In this #movingpeople quick-dive, we look into Via’s key figures. For those who are interested in the complete prospectus filed with the SEC - here it is.

The weekly #movingpeople is going on an August vacation - and a rethink time. It will come back in September, and will remain a FREE extensive weekly report on mobility and urban delivery, but I’m taking a time out to think on how it should be structured. If you haven’t already, please help me rethink my newsletter by answering this short survey:

Intro to Via

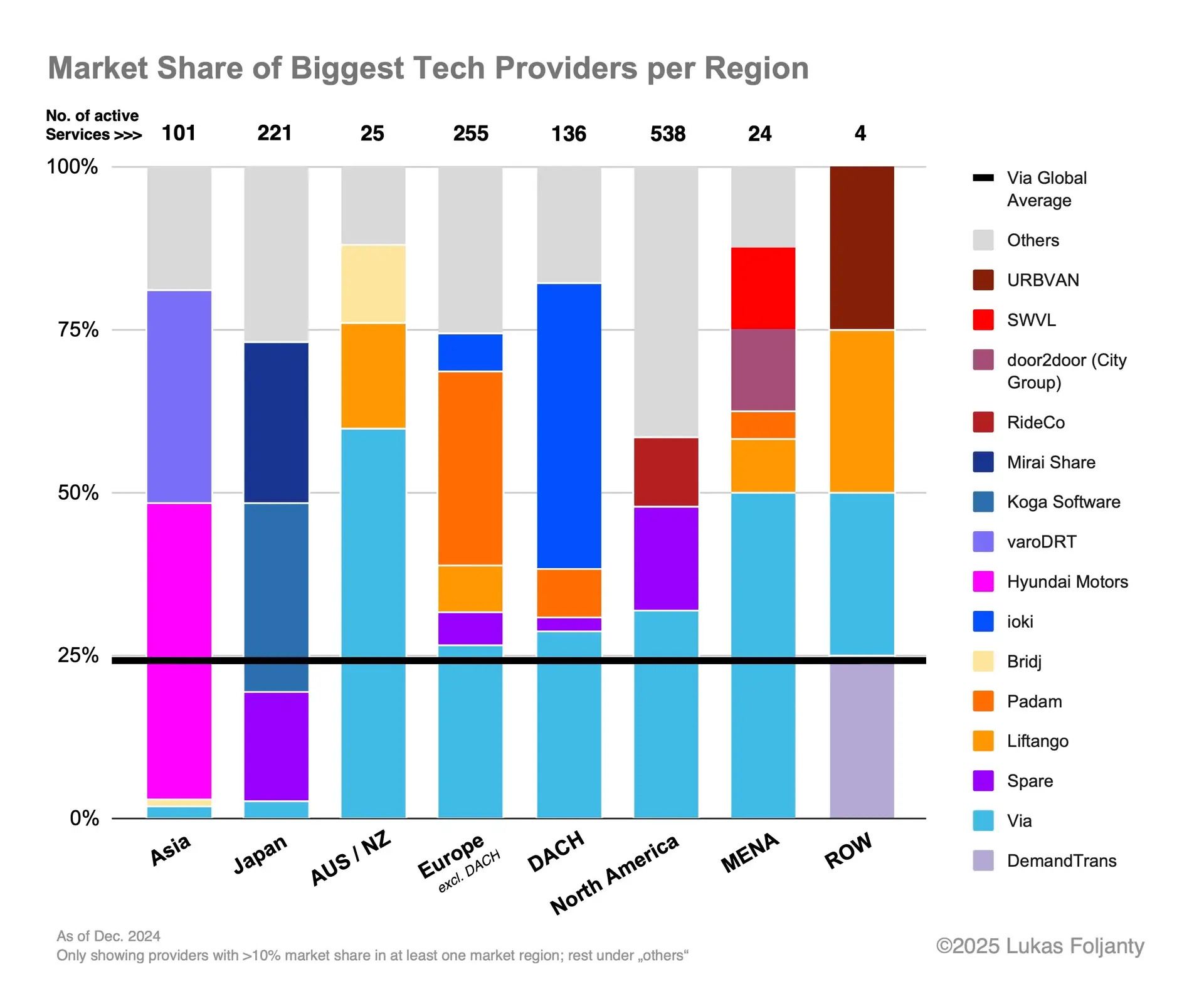

Via is one of the pioneers of mobility technology. Founded in 2012, the company invented DRT (/microtransit) technology and set up a new market, which it currently controls roughly 25% of.

But Via is more than just DRT. In 2021, Via acquired Remix, adding a planning layer to its platform. In 2023, the CityMapper acquisition added consumer-facing MaaS functionalities. Today the company also offers transportation operations, stepping outside of the software ‘comfort zone’ and into the complex world of daily ops.

Market Size <OR> Where is Via Heading

In its prospectus, Via’s SAM is defined as “networks of traditional buses with less than 250 vehicle fleets, microtransit and paratransit (all fleet sizes), school buses to serve the special needs community, non-emergency medical transportation (all fleet sizes), and end-user technology centered around passenger apps which we define as mobility-as-a-service (“MaaS”)”. For TAM, Via adds bus fleets over 250 vehicles, schools buses and ticketing technologies.

SAM North America = $38bn

SAM Western Europe = $44bn

TAM (NA + WE) = $250bn - 63,000 customers

Customers

Via has 689 customers in over 30 countries, of those 90% are B2G.

Interestedly, revenue growth outpaces customer growth. Very simplistic, but if we divide revenue by number of customers, then a customer in 2023 is worth $417k. In 2024 that customer is now worth $508k; and in H1/25 worth $299k (for half a year only). That has to do with some contracts being extremely big (New York) while some are still low-revenue pilots. From the look of it, Via is able to land more big clients or expand existing ones.

Via has built an impressive business, but financials are still in the red.

From 2021 to 2024, Via grew its revenue from $100M to $337.6M, CAGR of 50%. In H1/25 the company had $205.8M in revenue, with an expected annual revenue run-rate of $428.5M. Gross profit is a steady 40%*.

Now we get the answer to the most important question these days: profitability. Via has consistently lost money throughout the years, with accumulated “stockholders’ (deficit) equity” at minus $1 billion, and an operational loss of $83.9M in 2024.

$,000 | 2023 | 2024 | H1/2025 |

Revenue | 248,854 | 337,630 | 205,775 |

Gross profit | 99,408 | 130,840 | 81,761 |

% Gross/Revenue | 39.9% | 38.8% | 39.7% |

Total Operating Expenses | 213,863 | 214,736 | 115,095 |

Operational Loss | -114,455 | -83,896 | -33,334 |

% Ops/Revenue | -46% | -24.8% | -16.2% |

* Cost of revenue includes the “cost of providing certain tech-enabled services to our customers such as driver management, fleet management services, and customer support related costs… salaries, stock-based compensation expense, and benefits for our local operational teams…. as well as third-party cloud hosting services, allocated overhead, amortization of capitalized internal-use software, amortization of acquired intangibles and other direct costs.”

Bottom line

To hit operational profitability, assuming Gross Profit at 40% and sum of annual operational expenses constant at $215M, Via needs to reach revenues of $550M. That could be achieved mid to end of 2026. To reach profitability, and to continue growing organically and through M&As, the company needs more capital. Hello IPO.