Dear Substack subscribers,

Recently Substack announced it will not stop hate speech - including nazi newsletters - from being published on its platform. With online media being so transformative in our lives, we’ve grown to expect content moderation from the likes of Facebook and Google, and should expect the same from Substack. For me, this means that I can no longer be a part of the platform. In the coming weeks I will be looking for a new home for #movingpeople. To be continued.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

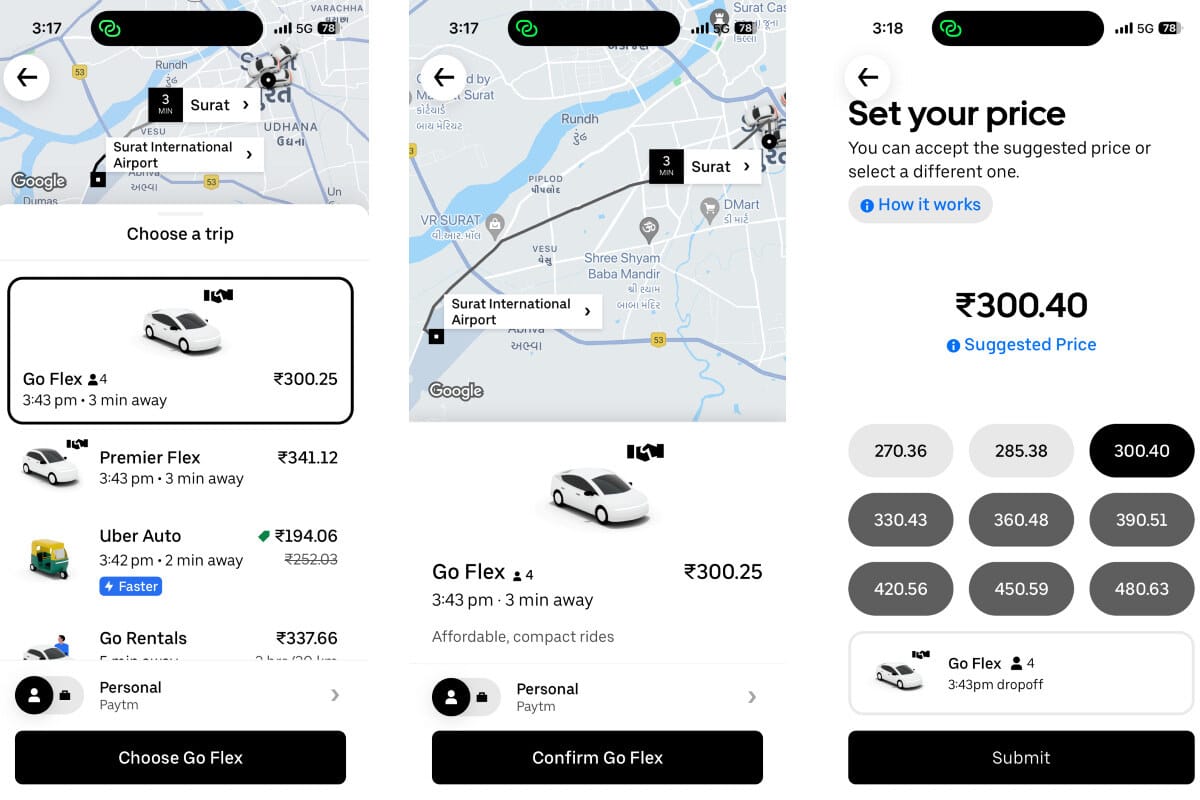

Uber expands “flexible pricing” - i.e. bidding - to additional cities. Bidding was a key feature for InDrive while it expanded in developing markets, and now Uber is playing catch-up. Riders are given 9 price points to choose from, and based on the chosen fare, drivers can choose whether or not to accept the ride. This differs from the solution InDrive employs, which allows riders to manually input their requested price, giving drivers less leverage during the bidding process.

Cabify reports a Spanish (only) market loss of €4.9M for FY22. Revenue was €199.5M, increase of 27.5% YoY. Remember that Cabify also has operations - which are said to be profitable - in LATAM.

Dubai Taxi (which recently raised $315M) starts ‘ride now, pay later’ service by partnering with Tabby, a BNPL player. Bolt expands to Eindhoven. SWVL looks to expand into Saudi Arabia. inDrive to launch financial services to help drivers in developing markets. Yango Zambia asks the government to reconsider its ban on taxi branding. Illegal taxis resurface in Seoul. In the UK, taxi and ride-hailing platforms begin recording the income of every driver on the platform, in order to comply with tax rules; data will be submitted to the taxi authority, HMRC. Lyft adds a reinsurance veteran into its board.

#movingpeople is a part of Mobility Business - consultancy dedicated to "All Things Mobility". If you are a seed to an established company with a challenge, or an investor with an appetite for mobility, let’s talk.

Car Sharing/renting 🚗

Zoomcar, P2P car-sharing, started trading on Nasdaq and seems to be doing OK - but I’ll also let you judge for yourself. The stock started trading on December 29th 2023 and fell, but picked up since:

Sixt to phase out Teslas from rental car fleet on poor resale value.

Text within this block will maintain its original spacing when publishedMicromobility 🚲🛴

Superpedestrian to auction 20,000 scooters from its shut-down US operations. In Europe, Superpedestrian claimed it wanted to sell its operation, but at least in the UK, the company is shutting down operations (see Derby and Nottingham).

Gbike, Korean shared scooters and bikes player, plans to IPO and execute acquisitions while preparing to do so, in order to increase market share pre-IPO. Gbike, which has raised $21M since founded in 2017, posted 2022 revenue of $40M and EBITDA of $13.7M and operates 35,000 e-bikes and 100,000 e-scooters in South Korea, with 3.4 million users. Competitor SWIFT generated revenue of $35.7M, EBITDA $10.5M and EBIT circa $700K.

I love meeting new people, learning about new companies and exchanging opinions. Want to get-to-know and talk mobility? Let’s set up a half-hour coffee chat.

Delivery 🍽🧺

DoorDash looks to grow outside core restaurant business in the US, where it controls 59% of the market, and further expand internationally. The company generated $878M of free cash flow in the 12 months to the end of September, meaning it has the “muscle” to expand. Also Wolt (by DoorDash) starts recruitment for Albania business.

Zomato to pause Blinkit integration to focus on building “super-brands”, rather than “super-apps”. When the deal was announced in 2022 the expectation was that the Blinkit q-commerce service will be integrated into Zomato, similar to the way competitor Swiggy did. Whether it is not needed from a business perspective, or too difficult from a tech perspective, the integration is now paused. Also Zomato completed the liquidation of 10 international subsidiaries in the past year. These were not active operations, simply legal structures put in place.

Invesco raises valuation of Indian food delivery firm Swiggy to $8.3bn, from $7.85bn in October. Invesco holds ±2% of the company. Also Pret A Manger enters first India delivery partnership with Swiggy.

Antitrust probe in Chile ended once Uber Eats, Rappi and PedidosYa agreed to end their “most-favoured nation” clause with restaurants.

Vietnamese food delivery market: GrabFood and ShopeeFood hold usage rates of 49% and 45% respectively; with Loship and BeFood sharing the 6% left after Baemin’s exit.

Hope you enjoy reading #movingpeople. If you do, please consider sharing it with others so that they may benefit from it too.

Autonomous & remote-driving 🤖℡

Aurora will produce autonomous trucks “in the thousands by 2027” via a partnership with Continental. Today the company has 30 autonomous with safety-driver trucks on-road in Texas. The company wants to have 20 fully autonomous trucks by the end of 2024, and circa 100 in 2025, before scaling up operations while selling its solution to fleets.

Mobileye’s stock dropped, from circa $39.7 close of trade Jan. 3rd, to ±$31.43 end of trade Jan. 8th. The reason: a profit warning the company issued, lowering 2024 revenue expectation to ±$1.9bn versus analysts’ expected $2.58bn. That’s $600M less. For Q1 Mobileye expects 50% less revenue, citing that OEM’s oversupplied on stock, and are now going through available supply rather than buying new. This profit warning also hints to a slow-down in ADAS and autonomous demand.

The Chinese autonomous industry finds itself in trouble: (1) widespread commercialisation of robotaxis is far from materialising; (2) route-to-IPO in the US is less likely (see Didi example); (3) funds are harder to raise; (4) Cruise has set trust in the industry back; and (5) OEMs are starting to work on their own autonomous solutions. Players are scaling back, investing in shorter-term commercial viable ADAS solutions and B2G partnerships. A TechCrunch longish read.

Don’t drive for me Argentina: the newly elected libertarian president wants to authorise autonomous vehicles, bringing regulation closer to that of San Francisco. This could be an opportunity for companies to test vehicles in a cheaper-to-operate environment, with favourable long-term regulation. TBC.

Foretellix and Nuro partner on virtual testing of its automated driving system. This will allow Nuro to cut costs and save time. Foretellix, which recently raised $43M, also has existing partnerships with Volvo and Torc Robotics.

Rimac, EV supercar, aims to launch a robotaxi service, partnering with Kia. The robotaxi is expected to be revealed next year and will be in operation in 2026. California lawmaker wants to start ticketing robotaxis. As of today, tickets can only be given to humans. GM robotaxi unit Cruise offers $75,000 to resolve crash probe disinformation allegations. How Tesla, BMW, Ford, GM and Mercedes driver assist systems compare.

Text within this block will maintain its original spacing when publishedEV OEMs 🛺⚡️

Xiaomi (yes, the cellphone company) unveils its first EV. The Xiaomi SU7 model, a competitor of Porsche's Taycan and Tesla’s Model S, “is in trial production and it will hit the domestic market in a few months”. The SU7 has been in development for the past 3 years and cost $1.4bn to develop. Expect Xiaomi to utilise its large cell phone customer base to launch its vehicles.

In 2023 BYD delivered 3 million vehicles, of those 2 million electric (92% sold in China), making BYD the #1 player in the market, passing Tesla. Why OEMs should be worried: excellent price, efficient battery, good design and a generally good quality car that can go head to head, and win, against current OEMs - except Tesla - which has a superior brand and software, and its own charging network.

Rivian deliveries dropped in Q4 by 10% QoQ, sending the stock down. Rivian, maker of premium truck & SUV EVs, has yet to cut prices, the way that many other EV makers have lately.

Arrival misses interest payment on convertible notes.

Text within this block will maintain its original spacing when publishedGig economy 💰

Gig-economy drivers are going to strike at Mineapolis’s airport over work conditions. On January 19th starts the next chapter in the Minnesota wage and job protection saga. Bills have been passed, threatened with exits from Uber & Lyft, vetoed, brought to a committee, were undecided and now an analysis on different wage options is awaiting the Minneapolis council. Definitely to be continued.

New minimum wage laws in NYC allow delivery workers to ride safely, knowing they are rewarded on a per minute basis. No more running red lights and squeezing between cars, yes to additional time it takes that dish to get to you.

Shipt, Target’s delivery service, to halt operations in Seattle before new pay and sick time laws take effect in the city.

Text within this block will maintain its original spacing when publishedIn other news 📰

TomTom stops selling GPS navigators in North America. Once a main pillar in the company’s offering and revenues, today everybody uses his phone to navigate.

Kwik Fit, UK car servicing and repair chain, acquires Fettle, bike repair and servicing, for an undisclosed sum.

Study shows that narrower lanes can improve both vehicle and pedestrian safety.

Thank you for reading Moving People. This post is public so feel free to share it.