#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

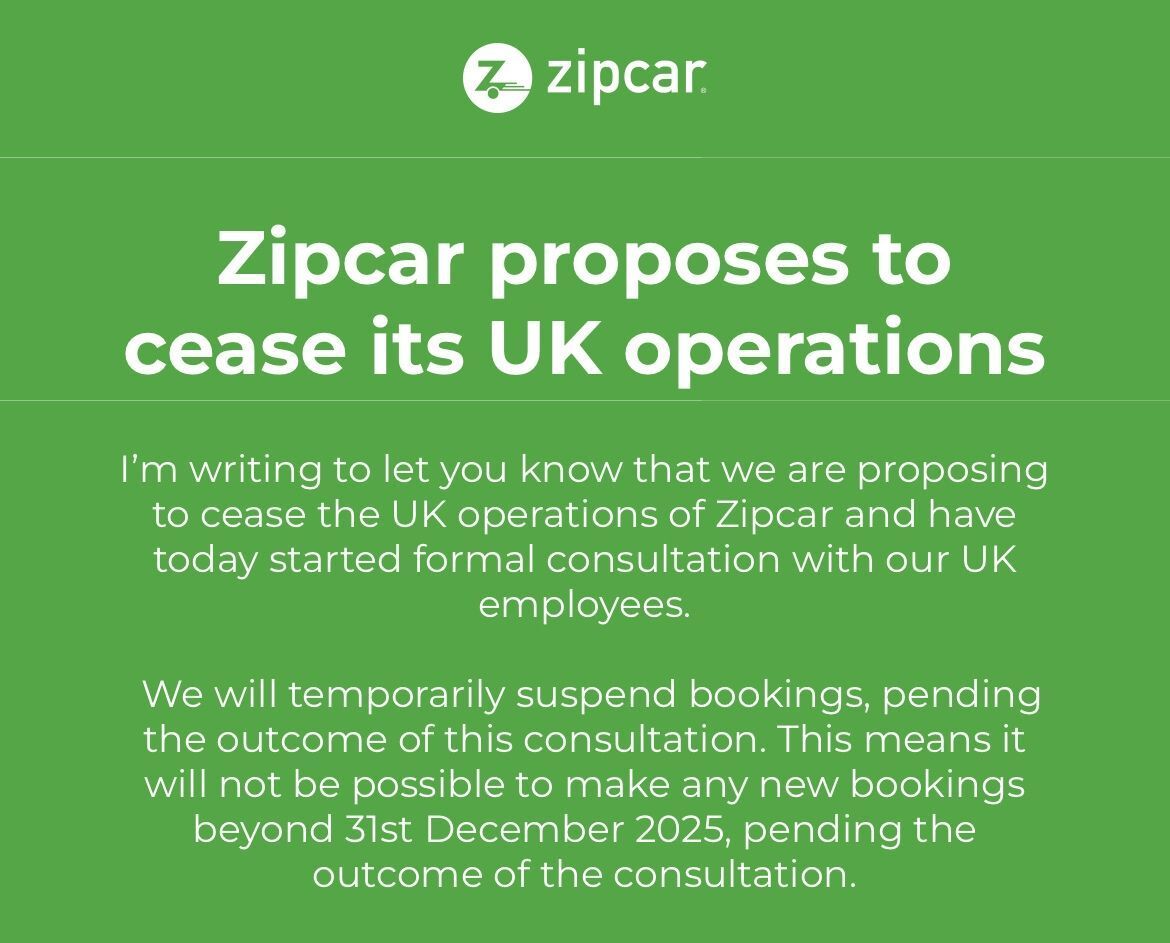

Top Story: Zipcar shuts down in the UK.

Zipcar, a part of the Avis Group and the only European location of the US-based Zipcar, is the largest car-share company in the UK, with over 3,000 vehicles across London, a third of those electric. This shutdown comes as a complete surprise, and is a negative testament for the UK car-sharing model.

Let’s unpack all the reasons Zipcar is shutting down, and why this isn’t really a surprise:

The industry’s transition to electric vehicles is costly. High UK charging costs negatively impact the financial attractiveness of EVs. Customers’ unwillingness to charge vehicles or mistakenly not charging correctly led to Zipcar’s own increased operational charging costs.

The cost of living crisis in the UK hurt demand - the number of active users stayed similar despite marketing efforts which increased membership by 12.4%; frequency of trips and average trip duration both declined.

Rising motor insurance costs - for Zipcar, 2024 costs were £6.5M, vs. £4.9M in 2023

Volatile resale value and high EV depreciation

And Starting 2026, London is introducing a change to its Congestion Charging Zone (CCZ) - from 100% car-share (club) exemption to exemptions only for vehicles that are picked up & returned to the same bay within the CCZ. That’s a big cost increase (±£10 per day) for many vehicles. That extra fee would have to be rolled over to the customer. Remember economics 101 - price goes up, demand goes down.

The CCZ increase might have been the straw that broke the camel’s back, but not necessarily THE reason. There are many reasons. Those who followed Zipcar know that 2024 revenue dropped to €47M vs. €51M in 2023 (-7.8%); that gross profit dropped from 31% in 2023 to 24% in 2024; that the company moved to operational loss in 2024; and that it spent 2024 and 2025 focusing on its London operations, closing operations in places such as Bristol, Cambridge and Oxford. Signs were there.

Goodbye Zipcar, and thanks for the cars.

Ride-Hailing & Robotaxi 🚙🚕

Bolt finds its (first) autonomous partner - Pony.ai. This isn’t Pony’s 1st partnership - which has so far partnered with the likes of Stellantis, ComfortDelGro and Uber. Details on the partnership are vague - we don’t know the OEM nor which countries this partnership includes. Expect Bolt to work with Pony in London and Eastern European markets.

Uber and WeRide launch (a) fully autonomous (b) open for public (c) commercial robotaxi operations in Abu Dhabi, starting with Yas Island, a tourist district. Up to now, since starting ride-hailing operations in December 2024, the service included safety drivers. Matching to autonomous vehicles will be done randomly when booking an UberX or Comfort, or you can book an autonomous vehicle directly via a special app category. Taxi company Tawasul manages the fleet; Geely is the OEM. This is Uber’s 1st non-US robotaxi operation.

Grab gets closer to acquiring Gojek (/GoTo): (1) SoftBank succeeded in a leadership change, with Walujo, GoTo’s CEO, stepping down and being replaced by the company's COO. Walujo has opposed the deal. (2) Indonesia’s sovereign wealth fund Danantara will retain a golden share and a minority stake in the combined entity, in what is believed to be an offering that will create the terms for establishing a >90% monopoly of the joint entity in Indonesia, and solidify control over SE Asia.

The UK government PHV (“Private Hire Vehicle”, aka minicab, or taxi) 2026 tax plans:

PHV and taxi services will be excluded (taken out) from the Tour Operators’ Margin Scheme, removing the ability for platforms such as Uber and Bolt to apply an effective ~4% VAT rate (VAT collected on margin only, not full fare)

In London, PHV services will be subject to 20% VAT on the entire passenger fare

Outside London, VAT treatment will depend on whether platforms are structured as principal or agent; where platforms operate as agents, 20% VAT is expected to apply only to the ride-hailing service fee rather than the full fare. Uber has declared it will act as an agent.

Bolt UK introduces Flex - drivers can set their own prices, and passengers can bid directly in the app, with Bolt taking a flat fee commission. Flex is now being introduced across 9 UK cities - outside of London. The bidding mechanism has proven to be successful elsewhere in the world, mostly in developing markets. This could be a way for Bolt to expand across the UK, not necessarily having to do with the new VAT regime, seeing that Uber has not bothered to change its model.

Uber back in Morocco after 7 years. Uber operated in Morocco between 2015-2018, leaving due to clashes with taxi unions and regulatory uncertainty. Since then, the likes of InDrive, Yango and local Votre Chauffeur (in which Bolt was in talks to acquire, readers welcome to update me if they are in the know) have been operating in the country, albeit still in a regulatory grey zone. To comply, Uber will work only with authorised tourist transport operators, not individual drivers.

Santa Monica officials directed Waymo, and its charging operator Voltera, to stop late-night (11pm-6am) charging at two neighborhood facilities, following months of residents’ complaints about noise. The city threatens litigation if companies do not comply. Why threaten? Because it is unclear if the companies would indeed comply. Michael Hurwitz recently raised a question of whether cities are hosts or rule setters; this case is an interesting field experiment. To be continued.

Waymo keeps expanding - this time adding additional zones in San Francisco. Waymo today has circa 2,500 vehicles - 800 to 1,000 of those in San Francisco, 700 in LA, 500 in Phoenix, 200 in Austin and 100 in Atlanta.

WeRide secures Switzerland’s first driverless robotaxi permit. It will operate in a 110-kilometer service area with 460 stops, at a maximum speed of 80 km/h. Fully driverless passenger service planned for the first half of 2026.

ComfortDelGro partners with Hello Robotaxi , by the Ant Group, on robotaxi operations. Hello is new to the AV race, announcing itself to the world in July 2025.

Tesla Autopilot accumulated over 10 billion kilometers of real-world driving experience.

DiDi reports Q3/25: revenue of $8.3 billion, $560M (or ±6.7%) of that coming from international markets; net profit of $212M, up 67% YoY.

Elmo remote drives over a 4,300km distance - driving through snowy public streets in Tallinn from Doha.

Azarel Chamorro with a map of all the self driving services in Japan.

DRT, Bus-Based Mobility & AV shuttles 🚍🚌

A video of a ride in an Ohmio shuttle by Rumika, detailing the ride itself, control centre and international footprint of the company.

BusCaro reaches 20 million rides.

Free buses - Iowa eliminated bus fares in August 2023 - results: ridership surpassed prepandemic levels by 18%; people drove 1.8 million fewer miles on city streets

Aurélien Gandois, VP of Buses at BlaBlaCar, interviews on the company's journey and future.

Car Sharing/renting 🚗

GreenMobility signs a non-binding LOI with Tensor to deploy up to 2,000 autonomous car-sharing vehicles in Denmark. Today, GreenMobility operates ~1,400 vehicles. Key takeaways:

The strategy is clear: expand the Serviceable Addressable Market (SAM) with roboshare vehicles - including privately owned cars that will be fed into the network by their owners

Better customer experience (doorstep pickup/drop-off) + lower logistics costs = a meaningfully better P&L

Denmark doesn’t yet have wide-scale autonomous regulation, so this is still intention, not reality.

Micromobility 🚲🛴

Moby launches €500k crowdfunding campaign, as part of its €2M raise. See here. Moby has 2,000 bikes and plans to use the funds to add more vehicles to its fleet. Recently, the company acquired Cargoroo, cargo-bikes.

Ryde Technology, Nordic micromobility operator present in 54 cities with 80,000 e-scooters, saw 2024 revenue increase to €47M, up 65% from €28M in 2023; profit increased X4 to €8M.

Voi a bit closer to IPO.

Lyft Urban Solutions (e-bike subsidiary) launches in Miami

Bird’s refurbishment centre in Barcelona counts its 50,000 restored scooters.

Delivery - from bikes & cars to bots & drones 🍽🧺

Uber closer to acquiring Getir - commercials are said to be agreed and a formal request has been made to the regulator.

Huuva’s mission is to deliver food to Finnish suburbs. The company partnered with Manna Drones and Wolt to run a drone delivery service.Key takeaways: much better delivery unit economics (as low as €1 from €5-6 traditional delivery); deliveries are approved by staff in Ireland.

Foodpanda partners with multiple ride-hailing firms - Tada, Bolt, and Line Go - offering ride-hailing benefits to its pandapro members in Singapore, Malaysia, and Taiwan. Wolt adds 3,000 non-restaurant stores across the territories it operates. Lalamove implements automatic goods insurance. Keeta launches in Sharjah, UAE.

AV Freight & Logistics 🚛🚜

Wabbi can now drive on both highways and “surface streets” (aka roads), enabling the first/lst mile connection from shipper facilities to customer facilities.

Felixport expands autonomous truck operations.

In other news 📰

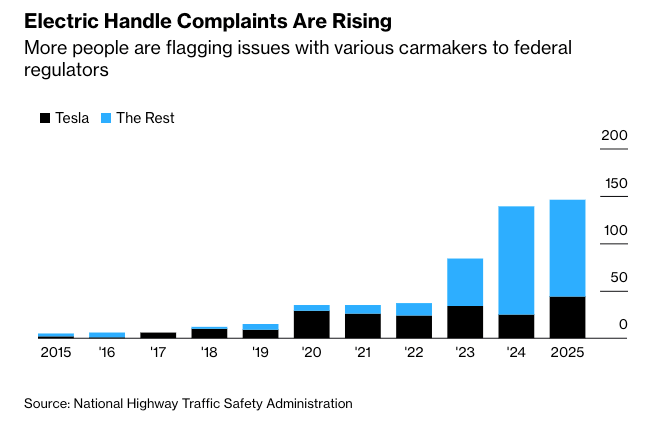

Tesla created the electric door handle. Those are extremely dangerous, with people finding themselves trapped in emergency situations. It has since been adopted by other OEMs, and has been receiving complaints. Now the NHTSA is looking into it. A Bloomberg special.

Kroger is shutting down three of Ocado’s automated fulfillment centers and is rolling back plans to open additional.

Volocopter is launching a European sandbox programme, featuring a series of flight trials simulating real-world operations. Volocopter also receives a special flight permit from the Chinese regulator.

Switch ranks Europe's capitals by mobility data maturity.

Michael Wanyama is raising £15,000 to reduce emissions in Uganda. See here.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Jawad Saleem is the new Onboarding Manager @ Cab9.

Congrats and good luck!

#movingpeople is a weekly mobility & delivery newsletter - from Ride-Hailing & Robotaxi through Remote-Driving & Delivery Drones to e-bikes and Autonomous Freight & Logistics.

Thank you for reading. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.