Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Obi published their very interesting “Global Rideshare Report 2024”, full of data such as how prices changed over the course of the past four years (spiked during the pandemic and reduced since), take home rates (drivers take less & less), consumer loyalty (low, which is why Uber insists on Uber One) and why people tip (be nice). Download here.

The graph below sheds light on the price sensitivity of people when it comes to “green rides”. People are HIGHLY price sensitive, preferring a normal UberX over an UberGreen anytime X is cheaper, even by a few cents.

InDrive is expanding into added-driver-services by creating a partnership with MIC, an insurance provider. InDrive will now offer its Latin America drivers personal accident and medical expense coverages. Driver retention and utilisation is an industry challenge, and with this partnership InDrive is working out new ways to enhance their position in the supply market. Remember that in November 2023 InDrive raised $100M for a “New Ventures” arm, which is where this initiative originated; seeing the budget, we should expect more announcements soon.

DiDi acquires Mexico’s JP Sofiexpress financial services. Initiated in late 2023 and now getting final regulatory approval, this acquisition will allow DiDi to improve its loans services. Note that the DiDi deal predates InDrive latest move.

Uber’s soon-to-be new features: “Advantage Mode”, a program benefiting top driver performers by giving them better rides and better commissions; and “Driving Insights”, a dashboard that provides insights and a score based on their driving while riders are in their car, to promote safer driving.

Ola Mobility plans to enter the grocery delivery market, via the ONDC network. Ola is currently a leading player in the food delivery market, with circa 30% market share in Bengaluru and Delhi-NCR. The company has previously tried to enter the grocery market, in 2015 and again in 2021, both times unsuccessful. This time around the ONDC network should create demand.

Uber takes the One Less Car trial to the US & Canada. Tested in Australia in 2023, this time Uber will select 175 people across North America, each getting $1,000 (in vouchers/credits only) for a period of 5 weeks. Uber is aiming for a “car light”, rather than “car free” scenario, i.e. study the effects of removing the 2nd car and how that influences usage.

InDrive resumes operations in the Philippines, after five months of inactivity. The company agreed to comply with the government’s fare fees, removing “bidding” and surge prices. Yandex expanded to Urgench and Khiva, Uzbekistan. Bolt expands in Belgium (also in micromobility).

Cudidi is a new ride-hailing app in Vietnam: drivers as employees (not contractors, i.e. no commission, but do bring their own vehicle); fixed per-kilometre pricing for riders, with no surge prices; additional revenue generated by insurance and vehicle maintenance.

MI NAVE is a Mexican company offering cars to gig drivers. Key takeaways from a “Rideshare Guy” podcast with the company:

Uber and DiDi each hold ±50% of the Mexican market with commission rates (for ride-hailing companies) of 15-20%.

In Brazil the market is again split 50%-50%, with lower rates of 10-20%.

Uber’s Trip Radar is a popular feature, allowing drivers to choose from a list of available rides.

InDrive brought in the negotiation feature, which is being tested by DiDi and Uber.

Uber beats lawsuit alleging race bias in driver ratings. The plaintiff claimed that passengers are more likely to give poor ratings to non-white drivers, but wasn't able to show any proof of such.

Car Sharing/renting 🚗

Greg Moran, co-founder and CEO of Zoomcar, was “terminated from his role”. Moran was Zoomcar’s CEO for the past 12 years, since the beginning, and will now be replaced by Hiroshi Nishijima, the current COO. Zoomcar’s 2023 revenue fell short, from an forecasted $21.6M to $8.8M. On the same day announcing Moran’s termination, the company also announced a $3M raise from institutional investors.

Voltio, car-sharing by the Mutua Group, started 1.5 years ago and now has 630 vehicles, on way to 1,000 by the end of the year. According to its Director, Voltio achieved 850,000 trips during that time, or roughly 1,500 per day. And according to Fluctuo, the current average TVD (Trips per Vehicle per Day) for European free-floating car share schemes stands at 2, which would mean Voltio is above average. Still focused on the Spanish market, Wible, which has been operating for the past six years, has 600 cars. Both are not profitable.

Astara Move offers a subscription service, from 1 to 18 months, serving 2,000 customers and expanding into Portugal and Switzerland.

Avail launches a business solution, branching out into SaaS on top of their own managed solution.

Micromobility 🚲🛴

Research in Academia together with Lime finds that taxes and program fees on dockless shared micromobility average 70 cents per mile, compared with 13 cents per mile for ride-hailing services and 3 cents per mile for private vehicles. The study also finds that fees vary dramatically between cities. For the full paper.

Lime is back operating scooters in Milan, following the removal of Voi and Bolt from the city due to tender violations. Remember, back in December 2023 Milan chose Lime to only operate e-bikes. Lime is also back in Baltimore. Atlanta’s e-bike rebate program breaks the (local) demand. Cargoroo’s cargobike fleet shuts down in Amsterdam, failing to get local permit.

I love meeting new people, learning about mobility innovation and exchanging opinions. Interested in discussing mobility? Let’s set up a half-hour coffee chat.

Delivery 🍽🧺

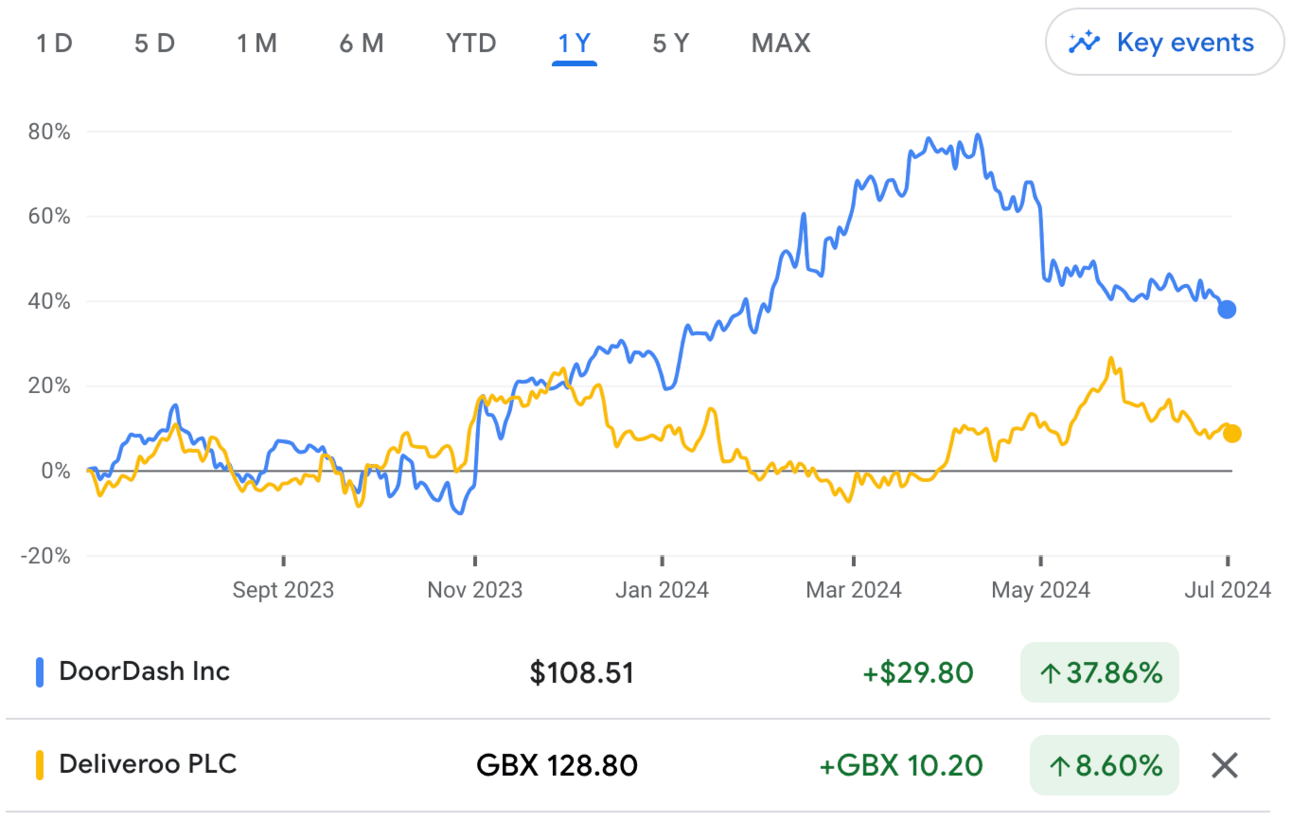

DoorDash held takeover talks with Deliveroo; the two companies couldn’t agree on price. DoorDash market value is roughly $45 billion vs. Deliveroo’s $2.6 billion.

Grubhub partners on grocery deliveries with Albertsons, a US food and drug retailer, allowing orders from 1,800 of Albertsons 2,200 stores. This is Grubhub’s first nation-wide partnership; Albertsons has similar partnerships in place with Instacart and DoorDash. Albertsons reach:

Zomato introduces Restaurant Services Hub, a platform offering restaurants to manage hiring and regulatory services. The platform has been piloted for the past six months.

Swiggy’s revenue grew 24% in 2023; EBITDA improved to negative $261M. We are waiting for Swiggy’s IPO, which has already been confidentially submitted.

Evri plans UK’s largest electric cargo bike fleet, reaching a total 99 vehicle fleet; the company has 33 e-cargo bikes today.

Autonomous & remote-driving 🤖℡

Verne (named after Jules Verne) is the new L4 autonomous robotaxi brand from Rimac, coming to markets, beginning with Zagreb, in 2026. Autonomy is being supplied by Mobileye, with Verne in charge of the vehicle platform. From the PR: “The vehicle is built on a completely new platform… engineered solely for autonomous driving using the Mobileye Drive autonomous platform... Built from the ground up it is free from the compromises and disadvantages necessary in using a legacy platform built for human driving.”

The company says that it has 11 cities (inc. Zagreb) that signed contracts for Verne taxis; from my knowledge, in Manchester the company is working with the local authority to become a part of the city’s transportation solution, with work led by Arup concentrating on data sharing. See company video (only if you have extra time).

Uber Freight and Aurora partner on ‘long-term’ driverless truck, after successful pilot. Aurora will facilitate Uber’s launch of an autonomous freight route between Dallas and Houston (note: Uber is the customer here) up to 2030. At the beginning, Aurora will operate up to 20 trucks which will appear as a carrier on the Uber Freight network (TaaS model); at a later stage this relationship will shift to a driver-as-a-service (DaaS) model, wherein carriers purchase trucks with the Aurora Driver technology on board. Those carriers will then offer their services via those trucks to shippers on the Uber Freight network.

Cruise names new CEO: Marc Whitten, a former Amazon and Microsoft executive. Marc is stepping in for the two co-presidents who have been in charge since Vogt resigned in November 2023.

Beti, rural mobility operator from the Groupe Bertolami, and EasyMile join forces for new Level 4 autonomous shuttle service on a private site. The service will transport employees between parking lots and various stops on the 15-hectare site. Project KIRA, L4 on public roads in Germany, ‘hits the road’ with Deutsche Bahn leading, Mobileye supplying autonomy, ioki the booking application and others.

Waymo opens San Francisco robotaxi service to the general public, removes waiting list. WeRide and Pony.ai start charging for trips in the Beijing Daxing International Airport. Toyota to launch its first EV with an advanced self-driving system for China in 2025, adopting Momenta’s AV solution. WeRide’s Robosweeper - the movie.

Flying cars 🚁

Boeing’s Wisk Aero buys Verocel to boost software safety for its self-flying eVTOL. Verocel has been in the market for the past 25 years, offering software verification and validation for the aerospace industry. Wisk’s 6th generation vehicle is designed to be flown autonomously with remote supervision, so software is crucial. Terms of the deal not disclosed.

OEMs 🛺⚡️

Volkswagen will invest up to $5 billion Rivian. The two companies are forming up a new, equally controlled joint venture, to share EV architecture and software. The deal allows Rivian funding to develop its vehicle roadmap and helps to create efficiencies of scale on way to reach profitability. VW gains knowledge and expertise in both software and EVs; software is a major issue here, as VW's software division, Cariad, consistently failed to meet its goals and budget.

Initial funding, $1 billion in unsecured convertible note that will eventually convert into Rivian’s common stock, will be transferred now in order to launch the JV. VW will invest another $2 billion in Rivian’s common stock and $2 billion to go into the joint venture, split between an initial investment and a loan in 2026..

Fisker went into chapter 11, and it's bad news for customers depending on software updates and parts; especially when seeing vehicles getting recalled. Meanwhile, Fisker is in talks to sell its stock, 4,300 vehicles, to gig-drivers leasing company.

Gig economy 💰

Uber and Lyft reached a $175M settlement with Massachusetts, resolving a multiyear lawsuit around the classification of drivers. Compensation will be paid to current and former drivers. In addition, driver pay will climb to $32.5 per hour, and drivers will receive inflation-based pay raises and some social benefits. There is also a ride-hailing platforms win: Drivers will continue to be classified as independent contractors.

Uber responds to NYC minimum pay rule with driver lockouts. The rule determines that platforms pay for idle time between rides; Uber is locking out drivers during low demand periods. Lyft is expected to follow with a similar step.

In India, drivers are demanding better pay, going on strikes which include more than 100,000 drivers at a time.

In other news 📰

Fetcherr raises $90M. The company develops AI for dynamic pricing for the airline industry.

Be.EV raises £55M in debt to expand rapid EV charging across local communities. Today the company operates 700 charging points, which will grow to 1,000 by the end of the year. This brings total funding to £165M.

Castrol, by BP, invests $50M in battery-swapping player Gogoro. This brings total funding to $1.1 billion.

Local Kitchens (ghost kitchens) raises $40M.

Fuuse, EV charge point management platform, raises £8.7M. Funds will be used to scale its enterprise product offer. Fuuse’s clients include the likes of SSE, Scottish Power, British Airways, Siemens and United Utilities.

Zeti raises €5.9M. The company provides flexible financing for low and zero-emission vehicles and infrastructure, and will use the funds to expand in the UK.

A colour changing BMW.

I love meeting new people, learning about mobility innovation and exchanging opinions. Interested in discussing mobility? Let’s set up a half-hour coffee chat.

People 🧑🤝🧑

Andrew Varley is the new Head of Service. Public and Integrated Transport @ Lancashire County Council.

Darren Gwynne is the new Chief Operating Officer & Director of UK Office @ Verne.

Drew Reynolds is the new Director of Marketplace Growth @ Getaround.

Gaurang Purwar is the new Associate Director - Partnerships, Social Media Marketing @ Rapido.

Halimah Haque is the new Editorial Assistant @ Global Railway Review.

Jacob Moses is the new Director of Operations @ Sherbet Electric Taxis.

Joseph Constanty is the new Sr. Director of Global Strategy & Growth @ NIU Technologies.

Meir Dardashti is a new partner @ Maniv.

Philippe Op de Beeck is the new Special Advisor to APCOA Advisory Board @ APCOA Holdings GmbH.

Congrats and good luck!

Thank you for reading #movingpeople. If you enjoy reading, please share with your friends and colleagues so they could enjoy it as well.