sur-Mer, replacing Lime, from January 2025 The company will deploy 1,000 scooters and 350 e-bikes. Voi wins Antwerp, replacing Bird.

In Madrid, operators Lime, Dott &/ Tier have until October 25th to remove all scooters from the city - and the city is also scraping all free-floating bike services. Lyon to issue a new micromobility tender, following the merger of Tier-Dott.

In Taiwan, Gogoro cleared of fraud charges after investigation. The company was investigated for subsidy fraud, for using foreign-made components. It turns out that it was a single component, which was attributed to a “supply chain mistake”.

I love meeting new people, learning about mobility innovation and exchanging opinions. Interested in discussing mobility?

Delivery 🍽🧺

Wolt now expands to Uzbekistan, its 28th country. Wolt’s plans to expand were reported here back in April. Chowdeck looks at expanding to South Africa, Kenya and Ivory Coast.

JustEat expands Waitrose partnership. DoorDash expands Wegmans partnership and announces new partnership with several local grocers.

Autonomous & remote-driving 🤖℡

Baidu looks to expand Apollo Go robotaxi service outside of China, targeting Hong Kong, Singapore, and the Middle East. Competitors WeRide and Pony.ai have already ventured outside of the country.

In China, there are 32,000 km of roads set for AV testing; 16,000 test licenses issued; 19 cities are testing robotaxis/buses; and 9 automakers granted approval to test advanced automated driving technologies on public roads.

Gatik initiates a comprehensive 3rd party safety assessment for its freight-only operations, together with Edge Case Research and TÜV SÜD; plans to launch driverless operations in North Texas early 2025.

May Mobility partners with NTT to launch autonomous operations in Japan. Karsan is active in 8 countries - video. Apple let go of its autonomous vehicle testing permit.

Rollee empowers lenders to better underwrite gig economy workers. Rollee (consequently and GDPR complaint) collects gig drivers’ income information, sharing with the likes of vehicle lenders and fintechs, for them to be better able to assess risk. The company works with leading companies in Europe, Africa, and the Middle East and is now expanding to the US.

OEMs 🛺⚡️

Fisker. After many hurdles and setbacks, the company saw its bankruptcy liquidation plan approved. Lucid sets third straight quarterly sales record; has outperformed 2023 sales, with 3 months to go. Palantir now owns nearly 9% of Faraday Future.

Luxury car sales, defined as vehicles with a >$100,000 price, have fallen by 46% YoY.

Gig economy 💰

The US Supreme Court refused to hear appeals by Uber & Lyft, which were asking to block California state labor lawsuits that seek back pay for drivers. Uber & Lyft will now have to pay back wages to tens of thousands of drivers, unless a settlement is reached with California officials.

Zomato’s CEO Deepinder Goyal calls on shopping malls to be ‘More Humane’ towards delivery partners.

In other news 📰

🚀 After 2,759 days - FleetFox is finally PROFITABLE! FleetFox is a fleet servicing platform, and the post sheds light on the company’s journey to date.

Understanding the (UK) road freight market by the DfT.

Numa raises $32M to bring AI and automation to car dealerships.

SpaceX has performed an amazing fit - catching a giant rocket with giant chopsticks.

I love meeting new people, learning about mobility innovation and exchanging opinions. Interested in discussing mobility?

People 🧑🤝🧑

Alexander Bräutigam is the new Global Head of Partnerships @ FREENOW.

Ben Kaufman (Dr.) is now the Head of New Mobilities @ Liftango.

David Koral is the new B2B sales and Customer Success Director @ FREENOW.

Jon Jenkins is the new CTO @ Lime.

Øyvind Sævig is the new Advisor for Mobility Startups (Nordics) @ Antler.

Rav Babbra is the new Chief Operating Officer @ conode (formerly dRISK Edge).

Sarah Barnes is the new Senior Manager, European Sales Operations and Strategy @ Lyft.

Venkatesh Gopal is the new CEO @ movmi.

Wesley Kent is the new Regional Sales Manager UK @ ChargePoint.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.