#movingpeople is a part of Mobility Business - a consultancy focused on Innovation, Growth and Autonomy in the Mobility industry.

Ride-Hailing & Robotaxi 🚙🚕

Lyft releases FY25 results- key takeaways: Lyft had a productive year in 2025 - going into Europe via the Freenow acquisition and into the chauffeur segment via the TBR Global Chauffeuring acquisition; scaling AV partnerships with Baidu, Waymo, Tensor Auto and BENTELER Group (& more); scaling the Media business; while keeping customer obsession at heart.

Gross bookings up 15% YoY to $18.5 billion (vs. Uber $193 billion and Bolt $14 billion)

Rides up 14% to 945.5 million (Uber 13.5 billion)

Revenue up 9% to $6.3 billion (Uber $52 billion and Bolt $3 billion run-rate)

But Q4/25 reported revenue of $1.6 billion missed analysts’ expectations of $1.75 billion and the operating loss of $188.3M was lower than the expected $33M profit - sending the stock down from circa $17 on Tuesday before reports were released to $13.27 when trade closed Friday.

Also Lyft introduces ‘teens’ feature - it allows riders as young as 13 to book a ride, as long as a parent / guardian created the account. On the driver side, Lyft has additional criteria for drivers, such as annual background checks. Uber and Waymo have a similar solution.

Industry Partnerships: AV Tech + OEMs

Pony AI and GAC-Toyota partner to mass produce Gen-7 bZ4X Robotaxi. The bZ4X robotaxi model features a total of 34 sensors, including 9 LiDAR units, 14 cameras, and 4 millimetre-wave radars.

By the end of 2026, the companies plan to produce 1,000 new robotaxis.

To put things in perspective, at the end of 2025, Pony had 1,159 vehicles

And Pony’s goal is to have 3,000 by the end of the year.

GAC-Toyota is a 50%-50% partnership between the two companies, with Toyota vehicles manufactured in China. And the relationship between Toyota and Pony AI goes back to 2020, when Toyota invested $400M in Pony.

Waymo releases 6th-generation Driver. The new system is (obviously better) more cost effective - there are 13 cameras (down from 29), four lidars (down from five), and six radars - a unit is expected to cost less than $20,000. Units are compatible with the Zeekr Ojai minivan the Hyundai IONIQ 5 - but are built to be OEM agnostic.

Continuing with Hyundai - the company to supposedly supply Waymo with 50,000 units by 2028 (details are not very clear). At $50k per vehicle, it comes out to be a $2.5 billion deal. Again to put things in perspective - Waymo has a fleet of 2,500 vehicles today. If both companies are able to produce that many robotaxis by 2028 - this is indeed a game changer.

And remember - it was before that Uber reserved 20,000 Lucid-Nuro vehicles and 25,000 unknown OEM-Wabbi vehicles.

On-Demand GMV up 21% to $22.1 billion; Grab grew ‘Monthly Transacting User’ (MTU) spend by 4% and number of MTUs by 14%

Revenue up 20% to $3.37 billion

Operating profit $65M and Net profit $200M

Looking at the mobility-delivery breakdown:

Deliveries: GMV $14.2 billion (+21% YoY) - Revenue $1.8 billion (+21%) - Segmented Adjusted EBITDA $287M (+47%)

Mobility: GMV $7.9 billion (+19%) - Revenue $1.2 billion (+16%) - Segmented Adjusted EBITDA $690M (+21%). Note the much higher margins on mobility.

Also Grab to acquire US fintech Stash Financial, an AI-powered investing app serving more than 1 million users and holding over $5 billion in assets, for $425M. The move will strengthen Grab’s financial services business, which in 2025 had a loan portfolio of $1.18 billion and revenue of $347M.

Waymo goes driverless in Nashville. The Nashville fleet operation is managed by Lyft (through Flexdrive) and booking will be available via both Waymo and Lyft. CaoCao, Geely’s ride-hailing unit, reaches a robotaxi fleet of 100 vehicles. WeRide and Uber to deploy an additional 1,200 robotaxis in Abu Dhabi, Dubai, and Riyadh as soon as 2027. In perspective: today WeRide has 200 robotaxis in the region. Baidu and Uber partner to bring Apollo Go autonomous ride-hailing to Dubai.

11 ways Waymo can improve the rider experience - from the Driverless Digest.

Uber’s early subsidies bought not network effect - but market power. Critics correctly identified that early Uber ran on subsidized growth disconnected from operational fundamentals, and correctly predicted that reaching profitability would require raising prices and squeezing drivers. They incorrectly predicted that Uber would prove unable to do this.Andrew Miller long read on the 2021 consensus that Uber was finished

DRT, Bus-Based Mobility & AV shuttles 🚍🚌

The Routing Company enters Fairfield County Transit, Ohio to offer “deviated fixed routes and demand response programmes”

Delivery - from bikes & cars to bots & drones 🍽🧺

Uber acquires Getir

In Turkey, Uber acquires Getir, 9 months after acquiring 85% of Trendyol Go, food and grocery delivery, for $700M. The deal sees Uber pay $335M for Getir’s food delivery business + $100M for a 15% stake in Getir’s grocery, retail, and water delivery business, with an option to complete the acquisition in the next few years.

Getir was once the poster child for quick delivery operations - raising a total of $2.4 billion and reaching a $11.8 billion valuation. That ended after the pandemic, and eventually the company scaled back US and European operations to concentrate on its home market - Turkey. 2024 and 2025 saw an ownership struggle between Mubadala, the Emirati sovereign wealth fund and Getir’s one of two founders. Mubadala won, and has now sold the business.

Bottom line: within a year, Uber has cemented its presence in the Turkey food, grocery and retail delivery business,

Glovo & Delivery Hero

In Chile, The Court for the Defense of Free Competition (TDLC) approved an agreement that finds Delivery Hero - parent company of both PedidosYa and Glovo - responsible for ‘fixing international markets’ between the two companies in Chile and in Egypt, Peru and Ecuador. The companies were fined $31.5M (in tax benefits) and to conduct executive antitrust training for the next five years. Note that this is the largest payment of free competition tax benefit from a single economic agent in Chile ever.

And in Italy, Foodinho, a subsidiary of Glovo, is placed under judicial supervision over alleged labour exploitation and the CEO is being investigated. The allegations are that riders were paid below the poverty line. Whilst under judicial supervision, a court-appointed administrator will ensure Foodinho gives its workers the correct legal status and will monitor compliance with labour rules and conditions.

For context, back in June 2025 the European Commission fined Delivery Hero and its subsidiary Glovo a total of €329M for participating in a four-year cartel, from 2018 to 2022, while Delivery Hero only still held a minority stake in Glovo.

In Nigeria, Chowdeck is being sued for misrepresenting the true cost of meals purchased through the platform. The claim is that Chowdeck inflates the base price of food items without clearly or transparently disclosing this markup.

In the UK, Just Eat launches both a robo-dog delivery trial in Milton Keynes with RIVR and a ‘regular’ delivery bot trial in Bristol with DELIVERS.AI. Robo-dogs can climb staircases, reach speeds of 14km an hour, open (unlocked) gates and carry up to 30kg of cargo.

Cainiao, Alibaba’s logistics unit, and Zelos, maker of freight & delivery robovans, enter in a strategic partnership, which sees Cainiao invest in Zelos and an order of 20,000 unique robovans.

Amazon Air drone delivery launches in Kansas City, the company’s 7th city. Service is available in a 7.5 mile (12km) radius from the fulfillment centre, and costs $4.99 per delivery or $9.99 for non-Prime members. Also Amazon Pharmacy to expand same-day delivery to an additional 2,000 US cities by the end of the year, bringing the total to 4,500 cities. To put numbers in perspective.

@kctv_5 More Amazon drones will in the sky in Kansas City, Kansas. Here’s what to know. #drones #amazon #kckpd @Jiani N

Uber Eats introduces ‘Cart Assistant’, an AI feature designed to help customers with grocery shopping. Using a chatbot, users can enter a list or upload a picture of one, and the feature will automatically add everything to the basket. To choose the right product (e.g. which kind of milk) the feature uses past history.

PNY, eCargo motorbike manufacturer, partners with UNY, swappable batteries - by bringing the Ponie P2 into UNY’s ecosystem. The Ponie P2 (by PNY) is now available in fixed and swappable versions. Read more about PNY here.

AV Freight & Logistics 🚛🚜

Aurora’s trucks can now travel 1,000 miles nonstop - more than a human driver. This is important because it adds efficiency into Aurora’s autonomous operations - and efficiency is of major importance in freight. The 1,000 mile route is achieved in 15 hours vs. a 30 hour for a human driver, which has to comply with driving safety regulations.

2025 was the 1st Aurora generated commercial revenue, with $3M in revenue

Net income loss of for the year was $816M

30 trucks on the fleet, of those 10 are operating fully autonomous (with a human observer). Fleet expected to grow to 200 by the end of the year

As of January 2026, the company achieved 250,000 driverless miles and over 4.5 million commercial miles

For more, read the Q4/25 Shareholder letter.

A 6:44 min video of a Gatik autonomous freight run.

Momenta expands to autonomous trucks - plans to build an in-house dedicated team.

Kodiak awarded autonomous ground vehicle development contract by the U.S. Marine Corps. Kodiak system will be added to the ROGUE-Fires, an anti-ship missile launcher.

In other news 📰

OX Delivers, a UK-based electric mobility company operating electric trucks in Rwanda, is set to be liquidated this week.

Chris Pangilinan created a geographic dashboard using the NYC Taxi & Limousine Commission's publicly available trip data.

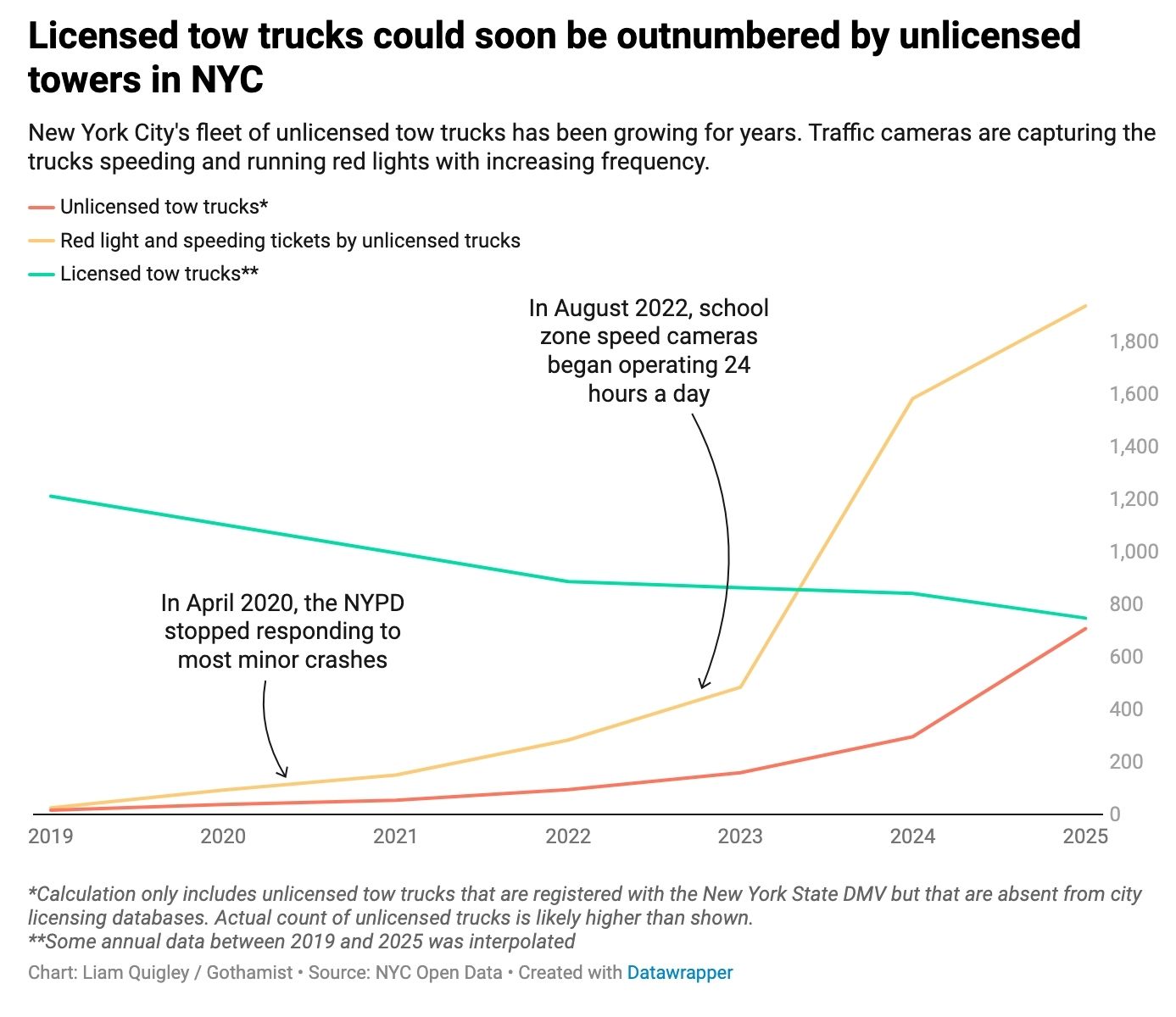

Ghost fleet: How New York City lost control of the tow truck industry by the Gothamist.

I love meeting new people and learning about mobility & delivery innovation. Let’s get-to-know.

People 🧑🤝🧑

Astrid Hagqvist is the new Product Manager Onroad Autonomous Solutions @ TRATON GROUP.

Dalene Campbell is the new Consultant @ Transport & Economic Support Services.

David Lane is the new Head of Strategy and Planning for Europe Mobility @ WEX.

Eifion Jenkins is the new Principal Client Director - National Governments @ Mott MacDonald.

Julie Authelet is the new Marketing Expert @ Losch Digital Lab.

Saurabh Kabra is the new Vice President - Non Trade Advertising, Partnerships and Catalog @ Zepto.

Wesley Bishop is the new Chief Customer Officer @ Addison Lee.

Yann Simon is the new Head of City Partnerships @ EIT Urban Mobility.

Congrats and good luck!

Thank you for reading. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.