#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on Innovation, Growth and Autonomy.

Ride-Hailing & Robotaxi 🚙🚕

Last week Waymo shared the 10 cities it operates full autonomy in, either robotaxi or autonomous pre-commercial runs. This week WeRide shared the 7 cities in which it operates robotaxi services. The most recent, introduced a couple of weeks ago, in Dubai, in partnership with Uber.

Waymo is looking to raise $15 billion, at a circa $100 billion valuation. The last round, in October 2024, saw Waymo raising $5.6 billion at a $45 billion valuation. Funds will go toward expansion. To put things into perspective: Tesla’s market cap is ±$1.5 trillion; WeRide ±$63 billion; Mobileye ±$8.3 billion.

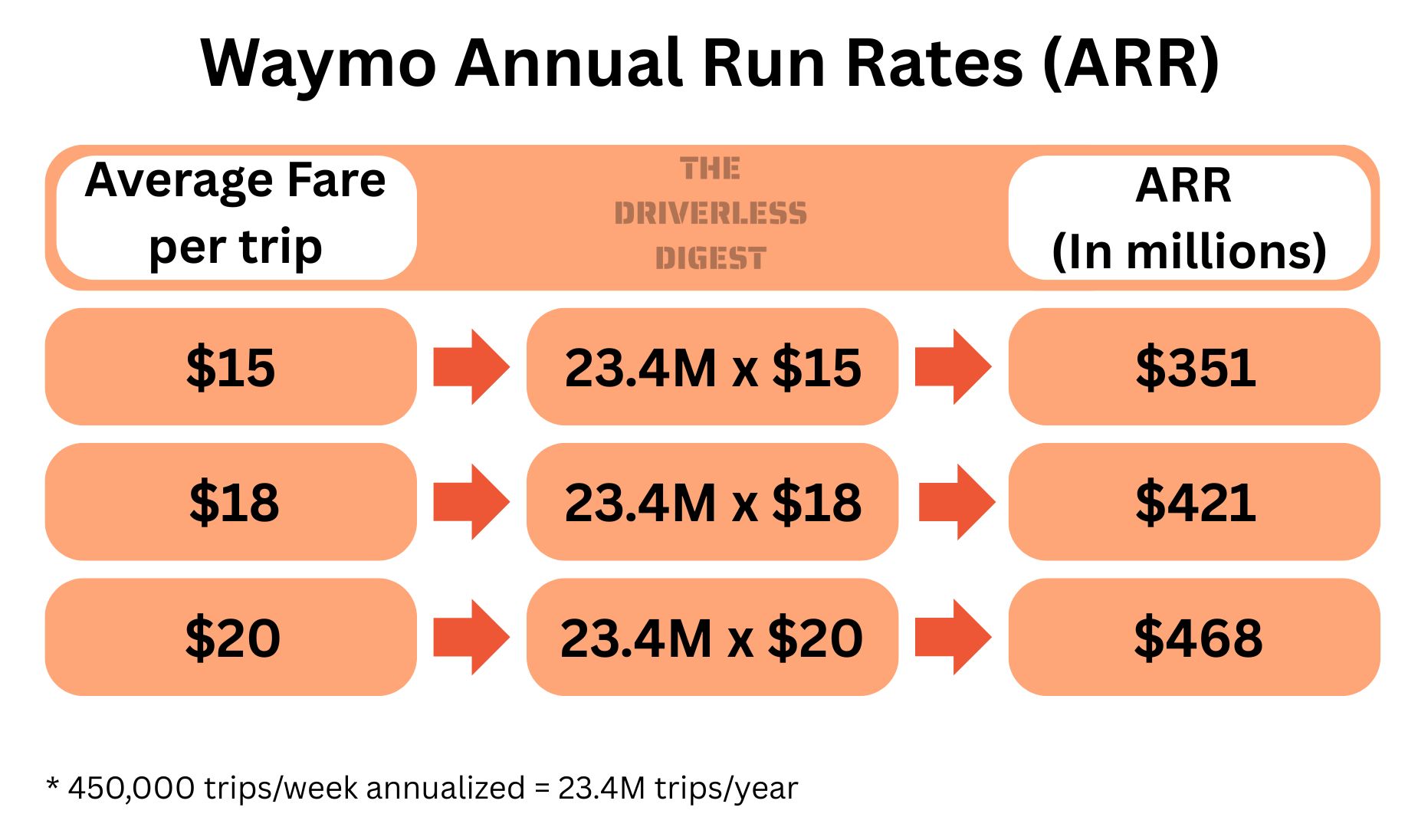

Harry Campbell calculated Waymo’s ARR, based on publicly available data.

Financial investors are looking at selling their 40% stake of Kakao Mobility. A few entities are interested, from PEs to Hyundai to Delivery Hero-owned Baemin. Efforts to sell the unit have continued since 2022, after a failed IPO.

Grab partners with Momenta for autonomy, via strategic investment in the company. This isn’t a first for both; Grab has partnered/invested in WeRide and Vay; Momenta with the likes of Mercedes, BMW and Uber.

Gett partners with Take Me Group. Gett taps into Take Me’s UK nation-wide supply, while Take Me will now be able to use Gett’s tech for their own bookings, creating a booking to execution synergy between the two companies.

Tesla starts testing robotaxis in Austin with no safety driver, after six months of operation. The fully autonomous 2-car fleet is not a part of the robotaxi service, which is still human monitored.

VW starts testing its Gen.Urban autonomous car on public roads - gathering data on user behaviour and interaction with the vehicle. Insights from this research will define how VW builds its future car, from a design and in-cabin experience perspective.

Cabify enters the AV race with a new hire and an aim to launch in Madrid. The company is in talks with different autonomous suppliers; no launch date yet.

Not all is smooth in Waymo’s operations. In the northwest part of San Francisco, residents experienced a blackout due to a fire, resulting in multiple fire trucks moving around, shut down of traffic signals and a strain on the 5G network. The uncertainty led Waymo vehicles to be disoriented, obstructing traffic, until Waymo decided to halt the service. For multiple videos of Waymos waiting aimlessly. Also in Austin, Waymo spotted driving the wrong way.

Uber Australia partners with Legion Cabs, enabling integration via Autocab, a taxi dispatch software owned by Uber. Uber UK per-trip driver commission ranges between 3% and 49% (as shown in the T&Cs). InDrive approved to operate in Malaysia, now adhering to local regulation. Evera Cabs to deploy 4,000 EVs, sourced from BluSmart.

DRT, Bus-Based Mobility & AV shuttles 🚍🚌

Via acquires Downtowner, Downtowner is a fellow on-demand (microtransit / DRT) company with limited operations, estimated at circa 25 running services (true to mid 2025), placing it toward the end of the global top 20 on-demand companies by number of services (Via, obviously, #1, with over 350 services). The Downtowner team, tech & operations will be absorbed into Via.

Solihull Metropolitan Borough Council (Who? map, just outside of Birmingham, UK) published its draft Automated Public Transport Services (APTS) specification - a 53 pages document on how to procure autonomous buses. Tym Syrytczyk sums the paper, concluding that the overspecification in the document could lead to increased costs, therefore eliminating the cost saving advantage autonomous vehicles bring with them and hindering technology advancements.

Adastec & Karsan launch in Munich. For now testing a 8-meter 52-passenger bus, with an aim of launching Robomidibuses as part of the public transport system in 2027 / 2028. KPIs: cost-effectiveness and practicality.

Boca Raton, Florida, launches autonomous shuttle service with Auve Tech (autonomous tech), Circuit (microtransit) and Guident (teledriving).

Hacon and Padam Mobility, two Siemens Mobility companies, are providing a MaaS + on-demand solution to Burgenland Call-a-Shuttle, Austria. The 60-vehicle service will be integrated with the existing public transport solution.

DfT Guidance & RMF Final Report on DRT

The UK DfT publishes its best practice guidance for Demand Responsive Transport (DRT). It is a thorough publication, a very long must read for any public official thinking about DRT programmes, with:

Basic principles of DRT, including a working definition, obligations and possible success criteria

A 4-stage model based on planning, procuring, launching and sustaining DRT, identifying the actions required for each

Case studies which illustrate existing DRT schemes

Timeline for a typical local authority scheme and the various stages of developing typical service models

In addition, the DfT also published its Rural Mobility Fund phase 1 evaluation: final report - a 120 pages document on the £19.4M funding the DfT gave 15 local authorities (LA) to initiate DRT schemes, starting back in 2021.

Bottom line: teething challenges (and there are many) aside, “DRT can play a role in providing transport in rural areas under the existing regulatory structure, and that it is worth considering as one of the available options… Bringing levels of journey subsidy to what was seen as acceptable (for each LA) remained a major challenge. There were clear calls for greater consideration of social value in the economic assessment of DRT services in locations where LAs felt they were never likely to fully cover their financial costs”.

Other interesting data points:

Service efficiency. Passenger journeys per vehicle hour saw small increases over time and by the last six-month monitoring period the average was just over two across schemes with a range from 0.9 to 3.9

Most journeys (87%) were booked with the mobile apps; phone bookings to a call centre constituted 11% of all bookings

The average advance booking time for DRT services was 2.7 days

Car Sharing/renting 🚗

KM Malta Airlines partners with CarTrawler to launch a new car rental service, bookable via the Malta Air website.

Greenwheels enters Hattemers, replacing MyWheels.

Vay in 2025: grew to ~100 commercial vehicles in Las Vegas and announced Grab’s investment of up to $410M. More 2025 milestones here.

Micromobility 🚲🛴

Islington Council vs. Lime and Forest - threatening to ban the two micromobility providers. The reason: dangerous parking and reckless rider behaviour.

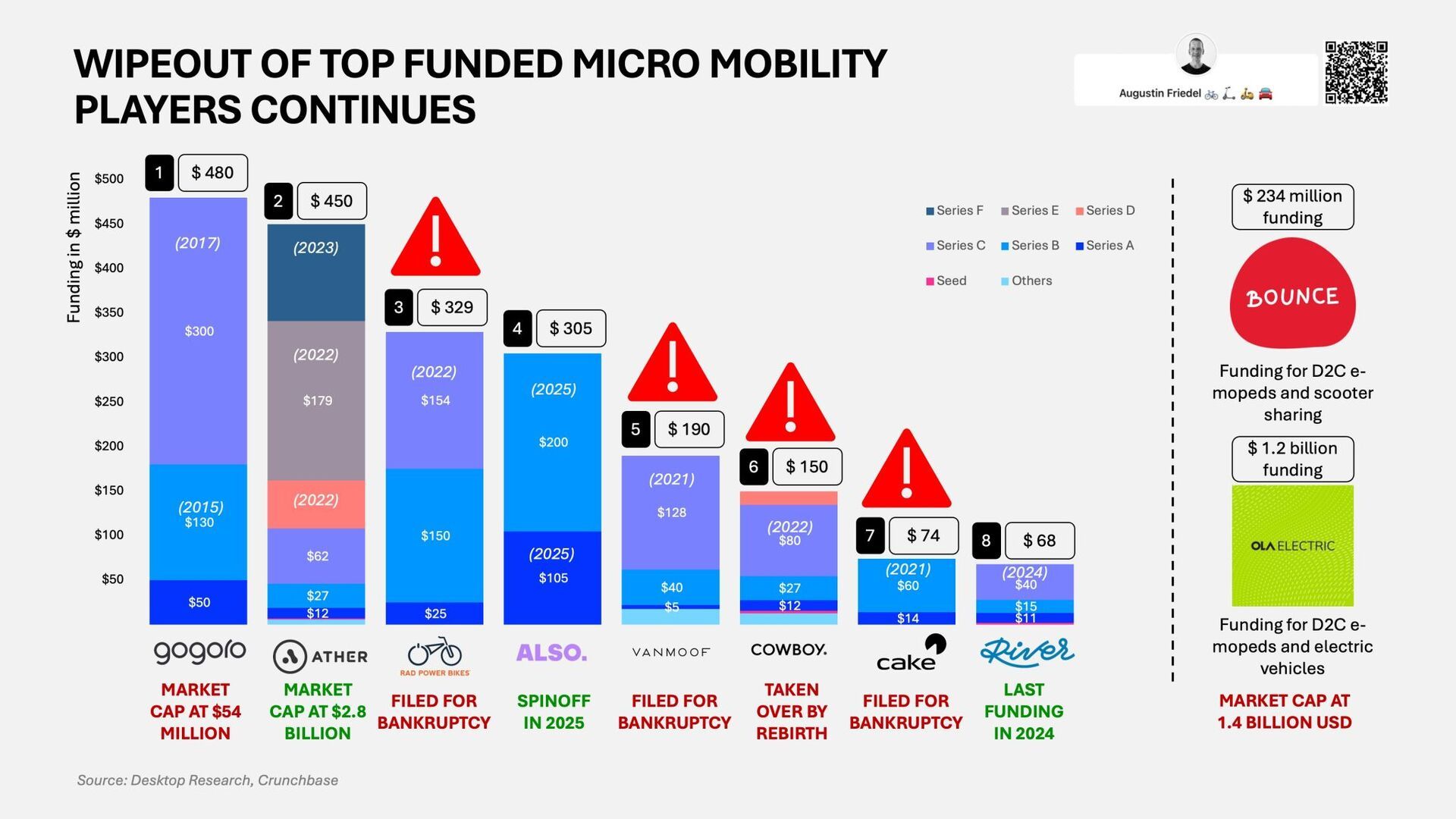

Western e-bike manufacturers have not had much success. This week we learn that Rad Power Bikes, which over its lifetime raised a total of over $300M, filed for Chapter 11 bankruptcy; and that Cowboy found a new home with ReBirth Group Holding, which also owns cycling brands Peugeot, Gitane, and Solex. Augustin Friedel summary and visuals:

Delivery - from bikes & cars to bots & drones 🍽🧺

Yango invests in Gigmile, vehicle subscription and financial services to gig workers in Africa, to accelerate last-mile push into Africa. This investment is a part of the $20M Yango Ventures fund.

Rappi and PicPay partner - Rappi’s “Turbo” delivery operations will be fully integrated into PicPay app, a digital bank with 64 million users across Brazil, via a new “Picpay Delivery” functionality.

DoorDash rolls out Zesty, an AI social app for discovering new restaurants. The app allows textual interaction with the engine, and learns users’ preferences. Zesty is currently in Beta and in the San Francisco area only.

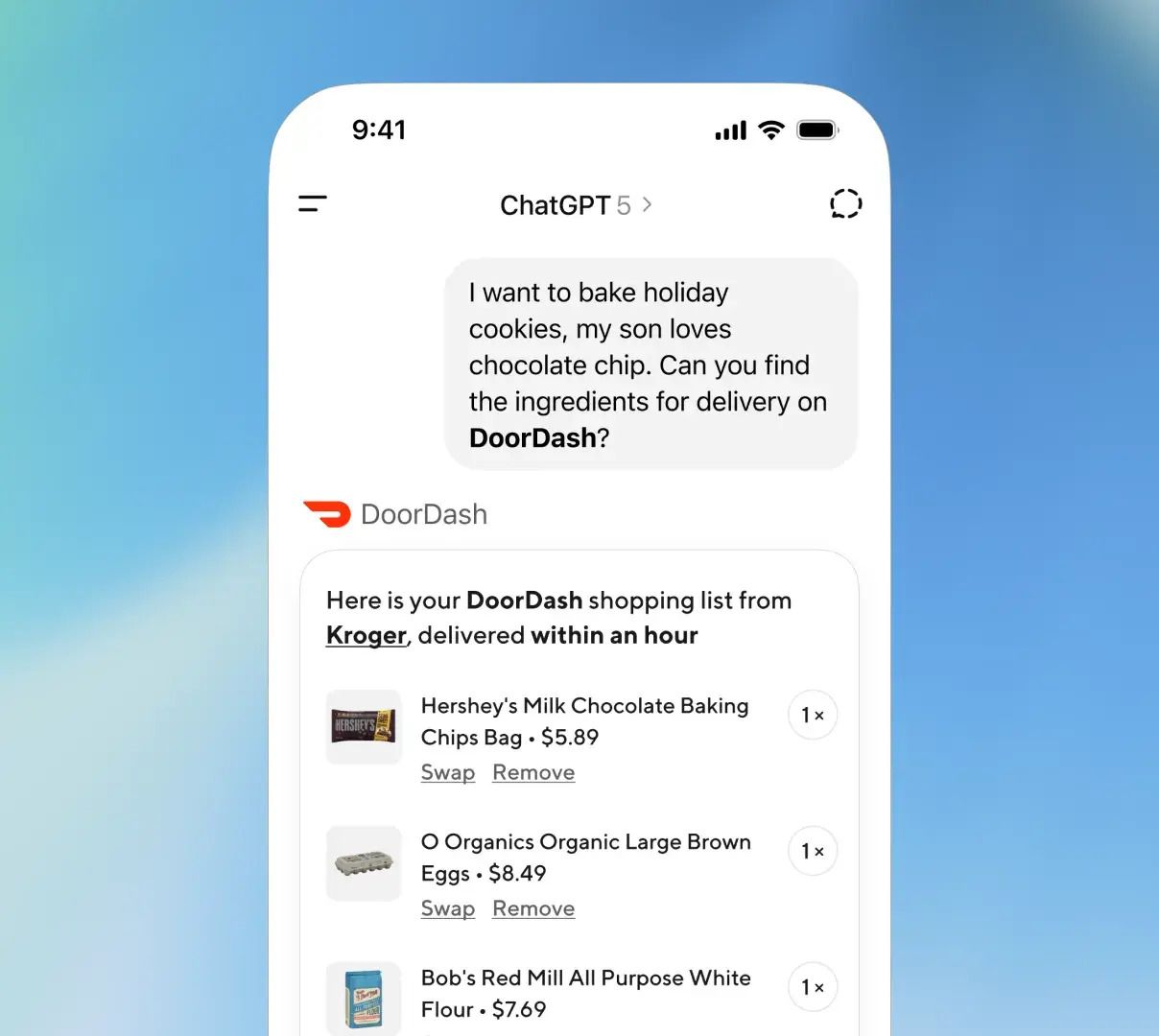

DoorDash launches a grocery shopping app within ChatGPT - enabling customers to turn recipes into grocery orders.

AV Freight & Logistics 🚛🚜

Tier IV invests in Turing Drive, a Taiwan-based autonomous driving startup specialising in geofenced areas and low-speed operations, such as in airports, factories, ports and commercial complexes.

Quantum Systems acquires FERNRIDE. Quantum Systems is a defense company specialising in air platforms; with this acquisition the company adds autonomous land capabilities.

Kargobot, a DiDi spinoff autonomous freight unit which raised ±$42M earlier this year, signs an MOU with Horizon Robotics, Chinese car-based autonomy tech company, to develop heavy-duty trucks and accelerate the scaling of autonomous freight transportation.

Waabi completed driverless operations on a closed course (done back in October, published now). Next stop: public roads.

Aptiv and Vecna Robotics to develop autonomous warehouse mobile robots.

A through report of the state of truck & yard logistics autonomy; a long must read for any autonomous trucking professional, covering Aurora, Bot Auto, Kodiak, Plus AI, Stack, Torc, Wabbi, Einride, Gatik, FERNRIDE (minus the recent sale to Quantum Systems), Forterra, HubPilot, ISEE, and Outrider. Super. Some takeaways on a macro level:

Driverless commercialisation of long haul expected in 2027 onwards - with some, such as Aurora and Wabbi, set to reach that goal in 2026. Long haul is a mix of retrofit and OEM ready trucks, but OEM needs mean that autonomous ready production lines are far from scale.

In short haul, Gatik and Einride are the two players standing; there is room for more players.

The yard autonomy space is quite robust and ready for industry-wide implementation over the coming years.

In other news 📰

Ford pivots from a fully electric F-150 truck to an “extended range electric vehicle” version, i.e. includes a gas generator which powers the battery. This is a part of a strategic move that comes with a $19.5 billion write-down. “Ford no longer plans to produce select larger electric vehicles where the business case has eroded due to lower-than-expected demand, high costs and regulatory changes”.

More on the EV truck market inefficiencies here - challenges in providing service; lack of dealer network out of metro areas; irrelevant SaaS / subscription business model; and battery weight are some of the reasons OEMs, not just Ford, are pivoting away from electric pickup trucks.

Mobileye to lay off 5% of staff, as competition intensifies, especially in China.

Wisk achieves first hover flight of Gen 6 autonomous eVTOL.

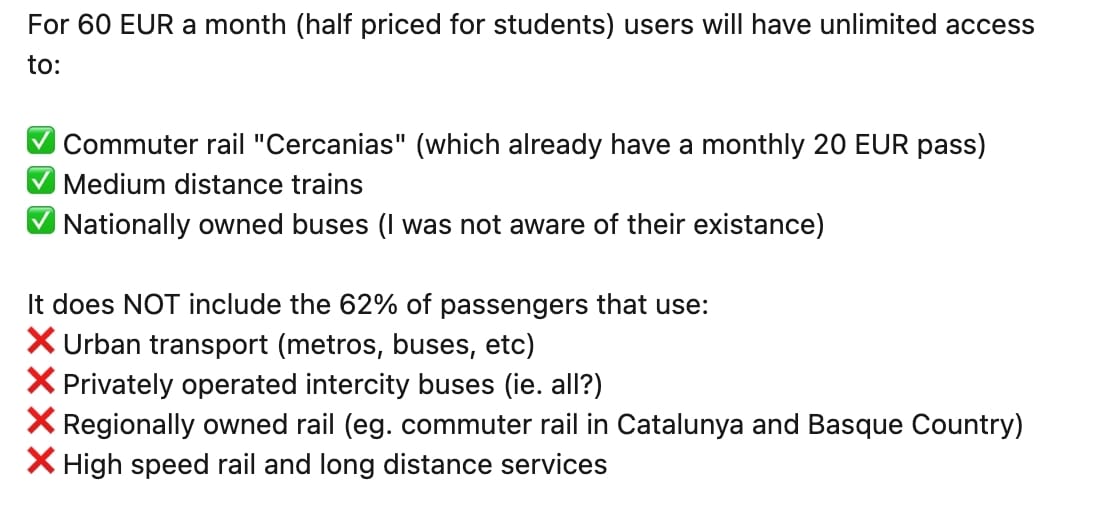

Spain to launch €60 monthly nationwide public transport pass, early in 2026. It is far from perfect, as Azarel Chamorro writes:

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Eli Magzimof is the new VP R&D @ ZIMARK.

Franziska Becker is the new Director of Autonomous Mobility @ Hamburger Hochbahn AG.

Geert-Jan (GJ) Kistemaker is the new Senior Vice President - Global Franchise @ Hertz.

Jorge Quesada is the new Transport Mobility Manager @ FIFA World Cup 2026.

Navi Dhinsa is the new Commercial Advisor @ Traknova.

Niv Oron is the new VP Sales for Peugeot, Citroën, DS & Opel @ Lubinski Group.

Congrats and good luck!

#movingpeople is a weekly mobility & delivery newsletter - from Ride-Hailing & Robotaxi through Remote-Driving & Delivery Drones to e-bikes and Autonomous Freight & Logistics.

Thank you for reading. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.