I took August off to rethink #movingpeople. In this edition:

What’s new with #movingpeople?

A roundup of major August news mixed with recent news

What’s new with #movingpeople?

First - I’d like to thank the people who took the time and completed the #movingpeople survey. It has been extremely helpful. I won’t be able to write everything you asked for, but here goes:

🤖 Autonomy is integrated into Mobility. No longer a stand-alone section, autonomy is now covered according to its relevant use case; i.e. each section now has autonomy.

🗂️ Sections reflect mobility trends. I’ve added AV Freight & Logistics; merged robotaxis into ride-hailing and more - see table at the very end of this article to learn more about the changes.

📰 Introducing “Top Stories”. Every week will start with 1-2 main stories.

Expect more 🔎 Deep-dives, such as London Calling AVs or Via goes Public.

And now… let’s start #movingpeople - August recap edition, focusing on major news and autonomy, and a mix of newer news from the past week.

#movingpeople is a part of Mobility Business - a consultancy dedicated to "All Things Mobility", focused on growth.

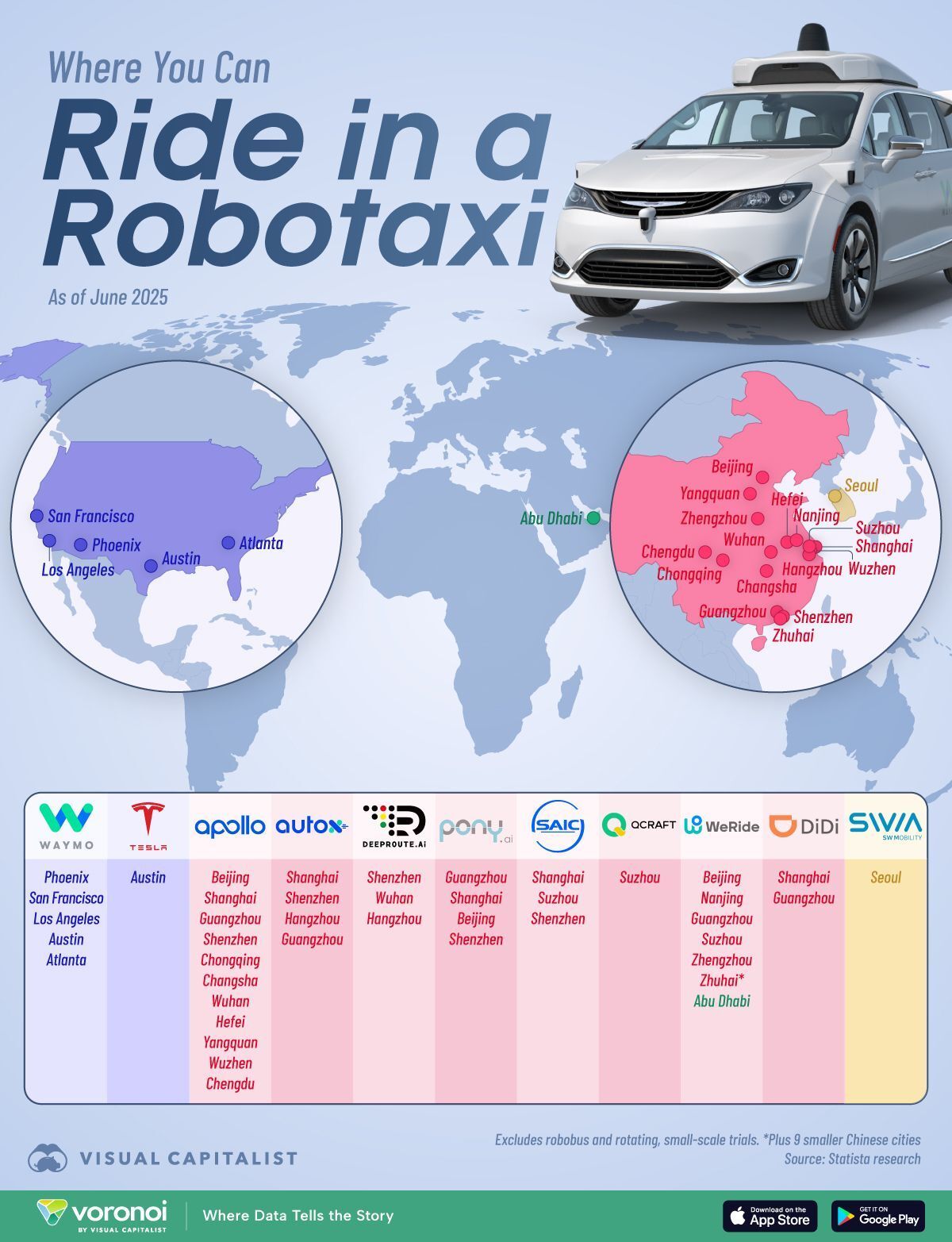

Top story: Global Robotaxi Expansion

The sum is bigger than its parts. Continuing this rate of expansion in the US, China and Gulf states, expect that by 2030 every Tier 1 and most Tier 2 cities will host robotaxi operations. The extent of which will be determined by commercial feasibility and available vehicle supply, not by technological readiness. Europe invests in public transport use cases (see AV shuttles section); but those are far from being at the same rate of technological and commercial development as robotaxis, meaning that Europe will stay behind.

From the past few weeks: Waymo approved for testing in New York City, in parts of Manhattan and Downtown Brooklyn. Waymo expands testing to Denver and Seattle. Waymo starts offering airport rides in San Jose Airport, California. Waymo has even more cities it targets, with the aim to achieve 1 million weekly rides in 2026. Avride continues to test in Dallas, ahead of a launch with Uber. Pony.ai launches robotaxi operations in Shanghai's Pudong district and eyes Hong Kong. This list of “where you can ride a robotaxi” shows how advanced China is, both in terms of active companies and number of cities deployed. Also take a look at this post about autonomous vehicles in the middle east - Abu Dhabi is leading, but the region as a whole is very ambitious.

Top story: Germany Approves Remote Driving

Germany passed a national remote driving law - enabling commercial services. The new regulation further details the regulatory regime, such as assigning full driver responsibility to the remote operator, limiting speed to 80 km/h, banning cross-border operations and more - but the bottom line is a progressive regulation which brings Germany closer to the US and others in terms of technology adoption. Vay, a prominent player in the remote driving space, is expected to benefit greatly from the new regulation, which goes into effect in December.

Ride-Hailing & Robotaxi 🚙🚕

Nuro closes a $203M series E raise, with Uber as an investor. Of that, $106M were announced in April and this is the 2nd trench, which includes Uber, is on the back of the Nuro-Uber-Lucid future robotaxi network partnership. So far Nuro raised a total of $2.3 billion; post-money valuation is now $6 billion. Note that while Uber's name is definitely shiny, the ownership Uber has in Nuro is limited, probably circa 2%.

A couple of weeks later, Lucid announced a $300M raise from Uber. The money will help fund the 20,000 vehicles Lucid is required to produce over the next six years, for the above-mentioned robotaxi partnership.

Gett sold for $190M to an Israeli financial consortium of 6 equal players. Gett is EBITDA profitable, with forecasted EBITDA of $18M in 2025. The most interesting question is what happens next - will Gett expand to additional markets, or focus on maintaining its market positions in Israel and the UK? TBC.

ComfortDelGro acquires rest of CityCab from ST Engineering for $116.3M.

Grab invests in WeRide, as it works to secure an autonomous partner for its Southeast Asian operations. The companies have been working together since March and the investment is expected to be completed in H1/26.

Bolt 2024 financials:

Revenue €1.99 billion, 17% up from €1.7 billion in 2023

Loss widened to €102.6M vs. €91.9M in 2023

Ride-hailing contributed €1.63 billion (82.1%); Micromobility + Car Rental contributed €173M and Food & Grocery contributed €185M

Lyft completed FREENOW’s acquisition and partnered with Baidu to launch autonomous vehicles in Germany and the UK. I wrote about London’s autonomous summer of 2026, with Uber-Wayve and Waymo expected to enter the market, and one question still bugs me: would European regulators approve the operations of a Chinese entity? While we have seen initial willingness (WeRide in France and Switzerland, Pony.ai in Luxemburg), future launches in Germany and the UK are very much different in terms of scale and national security scrutiny.

In Germany, KIRA autonomous vehicle project expands to Darmstadt, with six vehicles.

A Gridwise report finds that driver pay and utilisation is decreasing in markets that have seen the entry of autonomous vehicles.

Tesla loses Autopilot accident trial and will pay $243M in damages. The 2019 crash occurred while the driver was not fully minded to the road, assuming Tesla’s Autopilot will prevent mistakes. That didn’t happen, and the Tesla car ran into a parked car at more than 60 mph (±100 km/h). At the heart of the trial - did Tesla exaggerate (video clip inside) its autonomous capabilities? The answer here is yes. This is the first time the court (jury) found that it wasn't “just” the driver's negligence that caused the crash - but also puts Tesla responsible. Past lawsuits were either won by Tesla or settled before reaching court.

In the UK, the Supreme Court ruled that private-hire operators outside of London do not enter into a contract with passengers and therefore are exempt from the 20% VAT tax. This is a win for the private-hire sector and a loss for Uber, as Uber is required to pay the 20% VAT.

GSM (known as Xanh SM in Vietnam), a ride-haling company set up by the founder of VinFast, is expanding to Laos, Indonesia and the Philippines, and is expected to enter India. In Vietnam, the company holds 35-40% of the market.

VinFast is also the company who built Tensor’s autonomous vehicle - which Tensor intends to offer consumers starting H2/26. The market for private-owned robocars is one that is actively explored by Tesla and has returned to GM / Cruise focus.

CaoCao, the Geely owned Chinese ride-hailing company, published H1/25 results - and key takeaways: rides grew by 49% and revenue grew by 53.5% to roughly $1.3 billion; losses narrowed by 39.8%. DiDi pays $740M to settle lawsuit over US IPO. inDrive.Money launches in Brazil, offering digital loans for drivers. In H1/25, Ukrainian Uklon rides grew by 19.6% YoY. In Korea - competition between Kakao and Uber is escalating. Both companies launch subscription services. In India - the Karnataka High Court blocks bike-taxi from operating; while Uber and Ola discontinue service, Rapido is now giving access to its network for free.

Waymo completed Spotify integration. Autonomous In-Cabin experience is just at the beginning.

Uber EV adoption is better in Europe (as can be expected).

DRT, Bus-Based Mobility & AV shuttles 🚍🚌

Via is getting ready to IPO on the NYSE. Long awaited. I wrote about the IPO, and key takeaways are:

revenue grew from $100M in 2021 to forecasted $428.5M in 2025. That's >40% CAGR.

Via is losing money; with a $84M operational loss in 2024 (on $337M in revenue)

Assuming GP % stays at circa 40% and that operational expenses will grow only little above the current $215M annual expenditure, Via is expected to reach profitability sometime end of 2026.

These numbers explain why Via hasn’t gone public so far; the main question now is whether Via will be able to sustain its latest $3.5 billion valuation?

Lukas Foljanty’s midyear 2025 On-Demand Transit market report, key takeaways:

Growing market, with 180 new projects in H1/25 and net project growth of +98

Via has circa 25% of the market; and Lukas identifies five additional players which are 2nd Tier players.

Low average productivity of only 2.38 passengers per vehicle revenue hour

In this edition Lukas also looks at Via’s IPO and the growing autonomous market and how do On-Demand services stack up against the like of Waymo; this report is a must read for anyone in the ‘digital’ transport industry

WeRide starts night testing (10pm to 7am) in Beijing, making it 24/7 operational. The company has had a 24/7 operation in Guangzhou since May this year. The company is running its GXR model, a 5-seater van similar to MOIA’s model. Also WeRide launched Shenzhen’s first Level 4 fully driverless Robobus public transport route, in Luohu District. Booking can be done via WeChat.

ADASTEC launch autonomous operations in Switzerland on public roads and in Michigan State University; complete demo in Romania. Northern Ireland’s first autonomous passenger vehicle, powered by Oxa and eVersum, begins operations. The 1st Holon shuttle starts testing operations in Hamburg; passengers won’t be able to board the shuttle before 2026.

Zoox cleared for operations by US regulators; the company received an exemption for its custom-built no on-board controls (e.g. steering wheel, pedals). Zoox is not yet allowed to operate commercial ride-hailing activities, and is for now testing in Las Vegas and locations in California. Also Zoox closed a deal with The Routing Company to use their microtransit technology.

BusForFun raised an additional €4.4M to support international expansion and focus on corporate commute use-cases. The Italian company is now present also in Switzerland and Spain and is expanding into France.

Shucle, Hyundai's DRT platform, is expanding to Hungary; its 1st international expansion.

Fabian Hoeft invited me to his podcast to talk about autonomy, AI and all things mobility. To listen on Spotify:

Car Sharing/renting 🚗

Zipcar partners with Uber to offer daily vehicle rental to drivers.

India became Blablacar’s #1 carpooling market worldwide. August saw 2 million passengers; the company expects 2025 to end with 20 million passengers.

BlueSG, all EV Singapore car-share, is winding down operations; a new service is planned for 2026, with new tech and cars. US Kyte shuts down - and sells its customer list to Turo.

Micromobility 🚲🛴

Voi Q2/25 financial report - key takeaways:

Net revenue €46.8M, up 29% YoY

Vehicle profit margin increased by 0.8 percentage points to 60.4%

EBIT is €1.4M, up by €0.5M

Finnish Vapaus merges French Azfalte to support its expansion into the promising French market. This merger creates Europe's leading provider of corporate cycling solutions.

The UK: Voi is entering Glasgow and Essex; Bolt launches in London. Bolt also launches scooters in Kazakhstan - the company’s first Central Asian country.

Delivery - from bikes & cars to bots & drones 🍽🧺

EU regulators approve Just Eat TAkeaway €4.1 billion acquisition by Prosus. To complete the deal, Prosus must “significantly” reduce its stake in Delivery Hero, which today stands at 27.4%. We don’t know to exactly which extent, but it will mean that Prosus will no longer be the #1 shareholder in Delivery Hero. Additional remedies make sure Prosus has no say in Delivery Hero’s strategy and commercial decision, i.e. Prosus will leave the board and not exercise voting rights of remaining shares.

Rappi secures $100M debt financing to refinance and provide working capital as it expands operations across Latin America. Rappi operates in 9 countries and more than 350 cities across Latin America. Also Rappi partners with wallet platform AstroPay to launch the region’s first wallet-on-file integration, allowing users in Argentina, Brazil, and Peru to pay seamlessly across currencies - no cards required.

Citymall, Indian grocery startup, which focuses on budget-focused pre-planned grocery delivery for tier 2 and tier 3 towns, raises $47M.

Chowdek, Nigerian food delivery, raises $9M. Chowdeck is present in 11 cities across Nigeria and Ghana, serving 1.5 million customers with a network of more than 20,000 riders - and is profitable. Funds will be used to expand fast deliveries and dark store network on way to become a super-app.

Robomart, maker of self-driving delivery robots, unveils a new delivery robot with a $3 flat fee. The robot, named RM5, can carry up to 225 kilograms, travel at speeds of up to 25 mph (40 km/h) and has 10 separated compartments. The company wishes to employ the same business model as other delivery companies - i.e. provide the demand (booking app) and operational management, partnering with retailers. The company will launch in Austin later this year.

Rapido continues testing of Ownly - its delivery service. Swiggy, which holds 12% of Rapido, is reevaluating the situation - and is likely to sell shares of the company to reduce conflict of interest. Note that Rapido is currently delivering orders for Swiggy. Rapido’s business model is a fixed fee per order - taking 0% commission from restaurants. Also Rapido in talks with Prosus for a $200M investment, at a $2.5 billion valuation. Prosus today has a stake of roughly 3-4% in Rapido, and this investment should push it over 10%.

In Brazil, DiDi (via its subsidiary, 99) sued Keeta (Meituan) for trademark infringement and unfair competition. This happens after Keeta sued 99 for restricting restaurants from working with more than two restaurants; seeing iFood holds 80% of the market, the move is essentially blocking Keeta. For more on “Rest of World”.

Avride and Uber Eats expand robot food delivery in Jersey City; the service now covers over 100 restaurants.

AV Freight & Logistics 🚛🚜

FERNRIDE raises €18M to expand its ground autonomy platform into European defence logistics.

Aurrigo raises £14.1M. Funds will be used for additional R&D, getting products faster to market and scaling commercially. Also Aurrigo signs a £1m contract for an autonomous baggage and passenger moving system at Teesside International Airport.

Aurora has three self-driving trucks operating commercially between Dallas and Houston, and have logged more than 20,000 driverless miles by the end of June. The trucks are also now driving at night.

Dump Truck action: Komatsu, a heavy equipment manufacturer, partners with Pronto, AI tech stack, to introduce Smart Quarry Autonomous. Sensible4 is working on a similar solution.

In other news 📰

Revel quits ride-hailing to focus on fast EV charging infrastructure. Ride-hailing is a competitive business, and Revel had tough competition in New York. In contrast, fast EV charging is a growing business. And:

Hubber, a new fast EV charging startup, focused on commercial fleets in urban environments, raises £60M.

MaaS: Breeze is canceled, in what is a blow to MaaS in the UK; while HopOn / ECR started MaaS implementation in Essex, replacing Moovit. And a technical retrospective on MaaS by Eetu Tuomala, former VP engineering of MaaS Global (Whim).

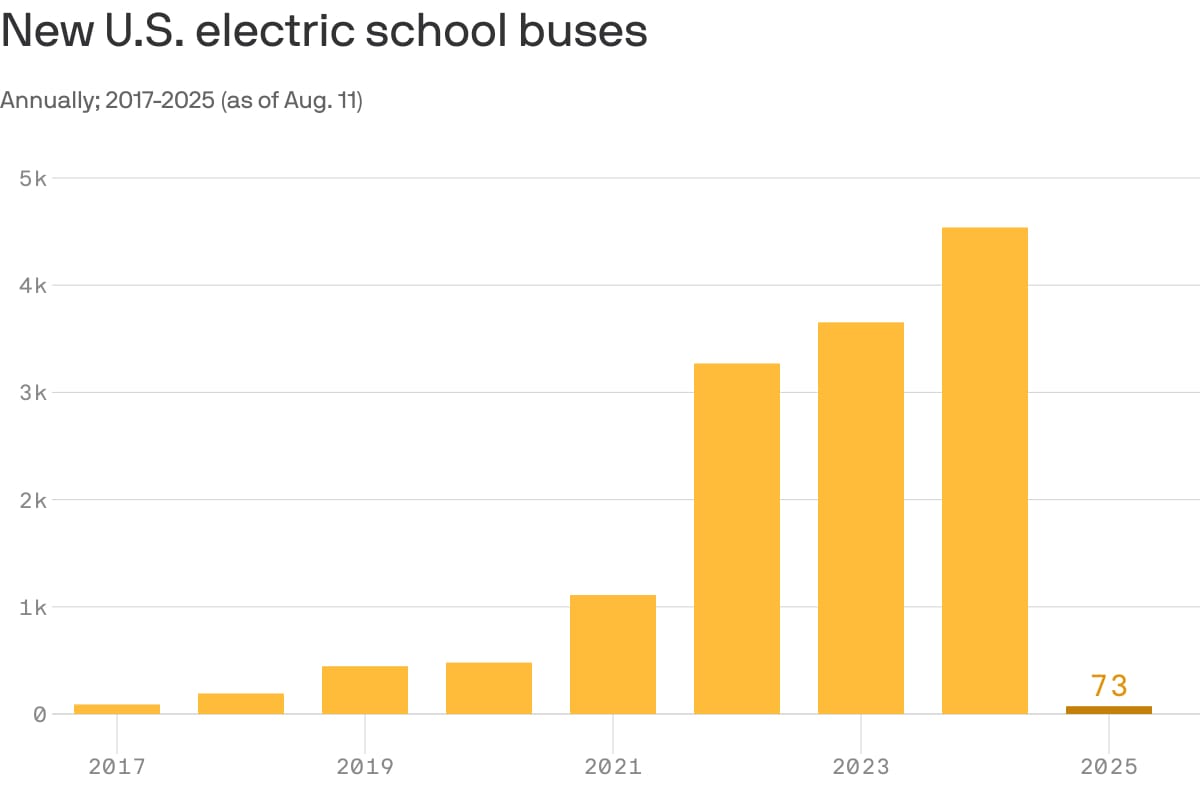

The collapse of Lion Electric, an electric school bus manufacturer, together with federal incentives to switch to electric drying up during the Trump administration, leads to a massive slowdown in new EV adoption, together with schools going back to Diesel vehicles.

Uzum, Uzbekistan’s e-commerce marketplace, fintech and delivery platform, raises $65.5M, achieving a valuation of $1.5 billion post-money. The company has 17 million monthly active users - half the adult population (!). Capital will be used to grow fintech and banking products. The company is working on a $300M bond issue sometime in 2026 and an IPO is expected in 2027.

Nevoya raises $9.3M as its EV truck fleet reaches cost parity with diesel. Oway raises $4M to solve the less-than-truckload (LT) challenge.

California legislators find a compromise with Uber-Lyft, in which drivers would be able to unionise, while insurance costs for ride-hailing companies would decrease.

EVs and ADAS are reducing accidents - but driving up repair costs. Analysis by Will Chamberlain at L.E.K.

I love meeting new people and learning about innovation. Let’s get-to-know.

#movingpeople is a weekly mobility & delivery newsletter - from Ride-Hailing & Robotaxi through Remote-Driving & Delivery Drones to e-bikes and Autonomous Freight & Logistics.

Thank you for reading. If you like what you're reading, please share it with your friends and colleagues so they can benefit from it too.

How is #movingpeople changing:

Old #movingpeople sections | New #movingpeople | |

Ride-Hailing & Taxi, Buses & DRT 🚙🚐 | - Broken into 2 different sections -> - Robotaxi as an integral part of ride-Hailing - Ride-Hailing to include taxi and bike/rickshaw modes | Ride-Hailing & Robotaxi 🚙🚕 DRT, Bus-Based Mobility & AV shuttles 🚍🚌 |

Car Sharing/renting 🚗 | Refresh of companies covered - no other change | Car Sharing/renting 🚗 |

Micromobility 🚲🛴 | Refresh of companies covered - no other change | Micromobility 🚲🛴 |

Delivery 🍽🧺 | Added more coverage on autonomous bots and drones | Delivery - from bikes & cars to bots & drones 🍽🧺 |

This segment covers autonomy in ground freight (i.e. trucks) and yard/industrial operations autonomy | AV Freight & Logistics 🚛🚜 | |

Autonomous & remote-driving 🤖℡ | Autonomy is no longer a stand-alone solution, but one that is integrated into mobility.. | Section Canceled. Significant news will be covered in relevant sections |

Flying cars 🚁 | Industry will not move the needle on mobility in the near future. | Section Canceled. Significant news will be covered in “other news” or pop-up sections |

OEMs 🛺⚡️ | Originally designed to follow new Electric OEMs; the fall of most have made this section irrelevant. | Section Canceled. Significant news will be covered in “other news” or pop-up sections |

Gig economy 💰 | This section did not generate interest from readers. | Section Canceled. Significant news will be covered in “other news” or pop-up sections |

In other news 📰 | As-is. | In other news 📰 |

People 🧑🤝🧑 | As-is. | People 🧑🤝🧑 |