#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth. Get in touch to see how we can support your growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

The taxi gates have been opened. Uber Taiwan acquires Crown Taxi, a local taxi company. My analysis: Supply, not demand, has been the focus of ride-hailing companies for a while now. From investing in vehicle financing (Moove) to acquiring dispatch software (Autocab) to drivers’ incentives (UK pension scheme) or enhancing taxi partnerships (Curb, Arro), Uber, as its competitors, has been active in the supply space. Uber is now also vertically integrating - acquiring taxi companies. It started in Denmark with Dantaxi 🇩🇰, and now in Taiwan 🇹🇼. Expect more acquisitions, in markets without a gig economy.

Bolt is going global In North America, Bolt made first steps back in February, launching the Hopp brand in Canada. Why Hopp and not Bolt? Because of “Bolt Mobility”, the bankrupt scooter company. Now Hopp is going full speed on the Americas. Bolt also expands to New Zealand, taking on Uber and DiDi. This has been six months in the making. My analysis: Bolt is successfully building itself to be the #2 global operators. IPO should come soon.

The Grab-GoTo (Gojek) $7 billion merger is getting closer. Indonesian Antitrust regulators are on-guard, but a solution could come from Danantara, an Indonesian sovereign wealth fund, launched in February. A proposed deal will see Danantara acquiring a minority stake in the combined entity. Meanwhile, Grab keeps denying the acquisition, but then why issue a $1.5 billion convertible note?

The Gett deal is alive again, in a slightly different format. Pango, who recently backed out of the acquisition due to antitrust issues, partners with Leumi Partners (Leumi is one of the two biggest Israeli banks) and other investors, who are now offering $190M for Gett, up from the previous $175M offer. This structure is expected to pass the anti competition authority. TBC.

Read an interview with Arsen Tomsky, InDrive’s founder/CEO, on his vision of becoming a super-app: offering ride-hailing, deliveries and financial products. We also learn from the interview: InDrive is testing algorithm pricing (and not bid pricing); examining the dark store model; exited Miami due to high costs; expects to be net profitable this year.

Also InDrive implements a new P2P payment feature in 🇧🇷Brazil, enabling real-time direct payment to drivers and couriers, not by cash or credit, but between banks. InDrive 🇳🇬Nigeria implements a feature which requires sender’s approval for couriers asking to cancel jobs. inDrive opens an office in Kathmandu, 🇳🇵Nepal. inDrive Yucatán, 🇲🇽Mexico, receives official certification to operate legally.

FREENOW launches in Coventry, UK, and in Regensburg, Germany. Is FREENOW’s strategy to go deeper into Tier 2 and 3 cities?

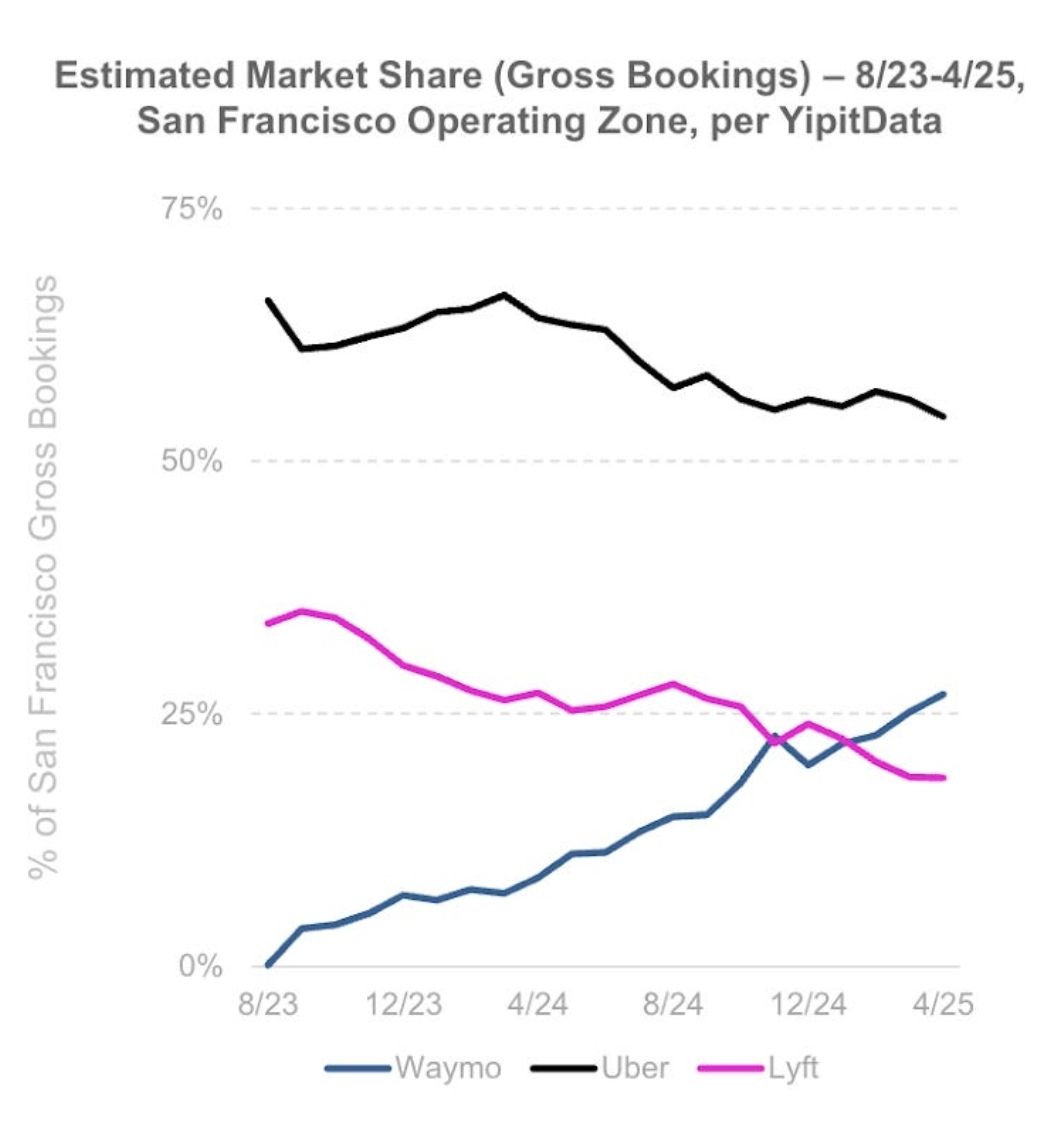

Just what is Waymo’s market share in San Francisco? According to YipitData, more than Lyft’s and on track to surpass Uber.

This data is true for trips originating and ending in Waymo’s operating zone. So not yet surpassing Lyft altogether in SF.

It is not clear why Lyft has been more affected than Uber.

YipitData

Data by Obi (see full report) tells the story of pricing - Waymo costs considerably more than Uber and Lyft, at peak hours costing an average of $11 more than Lyft. My take: since basic economics tells us that people would pay the lowest price for a similar service, one must conclude that these are not similar services. A survey Obi performed found that “for users that had taken a Waymo ride, a whopping 70% said they preferred a driverless car to a traditional rideshare or taxi with a driver”. I advise you to read the full report for many more insights.

Obi

Lyft launches new ad formats, from full map sponsor takeover to subsidising rides to videos. In addition, Lyft closed deals with IAS and DoubleVerify to verify media quality. Lyft is on track to close $100M annualised ad revenue run rate by year's end.

Uber launches elderly.senior account - a few weeks after Lyft did. In Uber’s case, it enables a better UI experience for seniors, and also allows users to add seniors to their family account, similar to the way you add your child into the teen account. Unlike Lyft, Uber doesn’t have more accessible vehicles and a human-manned customer service centre to add to the senior offer.

Uber vs. Lyft - different pricing strategies.

DiDi publishes Q1/25 figures - takeaways:

Revenue up 8.5% QoQ to ±$7.4 billion (53.3 billion yuan)

Net income of $334M (2.4 billion yuan) vs. a loss in Q1/24

Revenue from international operations (mostly via 99) rose to 3 billion yuan from 2.4 billion yuan a year earlier

Grab is entering the motor insurance market in Singapore. The company received its insurance license back in December 2024, and is actively recruiting for the new arm. Gojek partners with Vietnam’s taxi operator Green SM to utilise Green SM’s electric fleet. FixuTaxi - part of Cabonline - wins the Helsinki Central Station contract (together with another company). Ola introduces a zero-commission (subscription) model, in order to level competition with Rapido and Namma Yatri. flexdrive is a Lyft subsidiary, a fleet management company, managing 14,000 cars with a >90% utilisation rate. flexdrive is also the backbone on which autonomous vehicles would be managed. See video.

BusUp 20 million rides since 2017. Today the company has close to 1 million rides a month. Chalo raised $6.1M (INR 53 Cr) from founders and existing investors. The Routing Company partners with Sarah Car Care (SCC) in Washington D.C. to launch an on-demand transit service. In Gloucestershire, UK, Padam is launching a new DRT service. Roger French finds the Port Solent - Padam service to be a good one.

This week I will be attending UITP on Monday the 16th; the ITS UK Parliamentary Reception on the 17th; and MOVE on Wednesday-Thursday (18-19th). DM me on LinkedIn or ping an email on [email protected] if you’d like to catch-up / get-to-know.

Car Sharing/renting 🚗

Ukrainian car-sharing GeyMyCar expands to Germany and Romania. Free2move, Fiat 500e, and Ample introduce battery swapping in Madrid. MyWheels integrates V2G technology into its fleet, with 500 grid-connectable Renault EVs. This would be the largest V2G car-sharing scheme in Europe. Turo expands operations into the Yukon. Zevo is a P2P all-electric car-share platform, with $8M ARR. Bootstrapped.

According to Berg Insight, the global car sharing fleet amounts to 494,000 cars, and is expected to grow at 8.9% CAGR, reaching 755,000 cars by 2029.

Berg Insight

Micromobility 🚲🛴

Voi, Dott and Lime win the Paric e-bike tender. Each company will deploy between 3,000 and 6,000 e-bikes, with up to 7,500 during peak season. While Dott and Lime are incumbents, this is a new city win for Voi.

Lime and Uber renew multi year agreement that allows Uber to continue to feature Lime’s shared bikes and scooters on its app. Lime will also be included in the Uber One subscription membership. Uber has a 29% stake in Lime.

Also Lime hits 1 million rides a day milestone. Lime to add 200 new units of LimeBike, its newest e-bike mode, in Baltimore and in Charlotte (each 200). The city of Moscow signs with Spin. Moscow, Idaho, that is. The City of Pensacola, Florida, is considering ending Veo’s contract due to safety concerns.

Lyft introduces new fleet.

The Mayor of New York demanded that Lyft limit their Citi Bike e-bike speed to 15 mph (25 km/h). Lyft - a bit reluctantly - will comply. The current top speed is a whooping 18 mph (29 km/h).

Dott partners with Standab to use its charging racks. “The Standab charging racks are compatible with the different e-bike and e-scooter models… Deployed at highly frequented locations, they increase the efficiency of operations and reduce the costs for battery swapping operations, while at the same time the user-friendly infrastructure ensures clean and orderly parking in these dense areas.”

Umob integrates Dott into its offering.

Delivery 🍽🧺

Busy times at DoorDash. Completes acquisition of SevenRooms and in the process of acquiring Deliveroo; closed a $2.75 billion convertible notes offering; completes and a new $175M acquisition - of Symbioysis, an ad-tech company specialising in digital ads for retail brands; and faces a competition authority legal action over “allegedly advertising misleading prices and discounts” in Canada.

Delivery Hero (€223) & Glovo (€105.7) hit with a €329M fine from EU regulators for taking part in a cartel which included an agreement not to poach each other's employees, lasting between 2018 to July 2022, at which stage Delivery Hero reached 94% stake in Glovo. The companies admitted wrongdoing in exchange for a 10% cut in their fines. Also Delivery hero hits 11 million orders a day milestone.

Rapido’s entrance into the Indian food delivery market starts in Bengaluru. Rapido will charge restaurants a flat fee rather than the ‘standard’ percentage commission model; and will be cheaper in total. Will Rapido break the Zomato-Swiggy duopoly? Past attempts by Amazon and Ola failed to scale due to limited restaurant selection, fragmented supply, and weak customer experience. To be continued.

DiDi starts food delivery pilot operations in Goiânia, Brazil, via the 99 brand (ahead of Meituan). Wolt live in Bulgaria, the company’s 32nd country.

Wonder drops delivery fee for premium members. Grubhub is launching Multi-Store Ordering - one delivery fee, multiple restaurants and retailers in one order. Zomato launched an EV rental bike fleet in Delhi, introducing 300 bikes.

🛸Drone delivery corner

Wing partners with Walmart to roll out drone deliveries to over 100 Walmart stores across selected markets in Atlanta, Charlotte, Houston, Orlando and Tampa. In the background, the US government accelerates BVLOS operations.

Manna begins drone deliveries with Deliveroo, in a Dublin outer suburb, right outside the M50, an area already operated by Manna. Customers within the 3km trial zone will be required to select a drop-off spot for grocery and delivery items not exceeding 4kg. To date, Manna has completed over 200,000 deliveries.

Meituan (Keeta) launches first drone delivery route in Hong Kong, in a regulatory sandbox area. Meituan to expand drone delivery service in Dubai

🤖 Delivery bot corner

RIVR, autonomous delivery bot (dog), partners with Veho, delivery platform, to launch operations in Austin. The plan is to have both Veho and RIVR doing deliveries in parallel from one truck, to increase efficiency. RIVR unique design helps the bot overcome challenges such as steps or uneven terrain; for the pilot the bots will be escorted by a RIVR employee.

Amazon is reportedly training humanoid robots to deliver packages.

Coco Robotics raises $80M - which includes undisclosed funding events from 2021 to 2025.

I love meeting new people and learning about innovation. Let’s get-to-know.

Autonomous & remote-driving 🤖℡

The UK government is fast-tracking commercial autonomous pilots; Wayve and Uber partner to launch robotaxi service in the (expected) Spring of 2026. We don’t know much more, for example when will the pilots begin, where in Greater London, with which vehicles etc.

AV startup Plus Automation to go public via SPAC in a $1.2 billion deal. Plus will receive $300M to launch autonomous trucks in 2027. The company has Huyndai and Iveco as clients.

Pony.ai partners with Xihu Group, taxi operator, to deploy over 1,000 robotaxis in Shenzhen “in the coming years”.

WeRide to expand to Saudi Arabia. Zoox signs with Resorts World Las Vegas as its “official robotaxi partner”. Lyft and May Mobility get ready to launch in Atlanta, begin testing. The cars have names.

The good and the bad: Waymo knows to stop for people and dogs (video). Waymo blocks emergency vehicles (video) and drives straight into a huge puddle.

Waiting for Tesla robotaxis - June 22nd. One was spotted driving around a few days ago. For now Tesla is trying to register trademarks.

Hyundai appoints Motional with a new CEO - Laura Major - who has been the company’s CTO since formation in 2020 and the interim CEO since September. Motional targets commercial robotaxi services in 2026.

Can robotaxis reach profitability?

Goldman Sachs

Flying cars 🚁

On May 20th a short seller report on Archer acquired the company for misleading investors. Now Archer raises, by selling shares at $10 per share, raising a total of $850M, on the back of a White House announcement on accelerating deployment of eVTOLS. This brings total all time funding to $2.8 billion. Also Archer begins ‘Midnight’ piloted operations.

Joby signs MOU with Saudi Arabian conglomerate Abdul Latif Jameel (ALJ) to distribute up to 200 aircrafts. This is the 1st distribution partnership Joby is signing. ALJ is a Toyota distributor and participated in Joby’s Toyota-led series C.

Wisk acquires SkyGrid, a 3rd party service provider, strengthening its autonomous capabilities.

OEMs 🛺⚡️

Ola Electric - Hyundai sold all its stake (2.47%) and Kia reduced its holdings (to under 1%), in a combined $80M stock sale. Ola is facing competition and regulatory pressure, and experiencing slower sales. The stock has dropped 46% since going public in August 2024. The founder/CEO of Ola paid ±$2.3M in cash to increase collateral for borrowing against shares.

Gig economy 💰

DoorDash, Grubhub and Uber Eats settle lawsuits against New York City over minimum wages and fee caps. Those were created temporarily during the pandemic, but became permanent. The settlement is expected to turn into a new law.

Getir and Vigo delivery workers in Istanbul strike against major pay cuts, demanding protections. Kakao union initiates first strike amid failed labor negotiations with Kakao Mobility.

In other news 📰

Uber partners with Gemini Trains to launch “a 2nd Eurostar” - high speed rail from London Stratford to Paris and Brussels. Gemini does the ops, Uber the customer generation and has the branding.

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Alex Zelubowski is the new UK Lead, Autonomous Mobility & Delivery @ Uber.

Alistair Harvey is the new Process Engineer @ Relay Technologies.

Carl Bayliss is the new President, Aston Martin APAC & China @ Aston Martin Lagonda Ltd.

Florent Roulet is now the Managing Director, Technology Investment Banking @ Stifel Financial Corp.

Kushal Rajveer is the new Head of Strategy, Growth & Markets, APAC @ HERE Technologies.

Marc Riccio is the new Vice President of Strategic Partnerships @ Highland Electric Fleets.

Ruby Budd is the new Partner Success Principal, France & Switzerland @ Via.

Richard De Veer is the new Director Corporate Solutions (a.i.) @ Just Eat Takeaway.com

Saurabh Kabra is the new Senior Director - Head of Non Endemic Monetization @ Zepto.

Sigfried RJ Eisenmeier is the new Director of Public Policy, External Affairs @ DiDi.

Shantanu Sharma is the new Senior Manager 2 Legal, Policy and Corporate Affairs @ Rapido

Tim Rossanis is promoted to Senior Vice President, Turo US at Turo.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.