#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility".

Out of ink - #movingpeople is taking an August break and will be back in two weeks. Enjoy the rest of the summer!

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

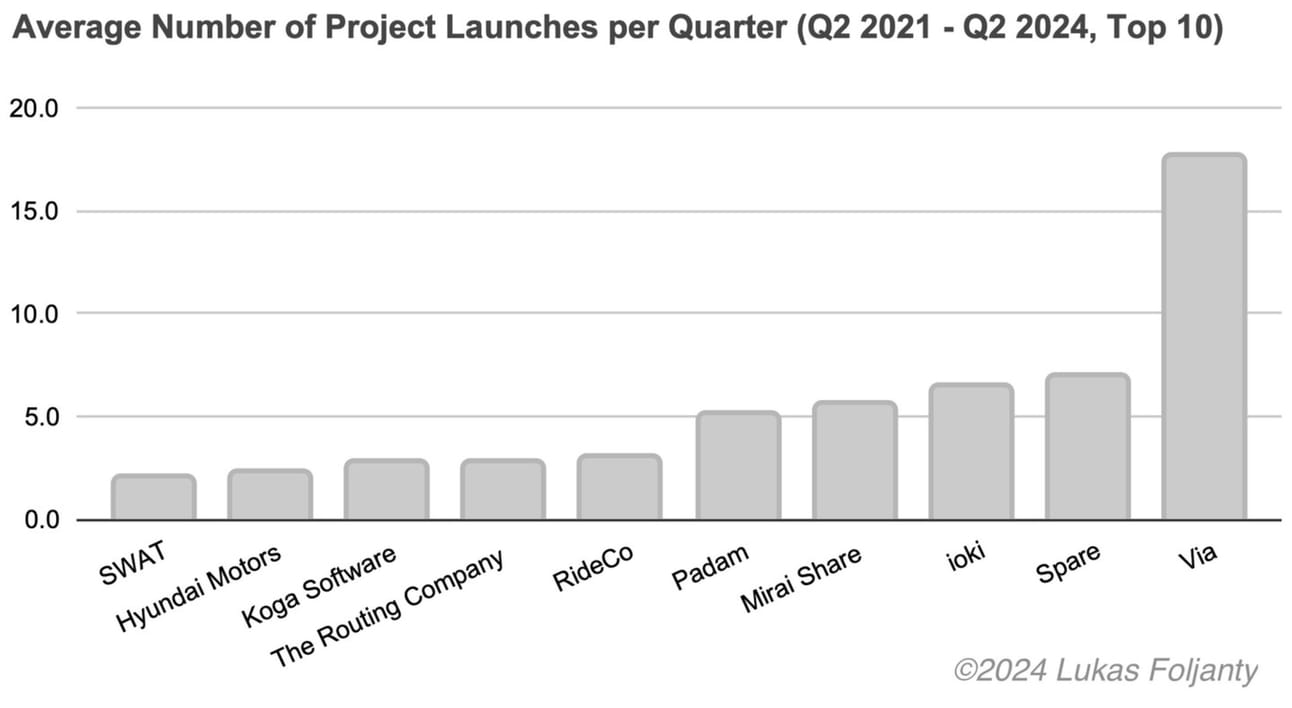

Lukas Foljanty’s mid-year 2024 On-Demand Transit report - key takeaways:

Weak start to 2024 - 120 new services launched - less than 153 new services in 2023 and 135 new services in 2022. Also, net services growth is less than previous years

DRT continues to be a B2G market - 85% of new services - with B2B at 15%

Via is still very much the leading player - followed by Spare, Padam, ioki and Mirai Share

The average utilisation per operating hour is 2.33 (passengers per vehicle revenue hour, or PAX/VRH).

This, and many more insights about the state of the industry, including much deserved criticism toward PTAs, can be found here.

Grab publishes Q2/24 report. Misses quarterly revenue estimates, shares drop (15/8), but mostly climb back. And the company is on-way to profitability.

GMV grew 13% YoY to $4.4 billion

Revenue grew 17% YoY to $664M; revenue is 15% of GMV

Adjusted EBITDA $64M, a $81M improvement YoY

Operating loss is ($56M), a $121M improvement YoY

For more and the earning call presentation.

Element, fleet management services, acquire Autofleet, a fleet and mobility operations platform, for $110M. Autofleet will continue as a separate business unit, leveraging Element’s resources, operational scale, and commercial team.

Uber back to Denmark - in partnership with taxi-company DRIVR. In the past Uber had gig-economy operations in Denmark, but pulled out in 2017 and in 2020 was forced to pay a fine for violation of the taxi act. Now the company is coming back in partnership with a taxi company.

Ola Cabs rebrands as Ola Consumer. The rebranded unit will also offer warehousing and electric logistic solutions, and financial services.

Uber expands in Switzerland. Namma Yatri expands to Delhi. Angkas launches car service in Manila, Philippines. Blusmart marks 1,500 trips in Dubai since launching on June 1st. Treepz completed the 1st international cross-border rental trip in Africa. Commuting is bad for you.

Porsche invests “low double-digit million amount” in Flix. The investment was done together with EQT, a Swedish global investment organisation.

Bolt turns 11.

RideNear is the new UK ride-hailing solution that aggregates multiple global and local providers into one convenient app, ensuring better access to available vehicles, a broader range of options, and superior price and ETA comparisons.

Founded by Miraskar Mirakhmedov, RideNear emerged from stealth with paying users and partnerships in place. Try it out, RideNear is available on Google Play and the App Store.

I’ve joined RideNear as an advisor to help them navigate the mobility ecosystem, and I am confident about their success. RideNear is in the midst of a pre-seed round - so DM the founder or myself for more information.

Car Sharing/renting 🚗

Getaround and Zoomcar publish quarterly reports - both showing major improvement but still a long way from profitability.

Getaround Q2/2 report - key takeaways:

Gross bookings 53 million, -1% YoY

Revenue $18.6M, 35% of gross booking and flat YoY

Adjusted EBITDA loss of $11.4M, improvement from a loss of $22.4M the previous year

GAAP net loss of $12M, vs. a net loss of $30.3M

Zoomcar Q1/25 report (ending June 24) - key takeaways.

Booking increased 9% to 112,944 - but revenue dropped from $2.6M to $2.24M.

58% reduction of cost-of-revenue; achieving gross profit and a 20% contribution profit

Adjusted EBITDA loss of $3.3M vs. $6.8 YoY

Adjusted EBITDA loss is more than the revenue

For reference, Turo’s Q2/23 gross bookings was $648M.

Also Greenwheels celebrates 200 shared cars in The Hague and how Cambio can save on corporate car fleets.

Micromobility 🚲🛴

Lime launches in Japan. Bolt launches in Wexford, Ireland - the first launch since regulation change in May which allowed scooters on public roads. Tier’s scooters in Bristol to be rebranded to Dott. Boston launches a cargo e-bikes scheme - making it the first US city to launch such a scheme; the operator is CargoB. Portland launches micromobility partnership with Lyft and Lime. The two companies will deploy a total of 3,500 scooters in the city.

Micromobility in Brazil - Whoosh is trying where Lime and Grin failed - to run a profitable scooter operation, and is working hand-in-hand with local governments to do so. Whoosh operates 5,700 scooters across three cities and plans to double that number by the end of 2024.

Serve Robotics and Shake Shack launch autonomous robot deliveries via UberEats. DriveU.auto and Ottopia support with connectivity and teleoperations, both on the software and operational side.

Vapaus raises €10M to expand in employee benefit bikes - supporting “international expansion, software development, platform automation, and the growth of our unique PreCycled concept for the second-hand market of bikes”.

Fundracer invests (undisclosed sum) in Bo Mobility. Fundracer set up a micromobility investment fund, and this is the company’s 3rd investment, after investing in Newton-Rider and in Specter.

Ford partners with N+, cycling company, to create a pair of officially licensed e-bike models to celebrate the Ford Mustang and Bronco.

Delivery 🍽🧺

Zepto raises $340M at a $5 billion valuation (post-money) - after raising $665M at a $3.6 billion valuation in June! Quick-commerce is a hot industry in India, taking away profits from the likes of Amazon.

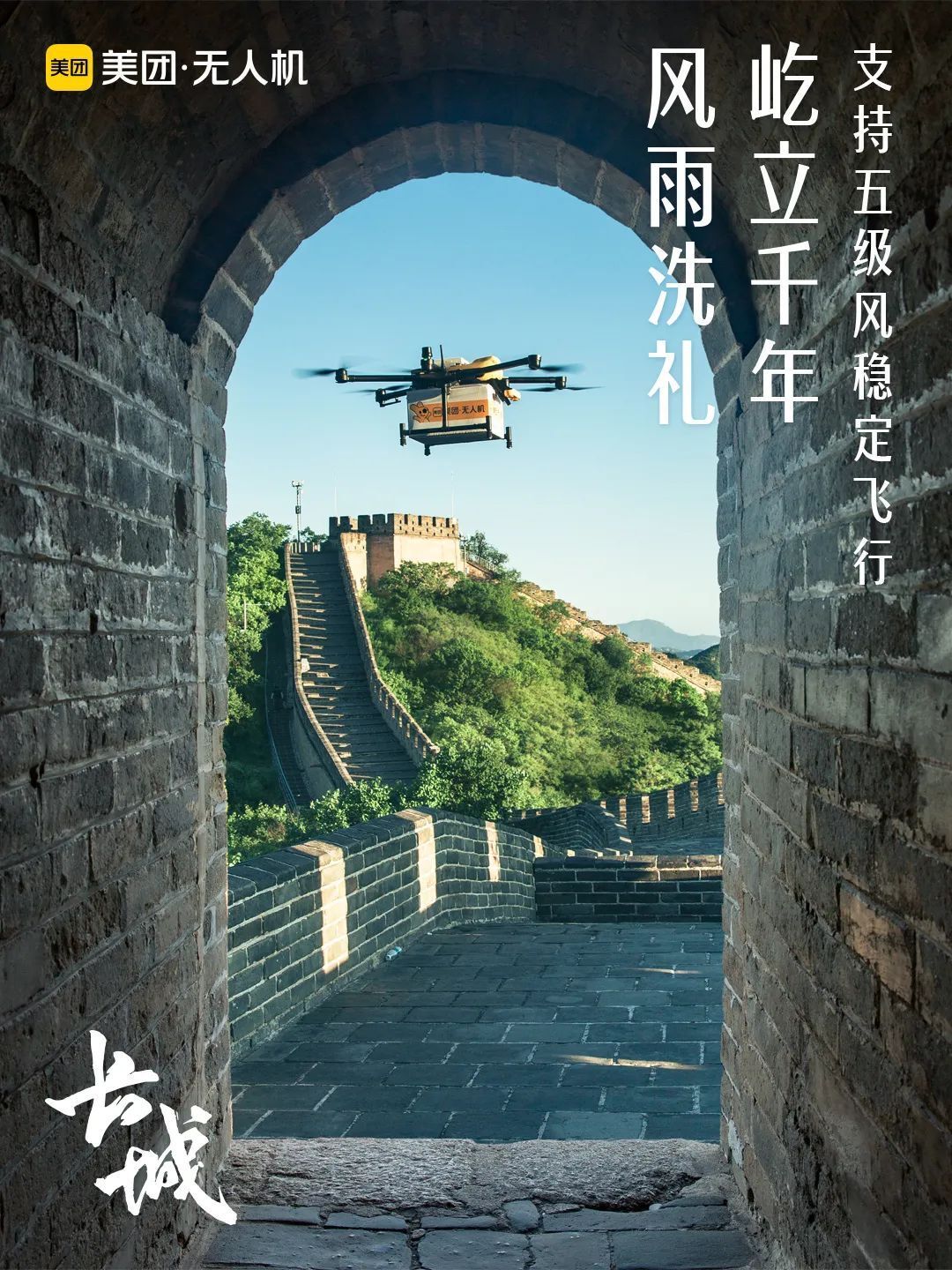

Flytrex, drone delivery, hits 100,000 U.S. commercial deliveries. The company plans to open 10 more new hubs (adding to the current 4) in 2025, after an expected BVLOS waiver from the FAA. Meituan launches a delivery drone route in Beijing, aimed for tourists. DroneUp 500 deliveries per day.

Swiggy launches Swiggy UPI, a new feature aimed to improve users’ payment experience. This feature will help complete transactions without leaving the app and reduce payment time from 15 to 5 seconds.

Rappi is investing in its travel proposition. Gopuff launches 24/7 delivery in London. Meituan partnered with Midea to offer 30-min deliveries in China. In Nigeria, Glovo expands partnership with SPAR. Zomato rolls out group ordering feature. Research by Clean Cities finds that the use of Cargo bikes in London increased by 73% from 2022 to 2023.

Wolt Algorithmic Transparency Report (3rd edition). Interesting read for the industry’s product managers / engineers.

Autonomous & remote-driving 🤖℡

WeRide receives approval to carry passengers on California’s public road (but not for commercial purposes). Meanwhile in Washington, The U.S. Commerce Department is expected to propose barring Chinese software in autonomous and connected vehicles. And more on WeRide’s planned IPO - the company is reportedly seeking circa $400M from the IPO (±$100M) and following private placement ($300M), on a $5 billion valuation.

Karsan to deploy a L4 autonomous bus in Switzerland. Waymo to begin testing driverless robotaxis on San Francisco’s freeways - first with the company’s employees (not a commercial service).

May Mobility’s CEO joins Uber’s CEO in criticism over Tesla’s flaws in its client-cars based robotaxi scheme: “It’s not viable. Individual car owners don’t want to be ‘landlords’ of their car. Riders are often hard on cars—they treat them poorly, make messes, slam doors—all because the vehicle is not theirs”. TBC.

Waymo disturbed peace, its autonomous cars honking at 4am in a car park situated in a residential area - but honking at each other. It’s been solved.

Zoox has a new commercial - why is this interesting - because it illustrates that for some (Amazon) the next challenge is public perception - not just tech.

Zeekr can now self-drive to charge itself.

Michael Muskat founded Proximity - a real estate marketplace, which enables companies to connect to underutilised real estate.

Michael is working with last-mile, e-mobility, car-sharing, logistic, fleet storage etc. who are looking for either land or car parking real estate, and has +600 locations across the UK.

DM me, reach out to Michael directly or leave your details here and I'll make sure he gets back to you.

Flying cars 🚁

Archer secures $580 million order for 116 Midnight eVTOLs, by Future Flight Global, an operating company. A bit of maths - Archer’s existing order book is near to the $6 billion mark - at $5M per unit, this means an order book of almost 1,200 vehicles.

Archerdelivers first Midnight aircraft to the US Air Force. Jobyon track to have 4 prototypes in the air in Q3. Skyportspartners with an Australian real estate developer to explore vertiport development opportunities.

OEMs 🛺⚡️

JLR to stop selling cars in the EU and UK starting from the end 2024, ahead of its re-launch as an all-electric brand. Of the brands JLR manufacturers, only the F-Pace SUV will remain in production in 2025.

BYD launches in Vietnam, facing anti-Chinese sentiment and a charging market controlled by its competitor, VinFast.

Zeekr says its new battery can charge faster than that of a Tesla - from 10% to 80% in just 10.5 minutes.

Rivian halts production of Amazon delivery vans amid parts shortage.

Ola Electric’s IPO is a success - from 76 rupees per share - to 146.

Gig economy 💰

In Costa Rica, a bill is presented to the parliament to improve the working conditions of gig-workers. iFood asks Brazilians to respect couriers. In Mexico, gig workers are switching from food to parcels, on account of the higher volume of the latter.

In other news 📰

Number of petrol vehicles sold in Norway in July: 45 (8% of car sales).

Clearly, a “climate intelligence” platform designed for fleets, raises $4.3M. Simply put, Clearly tracks logistic fleet movement and reports emission back, also focusing on driver behaviour improvement - the company says that 30% of fuel consumption is influenced by driving behaviour alone. Funds will be used to develop the product and scale team.

Map war continues - in this chapter MapmyIndia’s CEO goes against Ola: “We don't see a business risk, because we don't see a good product coming from there. People are complaining left, right and centre, about their (Ola) updated cab app, their updated electric vehicle app, that their maps are pathetic and causing users problems. Everybody knows that these are more announcements and gimmicks, but the quality of that product.” There is also a legal battle between the two, with MapmyIndia claiming that Ola took the licence of MapmyIndia’s APIs and SDKs and then embedded it and integrated it with their software.

Boston partners with Google for traffic signal optimisation.

I love meeting new people, learning about mobility innovation and exchanging opinions. Interested in discussing mobility?

People 🧑🤝🧑

A bit of movement in mid-August:

Jack Holland is the new DRT Operations Specialist @ AtkinsRéalis.

Maciej Klimkiewicz is the new Sales Director Eastern Europe @ GreenFlux.

Congrats and good luck!

Thank you for reading #movingpeople. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.

Weekly suggestion: send to a someone in a different time zone.