- #movingpeople

- Posts

- Waymo expands (again), Lilium, Canoo and Nikola down, Uber deeper in South Korea

Waymo expands (again), Lilium, Canoo and Nikola down, Uber deeper in South Korea

This week on #movingpeople

#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Uber buys out SK Square’s subsidiary T-map Mobility’s holdings in Wooty, branded as Uber Taxi since March this year, for 60 billion Won, or circs $41M. Wooty was established between the two companies in 2021, with Uber holding 51%, and has been in the red since. Now it will be 100% Uber. The two companies will continue to partner on data.

Kakao Mobility to pay $10.5M in an antitrust fine for limiting rivals’ access. Kakao, which offers general ride-hailing services via its Kakao T app, is mandated to allow “franchise”, or specialised ride-hailing, on the Kakao T platform. “Franchise” offer specific utilities, such as premium vehicles or faster time, and are offered by the likes of players Uber and TADA. The reason for the fine: Kakao demanded a per-driver fee or access to competitors’ data in order to host them on the Kakao T app, which has roughly 96% market share.

Blusmart secures Rs 100 crore (±$12M) in EV financing under its asset leasing initiative - “Assure by BluSmart”. In this scheme, partners, such as fleet operators and financial institutions, buy the vehicles and then lease them to Blusmart to operate. It's a win-win - partners make a monthly return on leasing the vehicles, and Blusmart doesn’t have to increase too much debt or give up equity in order to grow its fleet.

First Group to acquire RATP Dev Transit London operations for £90M. RATP holds 14% of the London bus market, serving the city with a fleet of 1,000 buses, a third of which are electric.

BlaBlaCar completes the obilet acquisition, becoming a majority shareholder. The acquisition was announced back in June.

Zingbus, intercity bus network focusing on electric buses, raises $9M.

Dubai has recently launched a bus pooling initiative - licensing three companies to offer public transport via (semi) DRT services. The companies chosen for managing public transport are Driven Bus, Liftango and Citylink (which acquired D2D solution a while ago). Watch this space, as three companies compete (not necessarily with each other) on ridership.

DiDi Australia is expanding its new tow truck service - to bring riders' cars home if they are too intoxicated to hop behind the wheel. Treepz pilots school transportation in Canada, getting ready to launch corporate and school services in 2025. UTOL is a new ride-hailing player in Cebu, the Philippines. Bolt delays entry to Luxembourg due to complexity of answering local regulations. Spare wins another UK DRT contract. In Bengaluru, the metro company is partnering with Rapido to deliver last mile connectivity to passengers. A similar partnership exists with Namma Yatri. Vietnamese e-taxi brand Xanh SM expands to Indonesia. Gett 2024 numbers:

iOS and Android users may pay different rates on Uber. This has to do with Apple users perceived as premium users with higher WTP and also with App stores fees. Example from India.

Car Sharing/renting 🚗

Zoomcar to launch Zoomcar Cabs, a cab rental product in Bengaluru, branching into gig-driver-rental, and away from “classic” car-sharing which the company was built on. Zoomcar had to do something different - in November the company reported it could not guarantee continuing on a “going concern” basis (simple English - not sure we are going to make it as a business).

Hyre Norway partners with Circle K, retail petrol gas stations, with over 200 stations across Norway. Hyre vehicles will be stationed at Circle K locations, allowing Hyre national scale. For now the companies are piloting in 21 selected stations.

The city of Las Rozas (near Madrid) has been subsidising car-sharing. Working with Zity and Wible, a discount of €3 per ride is offered, in order to increase equity and minimise dependency on private vehicles.

In 2024, Greenwheels added 140 vehicles to its fleet, which now stands at 2,900 shared cars, aiming for 4,000 by the end of 2026. More on Kias Rent & Share (/Kia Drive) offer to B2B customers, operated via local dealerships.

A story about car-sharing in the US, the financial challenges of the free-floating model, and car-sharing as an equitable solution, a part of the city’s transport mix.

Micromobility 🚲🛴

Voi has been selected as the exclusive operator of electric bikes and scooters in Saint-Quentin-en-Yvelines for the next three years, and will deploy 750 scooters and 150 electric bikes. The Seville City Council awards Bolt and Lime, each will deploy 700 e-bikes. GCOO launched a shared electric scooter service in Accra, Ghana. Beam introduces shared seated e-scooters to Mackay, Australia. Beam continues pilot in Forster-Tuncurry, Australia.

Italy’s new Highway Code entered into effect in December - now scooters require a licence plate, and riders are required to wear helmets. This is a major unit economics and logistic challenge for companies. TBC.

Lyon reduces scooter fleet from 4k to 3.5k, and keeps Dott as a single operator after tender saw Tier and Dott win (before the merger). Gütersloh, Germany, added a €25 per vehicle per month fee on Dott - and now Dott and its 250 scooters are leaving.

Bikmo, cycle insurer, raises £4.75M.

Debt restructuring and CEO change at Micromobility.com.

Delivery 🍽🧺

Grubhub to pay $25M for misleading customers and drivers and for hurting non-partner restaurants. In 2019 Grubhub started advertising lower delivery fees, only to add “service fees” that de-facto inflated total delivery fees. In addition, the company falsely advertised inflated driver earnings, and added restaurants to its platform without their consent in order to coerce them into joining the platform. Grubhub (recently acquired by Wonder) will now (1) be transparent regarding total delivery fees, (2) will not onboard restaurants without their consent; and (3) will only make claims about driver earning if those can be backed by evidence. Feels like all this should have been obvious.

Wing and DoorDash launch drone deliveries in Dallas-Fort Worth, Texas. Meituan introduces drone service in Dubai, operated by the Keeta Drone subsidiary, making Dubai Meituan’s 1st (drone) international expansion.

Avride receive certification in Japan, and plans to launch soon. Meituan and Walmart partner on e-commerce deliveries in China. Yogiyo reports EBITDA profitability,

Careem introduces 20-minute grocery deliveries in Abu Dhabi. Ola to introduce 10 min delivery in Bengaluru, via the ONDC-supported Ola Dash solution.

Autonomous & remote-driving 🤖℡

Waymo expanding to Tokyo in 2025. For now only a development program, which has human safety drivers and is in no way commercial. Waymo partnered with the ride-hailing GO app and taxi company Nihon Kotsu as operators. This will be Waymo's first foray outside of the US.

Waymo sums up 2024 - 150k weekly rides across Phoenix, San Francisco and Los Angeles. Four (4!) million autonomous trips in total in 2024. Next year will see Austion and Atlanta going commercial with Uber, Waymo going on a “road trip” to Tokyo, and in 2026 launching Miami with Moove. This has been a great year for Waymo (but not so much for the industry).

Tesla is courting cities in Texas to test its soon-to-arrive robotaxi service.. An autonomous commercial bus operating in Scotland will be discontinued due to “lack of ridership”. Autonomous shuttle on French streets (video). The NHTSA (US) is promoting regulation that will allow robotaxis without wheels or pedals to go on public roads. The agency is also demanding more data be shared with it. Pony.ai partners with GAC Aion, Chinese EV manufacturer, to develop robotaxis.

Einride launches Europe's first autonomous daily commercial application, moving goods between warehouses (aka middle mile). Embotech partners with Eurogate, a logistics company, to introduce an autonomous terminal tractor. Volvo and DHL partner on autonomous trucks in Texas. Volvo trucks use Aurora’s AV solution.

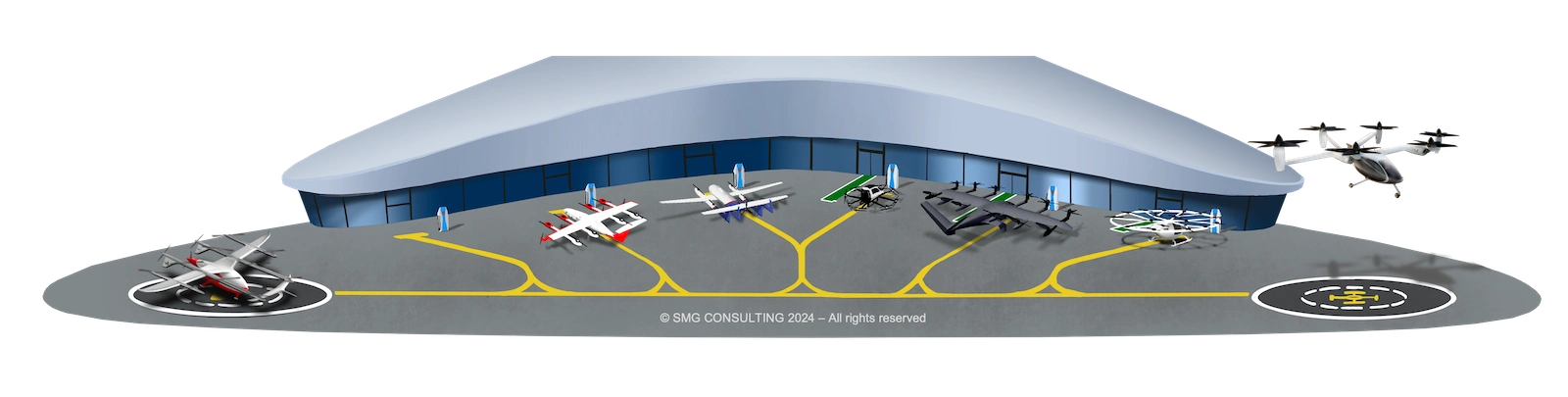

Flying cars 🚁

Lilium - the end. The company has laid off its entire workforce and is discontinuing operations. Lilium, which had €1.5 billion invested in it, has been looking for a buyer after its plea for a government loan was rejected, and it seems that no other backer was ready to step in.

A new AAM Reality Index came out in December. Leading the chart:

EHang with 8.5 points (scale 0-10)

Beta Technologies - 8 point

Joby, Archer and Volocopter - with 7.9 points. Remember Volocopter is also in financial troubles, and is has

And in 12th place with 7 points - Lilium.

Archer completes building of its manufacturing site. Initial production to begin early 2025, with Archer’s goal to ramp production to a rate of two aircraft per month by the end of the year and 650 aircraft annually by 2030. See the numbers - eVTOLs are not going to replace helicopters anytime soon - only add to them.

Joby enters final phase of the type certification process. Zuri, a Czech hybrid VTOL, raises €3M, bringing the total to €4.4M. The future is in hybrid VTOLs.

OEMs 🛺⚡️

Honda and Nissan explore merger, to be able to take on EV players such as Tesla and BYD, and overcome Chinese competition. Mitsubishi might have a part in this as well. Nissan, like many OEMs, is in trouble - with an estimated one year to survive independently.

Global automotive industry market cap. I wonder what will happen to Tesla’s market cap should Musk leave the company. But until then, behold:

Canoo is furloughing employees and closing factories as the company’s future hangs on a thread. Back in mid-November the company said that it had just $700,000 in the bank.

Nikola’s troubles deepen. "We currently estimate that our existing financial resources are only adequate to fund our forecasted operating costs and meet our obligations into, but not through, the first quarter of 2025."

Winds of change: Lamborghini delays first EV launch to 2029 as “the time is not ripe for full electrification in the sports car market segment”.

Tesla delivered its semi electric trucks to a new - and only the 2nd - customer. Vehicles were delivered to Saia, a large LTL player.

Gig economy 💰

Meituan pilots policy to log off overworked delivery riders automatically.

Uber to pay drivers $4M - after Drizly, which Uber acquired and later shut down - failed to pay drivers their tips.

Berlin is considering a minimum fare for ride-hailing, in a move that will protect the taxi industry.

Remember those 4 million rides Waymo had in 2024? Well, ride-hailing drivers do.

In other news 📰

CarDekho, Singapore-based auto financing service platform, raises $60M in equity, valuing the company at over $300M. Funds will be used for “further expansion into Southeast Asia, focusing on the used car and bike financing industry in Indonesia and the used auto financing sector in the Philippines”.

Orqa, autonomous drone solutions for defense and enterprise markets, raises €5.8M.

2024 Urban Mobility Readiness Index by the Oliver Wyman Forum - ranking of 70 major cities worldwide on their preparedness for mobility’s next chapter.

Boeing Starliner astronauts will be stuck in space for even longer. Astronauts Wilmore and Williams left earth in June 2024 for what was supposed to be a 8 days mission, only to see their ride break down and realise there were no motor clubs in space. NASA quickly rebooked with SpaceX but waiting times on that ride have been pushed back to February 2025. Astronauts have been crashing in the international space station since.

I love meeting new people, learning about innovation in mobility innovation and exchanging opinions. Let’s get-to-know / catch-up.

People 🧑🤝🧑

Congrats and good luck to:

Abhinav Bibhu is a new Vice President @ Zepto.

Camila González Arango is the new Partner Success Lead - EMEA @ Spare.

Nick Reed is a new Science Advisory Council Member @ the UK Department for Transport (DfT).

#movingpeople is going on a long Christmas / Hanukkah vacation. I’ll be back on Monday the 13th January. Happy new year!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too. The “Share” button is to your left, under the heart. Thank you.