#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

The On-Demand Transit (DRT/microtransit) 2024 market report by Lukas Foljanty.

A record year with over 390 new projects launched

The US (±120 new projects), Japan (±100) and South Korea (±50) lead

WW there are 1,300 active projects (which means that 2024 contributes ±30% of all active projects!)

Europe contributed 100 new projects, but also saw many discontinuation of projects due to lack of government (central and local) funding. Is this the future for other countries as well, especially the US which is likely to see public transport budget cuts? Note that “86% of the new services launched in 2024 were initiated and funded by the public sector”.

Tech suppliers: Via is still firmly in the lead with 24% market share, followed by Spare and Padam. South Korean and Japanese players entered the top 10.

For the full report and many more excellent insights from Lukas.

Lyft partners with Mobileye and Marubeni Corporation to launch robotaxis in the US, starting in Dallas. My takeaways:

There are 3 main functions to running robotaxi operations: (a) AV tech stack, (b) customer management & booking app; (c) fleet management. In Austin, Uber does b+c while Waymo does the tech stack (a). In Phoenix, Waymo is responsible for a+b and Moove does fleet management (c). With Lyft, each company does its part.

Who isn't on the list? The OEM. They get brand diluted. To be fiercely continued.

Texas is replacing California as the hub for robotaxi and drone solutions: Waymo in cars; Aurora, Torc Robotics & Gatik in trucking; Avride, Nuro & Clevon in delivery bots; Amazon & Wing in delivery drones (& more). Tesla is also expected to launch its own robotaxi operations in the state soon.

Marubeni is a Japanese corporation. It is a safe bet that Lyft will find its way to Japan with the same partners.

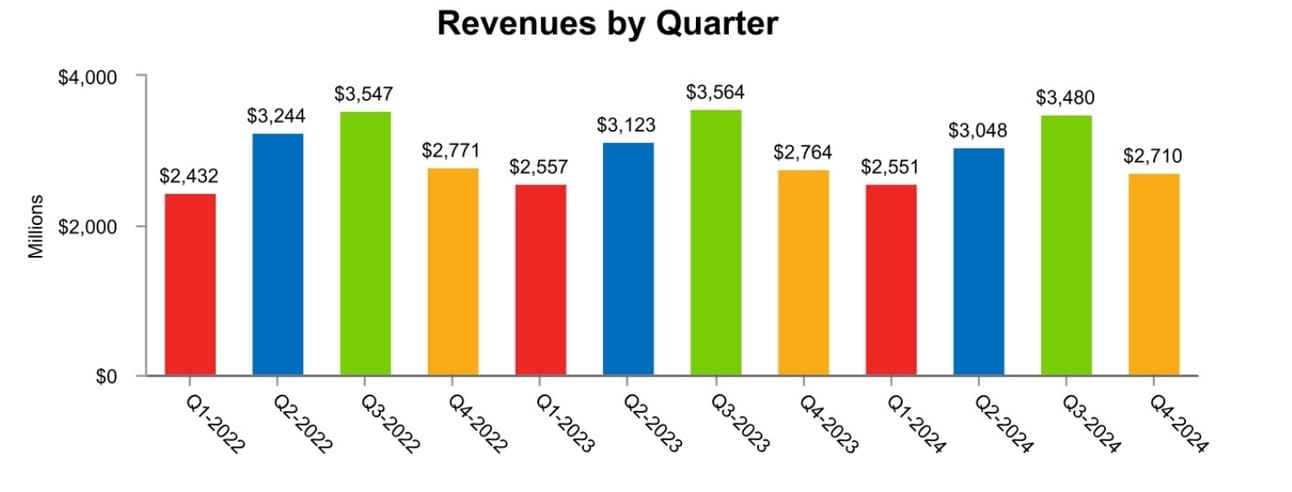

Lyft is profitable

Rides grew 17% to 828 million

Gross bookings up 17% YoY of $16.1 billion

Revenue up 31% to $5.8 billion

Net income of $22.8M vs. a net loss of $(340.3M) in 2023

Free cash flow of $766.3M vs. $(248.1M) in 2023

The market wasn’t happy with Lyft’s Q1/25 outlook, and sent the stock down.

Google Fina

Bolt to launch ride-hailing services in Canada, under the “Hopp” brand name, starting with Greater Toronto. Remember that a company named Bolt Mobility shut down in 2022, so Bolt isn’t such a good brand name in North America. Bolt/Hopp is currently recruiting drivers. Earlier this month the company won its first city micromobility contract, starting in Washington D.C.

Lalamove enters ride-hailing in the Philippines, expanding from existing delivery services. Lalamove is offering lower fares and a 2% driver commission rate. Industry leaders such as Grab, JoyRide and PickUp take a commission of at least 20%; Indrive takes 9.99%.

Revel secured a $60M loan from New York; funds will be used to accelerate roll-out of its fast-charging network in the city, with 267 new charging stalls across nine sites expected by 2027.

InDrive launches in-app bus ticket sales in Brazil. This move brings InDrive closer to super-app status. InDrive will offer 5,000 routes operated by more than 200 companies; interestingly, the PR did not mention who the ticketing partner is.

Jump (by Taxiworld, by Patons) is a new London Black Cab app - offering 0% commission for taxi drivers. Taxiworld specialises in payment systems, meters and cameras for the taxi trade. Jump’s revenue model is unclear from the website - in most cases there is a subscription payment attached to a % commission offer. TBC.

Solent Transport and Trafi extend the contract to run the Breeze MaaS service in the region. Rapido announced its intention to launch Bike Pink, a by-women for-women bike taxi service in Karnataka, India, this year. InDrive Nepal launches accidental insurance for drivers and passengers. Wayla partners with Terravision to get people from Milan to the airport. SWVL raises $2M in private placement; funds will be used for working capital and expanding presence in the US (?). FREENOW and Taxi Zentrale Erlangen partner. Yango Pakistan partners with Elixs Bikes to introduce EV bikes for partner’s drivers. Nemi launches six more Electric services in Spain, bringing the total to seven electric services. The Routing Company launches a new on-demand transit pilot in Southern California.

Zeelo’s impact report 2024 - key takeaways:

5.9 million rides. Taking over 5 million cars off the road.

20,500 EV trips.

Over 80k unique riders, allowing more people access to employment. 53,490 riders would not have been able to reach work without Zeelo’s commute solution

Business model analysis by Harry Campbell (Rideshare guy) - Uber vs. Waymo head to head. Waymo has a superior product, but Uber’s scale and flexibility are equally important. How will we see AV tech stacks and ride-hailing companies compete/complement each other?

Car Sharing/renting 🚗

Getaround is shutting down its US operations (inc. HyreCar) to focus on its European operations in Norway, Spain, France, Germany, Belgium and Austria. US users had only a few days to return vehicles, at which point insurance was no longer available to them. Over the years Getaround raised over $760M and was at peak valued at $1.2 billion; market cap today is circa $1.2 - million. Is the P2P model broken or is down to (old) management underperforming and Turo dominating the market?

Turo is withdrawing its plans to IPO. The company is active in the US, Canada, Australia, and France, and as of September 2024 had 150k active hosts, 350k active vehicle listings and 3.5M active guests. I analysed Turo’s 2023 prospectus - the company made $14.7M in net profits that year - numbers probably haven’t materially improved enough to justify an IPO.

FINN raised €1 billion in asset-backed security financing (debt). Funds will be used to acquire new vehicles (over the 25k existing today), expand in Germany and throughout Europe. FINN is a "car subscription" player, bringing more flexibility and covering more of the hassle related to car ownership. An "upgraded" version of existing traditional leasing and rental.

Zoomcar reports Q3/24 results - key takeaways:

Bookings up by 19% YoY to 103,599

Active cars increased 24% to 7,247 cars

Revenue for the Q 2.45M (up 1%); adjusted EBITDA minus $3.15M

Guest trip ratings increased in the Q from 4.16 to 4.7

While these numbers are still troubling (loss is greater than revenue) it is an improvement YoY compared, and the stock rose.

Google Finance

Avis (includes Budget, Zipcar and Payless brands) reports 2024 Financial Report - key takeaways:

Revenue down 2% to $11.8 billion

Leisure brought in 65% of revenue; commercial 35%

Airport activities are 67% of total revenue. This number illustrates how much travel has an effect of car rental companies

Avis is 57% of the group's revenue; Budget 36% and other (inc. Zipcar) 6%

Adjusted EBITDA $628M

Net loss $1.8 billion

Cash flow loss of $47M

Understanding Avis numbers is a complicated matter (For the full report) - the point I want to make is: even with incredible scale - profits don’t come easy in this industry. TBC.

Micromobility 🚲🛴

Hoppy, Belgium, finished 2024 with €6M in revenue, €2.2M EBITDA and €1M net profit. Hoppy operates 5,000 vehicles across 17 cities in Belgium, Greece, Gibraltar and Spain; 270k users take 1.5 million rides (simple average of €4 revenue per ride); and its fleet comprises e-scooter, e and mechanical bikes, e-mopeds and golf carts. TThe CEO attributes profitability to growing financially sustainably, focusing on station-based operations, keeping HQ lean and depreciating over “only” a four year period.

Trippy Mobility, Turkey, raises undisclosed sum to expand in Europe. Tripy currently operates its fleet of 4,000 e-bikes across Izmir, Sakarya and Eskişehir, and has 70 electric vehicle charging stations across seven cities.

Lime made $90M in EBITDA by switching to swappable batteries; using ML to predict demand and potential revenue; improving fleet’s durability; and more from this podcast with Wayne Ting, Lime’s CEO, inc. how Uber saved the company.

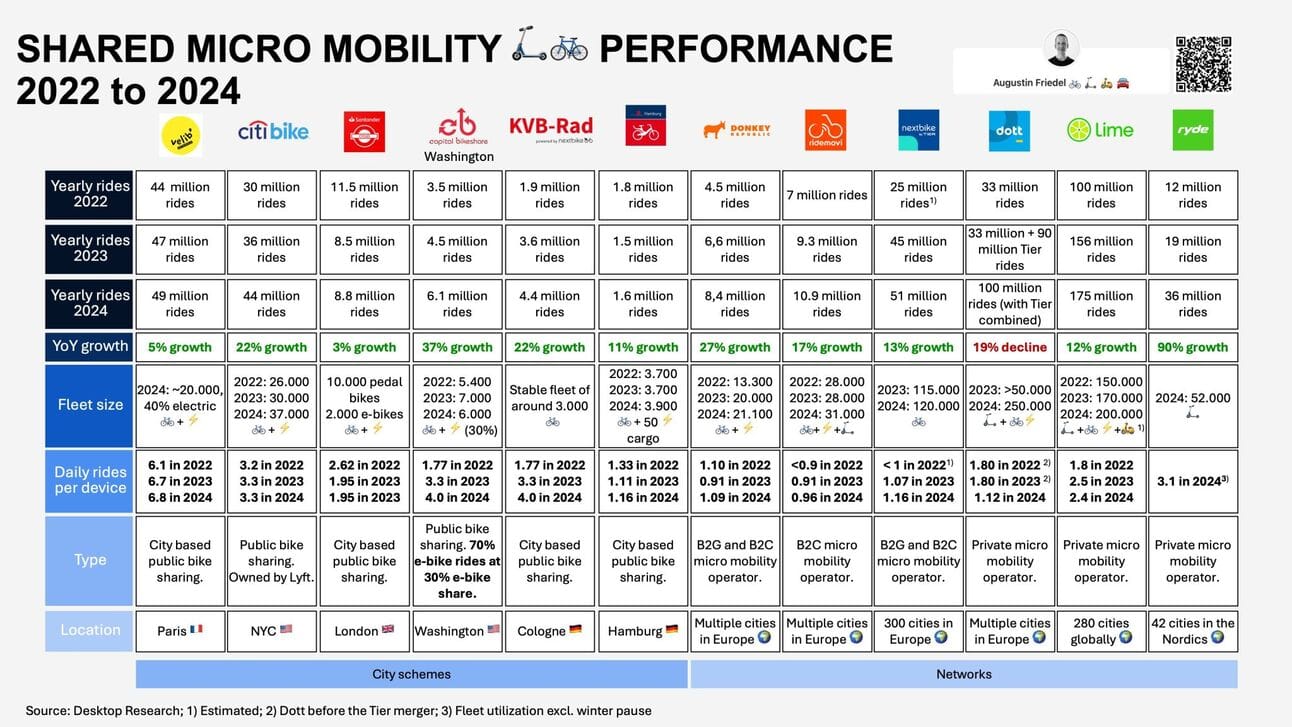

Shared micromobility performance, 2022 to 2024, by Augustin Friedel. In one word: growth.

Delivery 🍽🧺

Delivery Hero 2024 results:

GMV €49 billion (+8.3% YoY)

Revenue €12.8 billion (+23%) - that is a ±26.2% revenue margin

Adj. EBITDA ~€750M (+200%)

Positive cash flow

Growing in 9 out of 12 countries

Doordash 2024 financial results - we look at Q4/24 (only!)

685 million orders (+19% YoY)

GOV $21.3 billion (+21%)

Revenue $2.9 billion (+25%)

Net Revenue Margin increased to 13.5% from 13.1% in Q4 2023

Avride launches delivery bots in Jersey City, partnering with Uber Eats. The two launched similar schemes together in Austin and Dallas. A one square mile area in downtown and a handful of restaurants have been chosen for the launch.

Zomato has a new identity - the company changed its name to Eternal. The brand Zomato remains, the change is to highlight the difference between Zomato (restaurant delivery) and other services within the company: Blinkit (q-delivery), District (movies and events) & Hyperpure (grocery and vegetables to restaurants) and the company itself.

Swiggy might be increasing its commission by 2% (percentage points). “Might be” - because an email stating the increase has been sent - but it is unclear if this is across the entire board. This comes a few days after Swiggy’s Q3 report of widening losses.

Deliveroo’s founder/CEO Will Shu will or will not step down. Shu has 6% of Deliveroo, making him the 3rd largest shareholder. The COO is also said to be leaving.

Bolt Food expanded in the Ukraine in 2024, from 6 to 26 cities.

Uber sues DoorDash for (alleged) anti-competitive tactics; using DorrDash’s power to block restaurants from working with Uber, specifically on “first party delivery services”, i.e. handling deliveries from orders coming in the restaurant’s own websites.

I love meeting new people and learning about innovation. Let’s get-to-know.

Autonomous & remote-driving 🤖℡

Ush and Poppy – subsidiaries of D’Ieteren - partnered with Vay to roll out Belgium’s first commercial remote-driven car service - delivering rental cars around the Port of Antwerp-Bruges. Poppy is the car-share service; Ush operates the teledriving; and Vay supplies the tech. Phase 1 will see initial two car deployment on a defined route, safety driver included. By the end of 2025, there should be full scale deployment in the port, without a safety driver. Ush plans on commercial operations in Antwerp in 2026.

BYD to offer ‘God’s Eye’ self-driving system on all models. The system, developed internally by BYD’s R&D team, will enable advanced ADAS capabilities up to autonomous (more here) driving and parking. This is a major announcement, further positioning BYD as a leading global player. I expect a slew of autonomous partnership announcement from Western OEMs and AV tech providers in the coming week to combat this development. May Mobility launches 1st driverless commercial ride-hail service. The service, in Georgia, US, is using Via’s booking tool and a Toyota Sienna vehicle .

A Cybertruck crashes into a pole while on FSD. A day later, it was close to colliding with another vehicle. Do expect Tesla’s robotaxis in the summer in Texas.

Jonathan Challinger

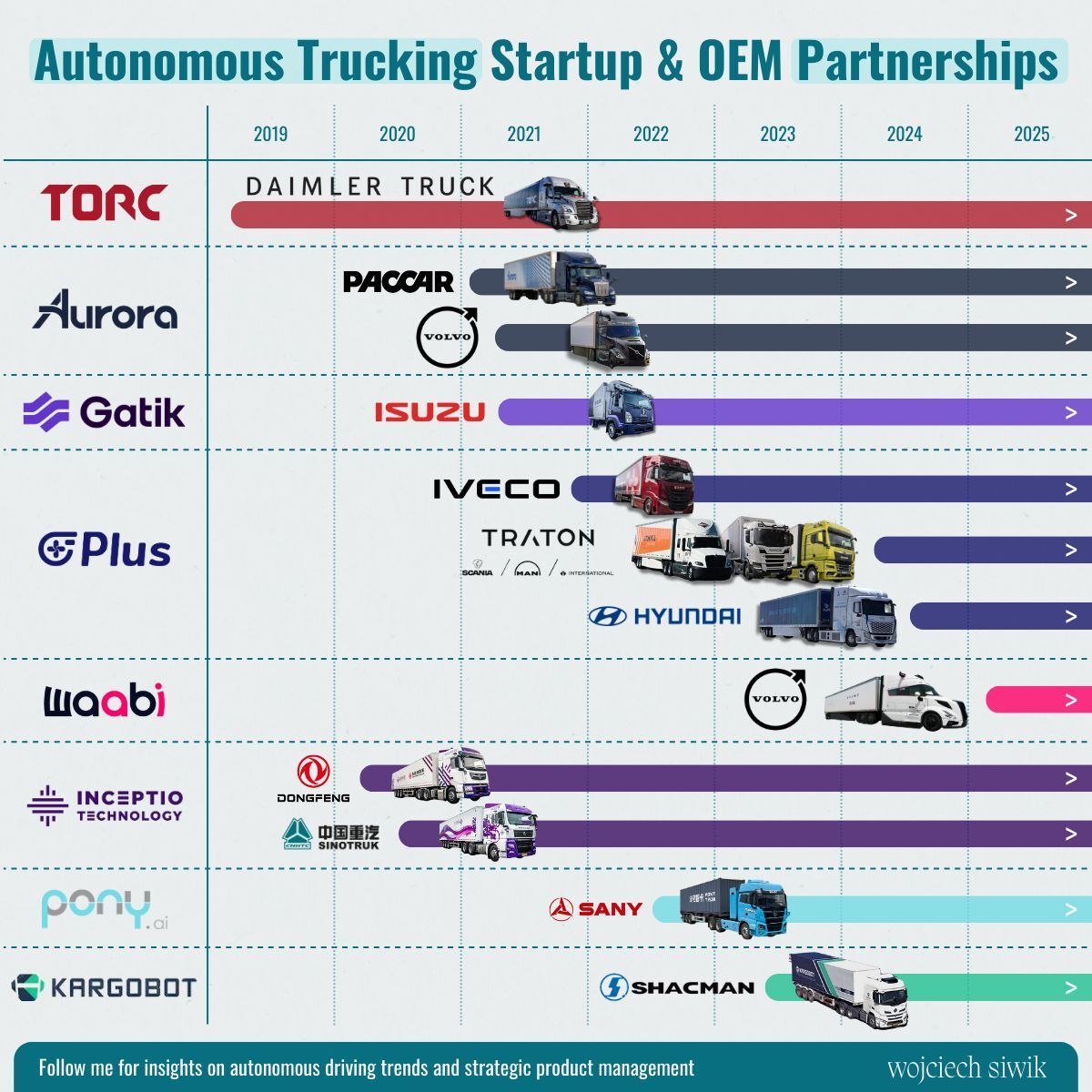

Autonomous trucking and OEM partnerships:

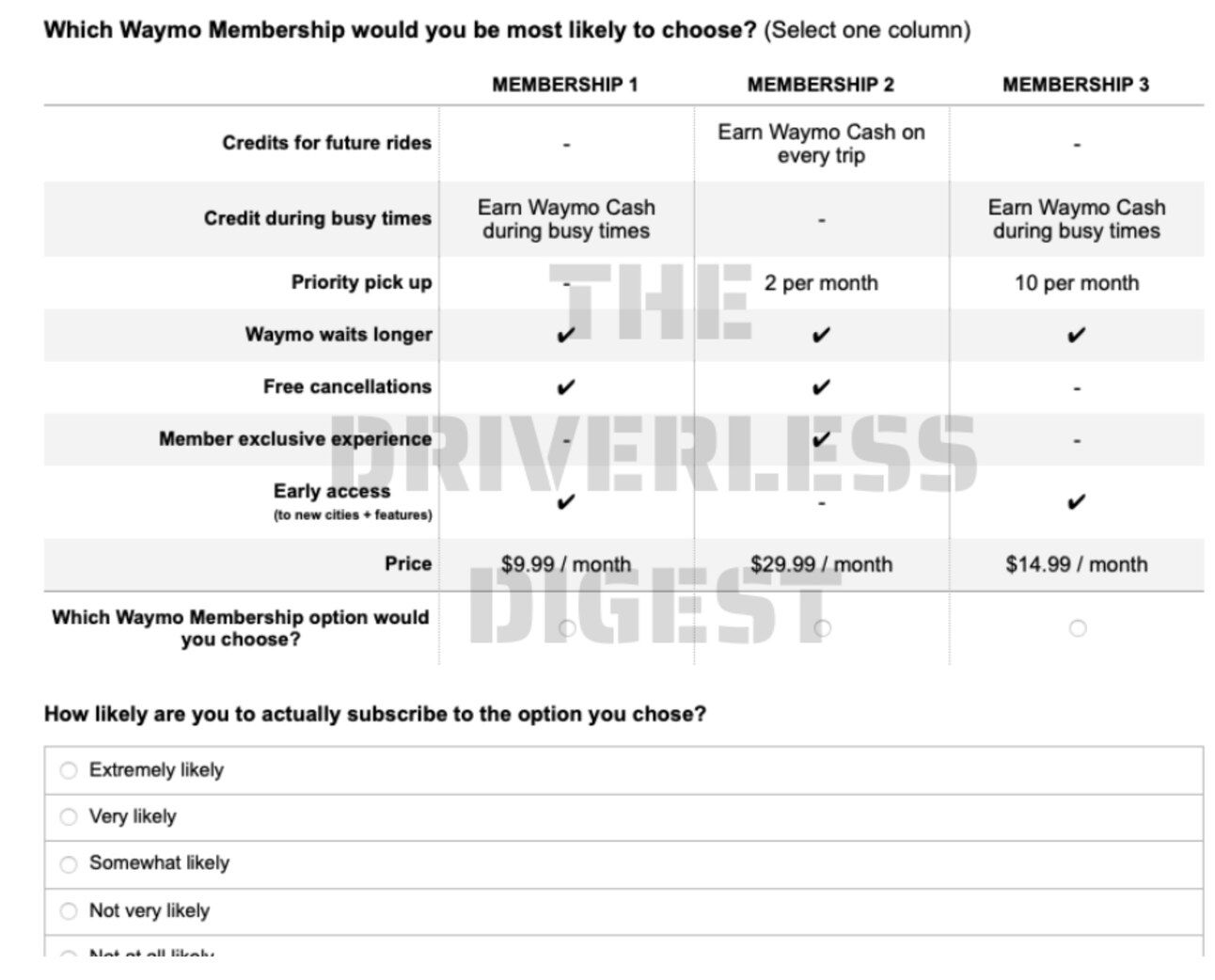

Waymo is considering a Rider Membership Program.

Flying cars 🚁

Archer raises $300M equity raise from institutional investors. This raise follows a $340M raise back in December, to develop Archer’s defense program, and this money, giving the company a liquidity of $1 billion, will go toward the same goal. The advantage of eVTOL lies in its lower noise and lower heat signature. That enables it to blend in more easily. The company is still very much working on civilian use cases, with the first air-taxi service to fly in the UAE in 2025 and more cities in the US, India and South Korea planned for 2026.

Lilium faces 2nd insolvency. Lilium announced a €200M funding deal back in late December, but only a fraction of the money has come in, making Lilium unable to pay salaries and sustain operations. The situation is dire.

In India, Taxi Shunya, designed by Sarla Aviation, is a new eVTOL player focused on commuting in Bengaluru. In Brazil, a new regulatory sandbox at Campo de Marte Airport (São Paulo). In Oklahoma, US, the state to invest in AAM and drone infrastructure.

OEMs 🛺⚡️

1,653,000,000 (1.65 billion) - the number of all vehicles in operation around the world.

And in contrast - over 17 million EVs were sold worldwide in 2024, growth of 25% YoY. China grew the most (40%), Europe saw decline (-3%).

76% of drivers are skipping connected car subscriptions. Reasons: price, connectivity, apps to slow.

Endera, US EV shuttle and school manufacturer, raises $49M - $36M in equity and the rest in debt. Funds will be used to accelerate growth. Rivianopens commercial van sales to all businesses (ended exclusivity with Amazon). Stellantis has introduced full-screen pop-up ads on Jeep’s infotainment systems - and people hate it. Nikolaconsiders bankruptcy. JLRexpands its US engineering hub. I think JLR is setting its future in the US, both sales wise and eventually product development.

Gig economy 💰

In the UK, drivers are protesting against Uber’s Trip Radar, a feature allowing multiple drivers to compete for the same fare. Drivers claim it is a safety hazard, as drivers are forced to reach out immediately to their phones; and that it pushes them to accept unprofitable trips.

Hong Kong taxi union threatens 5-day strike if city fails to clamp down on Uber.

In other news 📰

Latvian Mapon acquires Swedish fleet management company Interkom AB, thus expanding its presence in the Nordics. Auto Hauler Exchange (AHX), a digital marketplace for vehicle transportation, raises $5M. Carrar is looking to raise $18M for its EV battery production line; a $4.6M grant from the Israel Innovation Authority has been recently received. Self Inspection raises $3M for its AI-powered vehicle inspections. Innoviz announces pricing of $40M registered direct offering. Nvidia reveals investments and sends WeRide’s stock up by over 90%.

Is the Venture Capital Apocalypse upon us?

I love meeting new people and learning about innovation. Let’s get-to-know.

People 🧑🤝🧑

Esteban Velez Vega is the new Co-CEO @ Mejor en Bici.

Glenn Saint is the new Business Development Consultant @ Peec.

Hector Cañas is the new Head of Operations @ BABLE Smart Cities.

James Byatt is the new Business Development Manager @ Drive System Design.

Raaghav Dawar is the new Team Lead - Enterprise Accounts, Europe & APAC @ Blacklane.

Zoe Bazos is the new Senior Manager, Brand Partnerships and Activations @ BLADE.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.