#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

Uber launches Uber One, its subscription service, in India. Subscription costs roughly €1.7 a month, allowing discounts, credits and access to highly rated drivers. There is also a complementary 3-month Zomato Gold membership. Meanwhile in the US, the Federal Trade Commission is investigating Uber for its subscription service - allegedly signing up people automatically and making it hard to cancel.

The Gett deal is expected to close only in Q1/25, so updates VNV. The deal, announced in May this year, has yet to be approved by the Israeli Competition Authority.

Allride is a new mobility player - a platform that combines different transportation options into a single tariff for all journeys. Once this was called B2C MaaS. The “Allride” name drew attention, as it is already used by AllRide, allride and AllRide, and was of those is suing for trademark infringement.

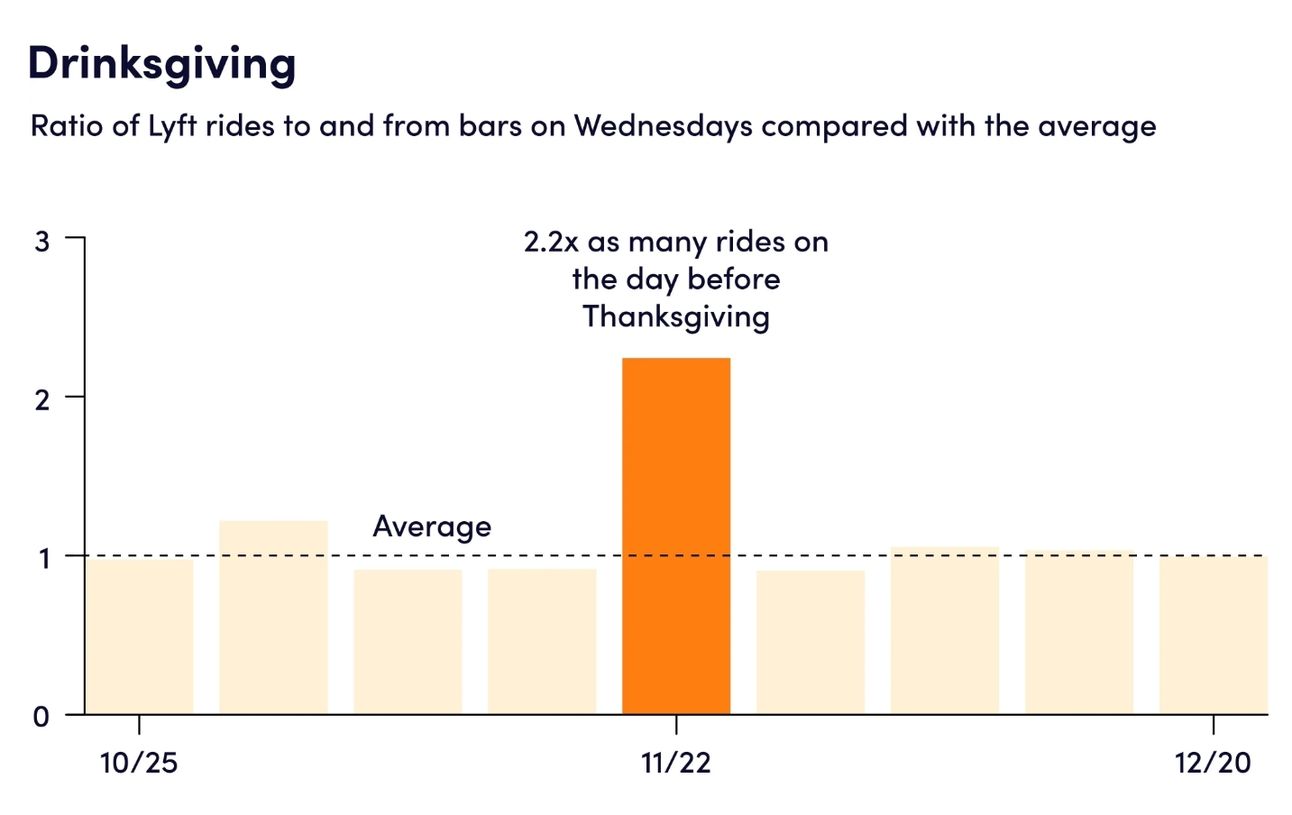

Judge orders Empower, a ride-hailing app, to immediately cease operations in Washington D.C, until the company registers with the city’s Department of For-Hire Vehicles. Shotl celebrates over 2 million passengers transported. Go-Ahead acquires coach-operator Swanbrook. In Paris, Uber and Bolt will now allow women to order women-drivers only. Lyft shares Thanksgiving bar-going data.

I hosted my 1st ever podcast - hosting Paul Comfort, Modaxo’s SVP & Chief Customer Officer. It was an interesting conversation about bouncing back from the pandemic, use of autonomy in public transport, fuels that aren't electric nor ICE, DRT/microtransit & how Uber connects to it, zero fares and the differences between "us" Europe and the US. Judge for yourself:

🇮🇹 Shared mobility landscape in Italy - a 69 page report - key takeaways:

Contraction in number of services and available vehicles between 2022 and Q1/2024. Services went from 211 in 2022 to 143 in Q1/24 while available vehicles went from 113,000 to 81,000.

While demand stays stable - both in number of rentals and distance traveled and in the sector’s total revenue - €178M annual revenue in 2023.

Casharing returned to pre-pandemic levels, with 70% EV fleet.

Bikesharing grew 12% in 2023 and is expected to grow 22% in 2024. Demand grew mostly with free-floating services, which are 62% of the total bikesharing fleet.

Scooter saw numbers reduced (Milan had to do with it) by circa 18,000 vehicles between 2022 and Q1/24, with circa 30,000 scooters available today across Italy. The number of cities offering shared scooters dropped from 47 to 35.

Car Sharing/renting 🚗

Cabify added rental vehicles business activity to their corporate purpose listing. Today Cabify operates rentals via partnership with Wible, a Madrid per-minute based scheme, and in the past had a partnership with day/month rental company Bipi. To be continued.

On the basis of Wible, Kia rebrands as Kia Drive, working also in partnership with dealerships on car sharing/rental. The Wible brand will remain in Madrid.

Renault Group, We Drive Solar and MyWheels partner with the city of Utrecht to launch Europe’s first V2G enabled car-sharing service. 500 vehicles are to be deployed in the city. Analysis on Volvo-On-Demand’s shut down. New car-sharing scheme in Chelsea, Quebec. Socar launches a B2B solution. HOURCAR and Xcel Energy launch an electric shared mobility hub in Minneapolis.

Micromobility 🚲🛴

London implements tougher regulation on e-bike parking - now limited to designated zones only. Scotland to begin an e-scooter trial 'within next nine months'. BIXI, operating Montreal’s and nearby cities bike-share scheme, reaches a record of over 13 million rides in 2024, up 15% YoY. In Turku, Finland, Voi, Tier and Ryde are asking the city council to keep scooters in streets in Winter, on regularly maintained roads. TBD.

Delivery 🍽🧺

Zomato raises $1 billion from Indian institutional investors. The move allows Zomato to be registered as a “domestic” company (now under 50% foreign ownership), in turn allowing Blinkit to adopt an inventory-led model.

Zepto raises (another) $350M, which is now a total of over $1.35 billion since June. Foreign ownership currently exceeds two-thirds, and this round was focused on Indian investors. The Quick-commerce market in India is booming, and Zepto is collecting funds to be able to fight back Blinkit (by Zomato), Instamart (by Swiggy) and BigBasket.

JustEat Takeaway to delist from the London stock exchange, in a cost cutting move. The company expects to complete the delisting by the end of the year, and will trade only in Amsterdam.

Yandex Uzbekistan launches a rapid delivery service with its own dark kitchens. DoorDash adds more groceries into the platform.

Autonomous & remote-driving 🤖℡

Augustin Friedel gives us this beautiful image - Europe is non-existent in the AV deployment stage.

Apollo Go, Baidu’s AV division, says that in China in Q3/24 - it provided 988,000 rides - and that cumulative public rides reached 8 million in October. The company has just received a licence to test autonomous vehicles in Hong Kong, venturing outside of mainland China for the 1st time.

Tesla is (seemingly) building a teleoperation team. This would make perfect sense, as Musk’s ambitions to ASAP launch a robotaxi service do not align with the maturity of Tesla’s technology. Then again, Musk has been bullish on using only tech to operator robotaxis, so probably a lot depends on how the federal regulations will be structured. Also, Tesla brings ‘Actually Smart Summon’ to Europe and Middle East.

Holon shares a presentation - the company is calling regulators to harmonise regulation and to ease procurement processes, fund large scale projects (150-200 vehicles) and work on societal acceptance.

Ush received a permit to operate autonomously on public roads. This is the first ever pilot in Belgium. On Singapore and autonomous deployment. Mobileye publishes a scientific paper on the safety of autonomous vehicles. To the paper. A Bloomberg piece on autonomous vehicles.

You might have seen the story about Uber wanting to invest $10M in Pony.ai’s IPO. So just to put things in perspective - Pony.ai started trading last week at a $5.25 billion valuation - so 10M would be 0.19%. That’s it.

The Global Decarbonization Expo, taking place in March in Paris, is the first international event that focuses on the adoption of sustainable energy saving and management systems within the framework of commercial operations. The event focuses on (1) Battery energy storage systems (B.E.S.S), (2) Autonomous Vehicles, (3) Electric Vehicles and (4) Photovoltaic energy. As part of the event, a summit for 150 top executives will be held at the La Poste headquarters in Paris. To join the biggest decarbonisation conference in Europe, please reach out to François Hoehlinger, also via [email protected].

Flying cars 🚁

Vertical Aerospace raises $50M from Mudrick Capital, in a round that will also involve conversion of circa $130M of debt into equity. Conversion will be done at $3.5 per share, lower than the circa $4.8 trading price on November 22nd (makes sense) and also lower than the $10 per share invested by founder Fitzpatrick in March this year. This finding allows Vertical more time to develop its new model, the VX4.

OEMs 🛺⚡️

Stellantis CEO steps down “due to differences with the board and in the face of disappointing sales”. This was expected, with Stellantis struggling with sales lately, but indeed up rather abruptly.

Tesla and Rivian reach a ‘conditional’ settlement in their trade secret lawsuit; Tesla sued Rivian for allegedly poaching employees and stealing trade secrets. Rivian “conditionally" approved for a $6.6 billion loan from the US government, to build a factory in Georgia, US. Production expected in 2028. Lotus embraces EREV hybrids as it axes all-electric plans.

Gig economy 💰

Uber and Lyft drivers say Waymo's robotaxis are hurting their earnings in Phoenix and LA, as Waymo now provides more than 150,000 paid rides weekly in Los Angeles, San Francisco, and Phoenix.

In other news 📰

The story of Nebius - which includes Avride.

Trump is expected to kill the $7,500 Biden EV tax credit and California’s Governor Gavin Newsom is getting ready to implement a similar scheme of his own - which actually operated between 2010 to 2023. Tesla’s popular vehicles might be excluded, as the scheme has market-share limitations. Elon Musk calls this “insane”. To be continued.

Pickle Robot, robots to unload cargo from trucks, trailers and containers, raises $50M.

Inversion, a precision delivery on-demand company from space to anywhere on Earth, raises $44M.

KeySavvy, vehicle payment platform, raises $4.25M.

New tram-like electric buses in London, using supercapacitor technology - charging for 15 miles / 24 km in 6 minutes. This brings back memories - I used to import such vehicles back in 2019 🙂.

I love meeting new people, learning about innovation in mobility innovation and exchanging opinions. Let’s get-to-know / catch-up.

People 🧑🤝🧑

Dylan Jouliot, MURP is the new City Parking System Expert @ Spokane Transportation Commission.

Florian Brunsting is the new Business Development / GTM Director BESS @ Sympower.

Glenn Lyons is a new Member of the Capital Review Panel @ Department for Transport (DfT), United Kingdom.

Graeme Dickson is the new Senior Partnerships Manager @ Snapper.

Jon Salmon is the new Chief Revenue Officer @ Snapper.

Mikko Ampuja is the new Vice chair - Leasing work group @ Cycling Industries Europe.

Seth Hochhauser is the new Chief Revenue Officer @ Autofleet.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too. The “Share” button is to your left, under the heart. Thank you.